Update, Jan. 1, 2021: The Senate voted to override President Donald Trump’s veto of the defense spending bill, days after the House did the same. It’s the first veto override by Congress in the Trump presidency.

Landmark laws to thwart the use of U.S. shell companies by terrorists, human traffickers, arms dealers and kleptocrats are set to be enacted after more than a decade of lobbying and politicking with rare bipartisan support.

The sweeping anti-money laundering reforms hitched a lift in the annual defense spending bill that passed the Senate 84-13 today, and was approved by the House 355-78 earlier this week.

The Corporate Transparency Act requires U.S. companies to report their true owners to the Treasury Department’s Financial Crimes Enforcement Network, known as FinCEN — largely ending anonymous shell companies in the country.

The International Consortium of Investigative Journalists has repeatedly documented how the rich, the powerful and the criminal have used anonymous entities to hide their wealth, including in the 2016 Panama Papers and the 2020 FinCEN Files investigations.

Welcoming the clampdown, Transparency International’s U.S. director Gary Kalman said, “It is rare for such a simple measure to promise such an enormous impact.” Kalman added that the long sought anti-corruption reforms would “move us into a new era of enforcement.”

The new legislation will allow law enforcement agencies and financial institutions to request company ownership information from FinCEN. The data will not be publicly available.

FinCEN Files was based on a trove of suspicious activity reports filed by banks and other financial institutions to FinCEN. BuzzFeed News obtained the secret documents and shared them with ICIJ and more than 100 other media organizations.

The global investigation exposed how a broken U.S.-led enforcement system allows banks to continue to profit from moving dirty money tied to drug cartels, trafficking rings fueling the opioid crisis, fraud, organized crime, sanctions evasion, ruinous real estate schemes, and terrorism.

“Too many times, people … think money laundering is a federal, victimless crime. It is certainly not that,” Sen. Sherrod Brown of Ohio, the top Democrat on the Senate banking committee, told reporters on a call organized by the advocacy group the FACT Coalition. “Sinaloa cartel actors, fentanyl traffickers have been destroying thousands of families in my state and across the country.”

Earlier this year, Brown credited FinCEN Files for revealing the lack of forceful enforcement against banks that repeatedly violate the law. Advocates said a number of proposed bipartisan bills, including one co-sponsored by Brown, were instrumental in generating the support needed to attach the reforms to the spending bill.

“This is a really big deal to get this passed,” Brown said Thursday. “No more hiding these abuses in anonymous shell companies. It also cracks down on bank officials who look the other way or actively aid money laundering.”

A long time coming

ICIJ has shown how offshore shell companies have been used for dubious financial dealings and tax avoidance through a series of global exposés, including the Secrecy for Sale investigation, Panama Papers and Paradise Papers. U.S. lawmakers have repeatedly cited the investigations in proposing reforms over the years.

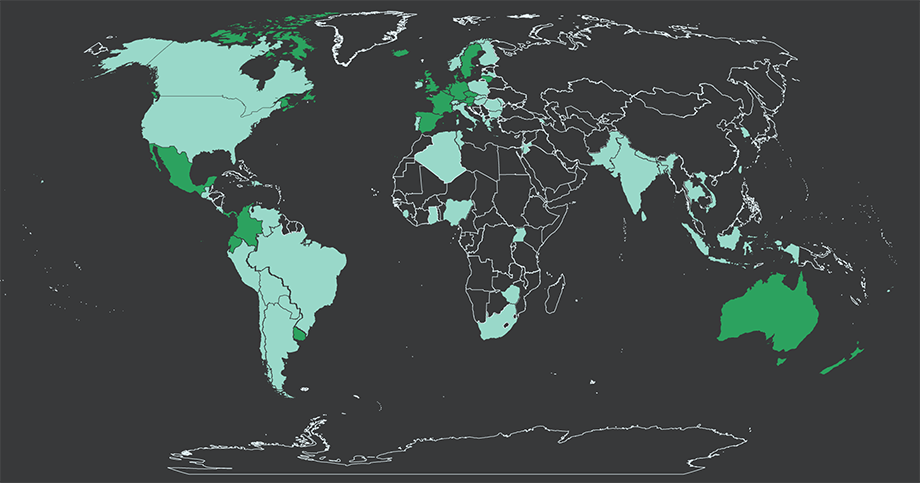

Countries like the United Kingdom, Indonesia and members of the European Union also took steps toward ending anonymous shell companies in response to ICIJ reporting.

“When the Panama Papers leaked, there was a huge flurry of interest because there’s all of a sudden this recognition that it was kleptocrats, money launderers, corrupt officials the world over, as well as criminals, were all using a very common structure to help evade law enforcement, which was setting up an anonymous company,” Lakshmi Kumar, policy director of Global Financial Integrity, said.

The phenomenon is not limited to the exotic offshore tax havens of popular imagination. U.S. jurisdictions like Delaware, Wyoming and Nevada are among the world’s top locations to set up anonymous companies. Legislation to require corporations to disclose their true owners was first proposed in the U.S. over a decade ago, co-sponsored by then-senator Barack Obama, and similar bills have been introduced over the years.

Advocates credit years of lobbying a broad coalition of stakeholders, including the U.S. Chamber of Commerce which had previously been a leading opponent, in getting the reforms across the finish line this year.

“What’s changed now is a growing understanding among various constituencies about the harms that anonymous companies pose, and the threats that they pose for our financial system, to our businesses,” Clark Gascoigne, senior policy advisor at FACT Coalition, said.

But it’s not a done deal quite yet.

Although the anti-money laundering proposals have had the support of the administration, President Donald Trump has repeatedly threatened to veto the National Defense Authorization Act over provisions unrelated to financial secrecy.

I hope House Republicans will vote against the very weak National Defense Authorization Act (NDAA), which I will VETO. Must include a termination of Section 230 (for National Security purposes), preserve our National Monuments, & allow for 5G & troop reductions in foreign lands!

— Donald J. Trump (@realDonaldTrump) December 8, 2020

Both the House and the Senate votes surpassed the two-thirds margin that would be needed to override a veto, although some Republicans have indicated that they would not support what would be the first veto override of the Trump presidency.

But the NDAA has been reliably passed by Congress every year for six decades and advocates are confident that the time has come for the landmark financial transparency measure that’s included in the omnibus bill.

“It’s one of the few areas where the outgoing Trump administration agrees with the incoming Biden administration,” Gascoigne said. “It may be the first bill in the history of Congress that has the support of both Dow Chemical and Friends of the Earth. Heck, the state of Delaware even supports reform.”