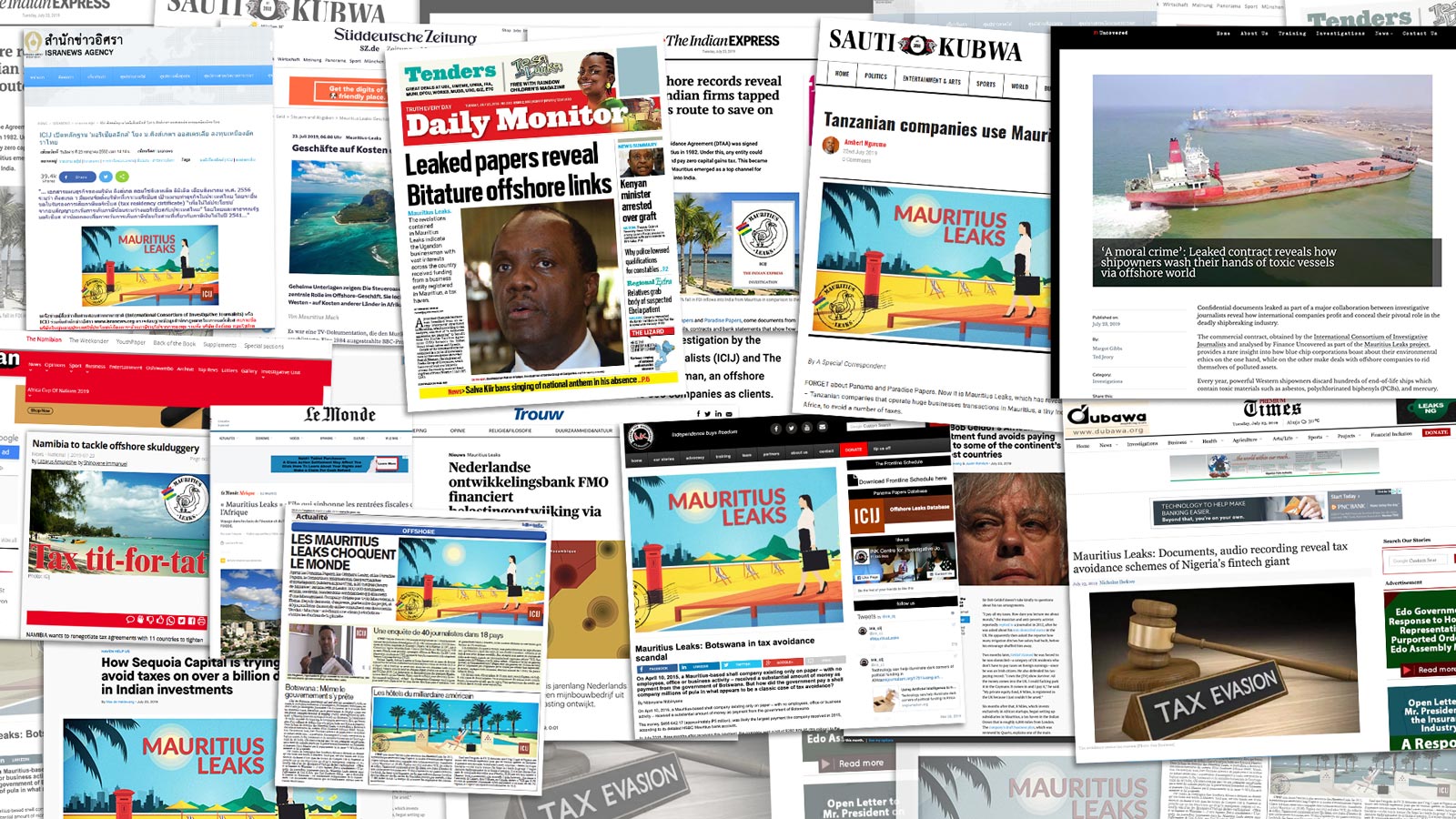

Within hours of the publication of Mauritius Leaks, the latest investigation by the International Consortium of Investigative Journalists, officials from the island tax haven huddled to respond to the exposé of its offshore sector.

Ministries and official agencies called the findings “serious and malicious.” Police opened a probe into the alleged “hacking” of the law firm whose files formed the basis of the investigation, according to news reports. (ICIJ received the documents from an anonymous whistleblower.)

Mauritius Leaks revealed how prominent multinational corporations and investors from North America, Europe, Australia and Africa, including an investment fund co-founded by Irish singer and anti-poverty crusader Bob Geldof, planned to cut tax bills through Mauritius.

The government of Mauritius denies that its tax laws facilitate tax avoidance and accused reporters of seeking to harm the country’s reputation. Officials from Africa and Asia welcomed the disclosures and promised to examine the investigation’s findings.

“We have to continue with revelations like these that shape the conscience of citizens,” one Senegalese tax inspector told ICIJ. “In the end, pressure on political authorities will lead to virtuous reforms.”

ICIJ collaborated with 54 journalists from 18 countries, including first-of-a-kind partnerships with reporters in Tanzania, Mauritius and the United States. Journalists explored more than 200,000 records, ranging from tax advice from major audit firms to audio recordings.

Here are some of the investigation’s key findings and reactions so far.

Mauritius

Reporters at L’Express in Mauritius were prepared for backlash from the government and offshore sector after the publication of Mauritius Leaks.

The Mauritius government accused reporters who worked on the investigation of having an “agenda” and seeking to harm Mauritius’ reputation. Mauritius denied that its laws facilitated the leaching of revenue from other countries, including poorer neighbors in Africa, and pointed to its recent reforms.

“The problem isn’t the role of our newspaper in this investigation of 200,000 documents, emails, contracts and recordings,“ wrote L’Express editor Nad Sivaramen about his newspaper’s involvement in the project. “The world isn’t a playground and our country was bound to attract criticism sooner or later,” Sivaramen wrote.

Botswana

Botswana’s INK Centre for Investigative Journalism exposed how Esri, a California-based digital mapping company, received payments from the government of Botswana to a shell company in Mauritius for software licenses. In a leaked audio recording from a 2015 meeting, directors of the Mauritius company admitted it had no real operations.

“In my opinion, it is a real problem insofar as Mauritius … now behaves as a gateway for potential tax avoidance through the issuance of invoices,” Reine Flore Tamo, a tax specialist in Cameroon, told INK. “We are looking at possible misappropriation of public funds.”

Uganda

Uganda’s Daily Monitor reported how one of the country’s most high-profile businessmen, Patrick Bitature, may have benefited from investments structured through Mauritius into a power station.

Experts told Daily Monitor that the multi-million-dollar investment via Mauritius raised red flags for tax avoidance. Bitature denied wrongdoing. After the publication of The Daily Monitor’s investigation, Electro-Maxx, the company that received the offshore loans and investment alongside Bitature, published a press release that claimed there was no tax benefit gained through Mauritius and labeled the reporting “sensationalized.”

India

The Indian Express published a series of revelations on multinational corporations in India that sought to cut taxes with the aid of the tax treaty between Mauritius and India. Until changes to the treaty in 2016, Mauritius companies paid no capital gains tax, which encouraged Indian companies to claim tax benefits through Mauritius-based shell companies without having any real operations there.

“Due to this treaty shopping, no taxation took place,” a senior tax official told ICIJ and the Indian Express. “It was so significant that almost a third of FDI [foreign direct investment] came through Mauritius. So there was quite a bit of concern raised in India.”

Nigeria

Premium Times reported that Lagos-based Venture Group, a company that sells revenue collection technology to government agencies, opened a Mauritius company and planned to transfer intellectual property more than 4,000 miles away to the island tax haven.

Premium Times reported that a leaked audio recording of Venture Group discussed attempts to transfer the intellectual property rights of “payment software used in the power sector from its Nigerian subsidiary to its parent company in Mauritius.” Tax experts told Premium Times that the transfer may have been problematic if the transfer was not at “arm’s length,” which requires that the transfer be done at market value. The company told Premium Times that it is not illegal to move intellectual property to Mauritius.

Global tax benefits are not the reality, and the benefits accrued are mostly in favor of the developed country partners – Namibian Finance Minister Calle Schlettwein

Namibia

Namibia will sign a new tax treaty with Mauritius as soon as the end of the year, finance minister Calle Schlettwein confirmed in an interview with The Namibian. Namibia joins other African countries such as Lesotho and Uganda that are seeking to revise elements of tax treaties that allow corporations to pay less taxes to revenue-hungry national governments.

“Global tax benefits are not the reality, and the benefits accrued are mostly in favor of the developed country partners,” Schlettwein told The Namibian about his country’s experience with tax treaties.

Tanzania

ICIJ’s media partner in Tanzania reported on tax advice by the local branch of accounting and advising giant KPMG.

According to an internal document prepared for children’s television station Ubongo, KPMG proposed creating a Mauritius company to extract profit from Tanzania in the form of interest repayments and royalties. The plan did not proceed, Ubongo told ICIJ. KPMG told ICIJ its “tax professionals act lawfully” and “with integrity.”

Tanzania’s Revenue Authority is investigating the reports, one official told ICIJ.

The Netherlands

Dutch newspaper Trouw reported that mining company Kenmare paid an average of half a million dollars in taxes for eight years while making $125 million in operational profit. Kenmare, based in Ireland, used Mauritius offshore companies and tax exemptions offered by Mozambique, according to Trouw.

The Netherlands’ government-owned development bank, FMO, co-financed Kenmare’s titanium mine in Mozambique. Responding to Mauritius Leaks, which includes details of FMO’s loans to Kenmare, FMO’s tax director told Trouw: “We cannot tell a company that they cannot avoid tax. You do not intervene in that.”

The Netherlands, like Mauritius, has signed tax treaties with countries in Africa that, according to critics, help companies avoid taxes. The Mauritius treaty and the Netherlands treaty are “the most commonly used” by companies looking to cut their tax bills, a senior Ugandan official told ICIJ.

United Kingdom

In its first collaboration with ICIJ, London-based Finance Uncovered revealed a confidential contract that showed Spanish oil company Cepsa sold a tanker to an offshore entity that had ties to a company accused of exploiting South Asia’s under-regulated ship recycling industry.

The tanker was later transferred to a beach in Pakistan where boats are often broken apart for scrap in hazardous working conditions, according to Finance Uncovered. Chemicals can leach into the soil and sea.

Cepsa told Finance Uncovered it was “unaware” that the tanker “was to be broken up in an unsafe beaching yard.”

Ingvild Jensen, director of nonprofit Shipbreaking Platform, told Finance Uncovered: “The use of these tax haven companies and flags of convenience are clearly what enables substandard practices across the entire shipping industry.”

Thailand

In Thailand, reporters revealed that Australian mining company Kingsgate set up a company in Mauritius with plans to benefit from the tax treaty between Mauritius and Thailand.

Tax officials in Bangkok told ICIJ that they viewed the treaty with Mauritius as a problematic contributor to tax avoidance and were seeking to renegotiate the 1998 agreement.

In 2016, the government of Thailand suspended Kingsgate’s gold mine operations on the grounds it was harmful to the environment and local health. Kingsgate disputed allegations that it had contributed to toxic groundwater. The company has taken the government to court and is seeking hundreds of millions of dollars in compensation, according to news reports.

United States

“The Mauritius Leaks show the West profiting from poor nations while depriving them of tax revenue,” Quartz wrote in one headline, part of a series of articles that examined the Mauritius operations of U.S. firms Aircastle, Esri and Sequoia Capital.

In one investigation Quartz reported that Sequoia Capital, “one of America’s most vaunted venture capital firms,” used Mauritius to legally avoid taxes in India.

As part of the Mauritius Leaks investigation, Quartz used artificial intelligence to build a computer program that helped reporters target and analyze specific documents from among the 200,000 files.