April 2016

The world responded

Within days of publication, protesters hit the streets, politicians resigned, police raided offices and prosecutors launched investigations.

The impact didn’t stop after the initial uproar.

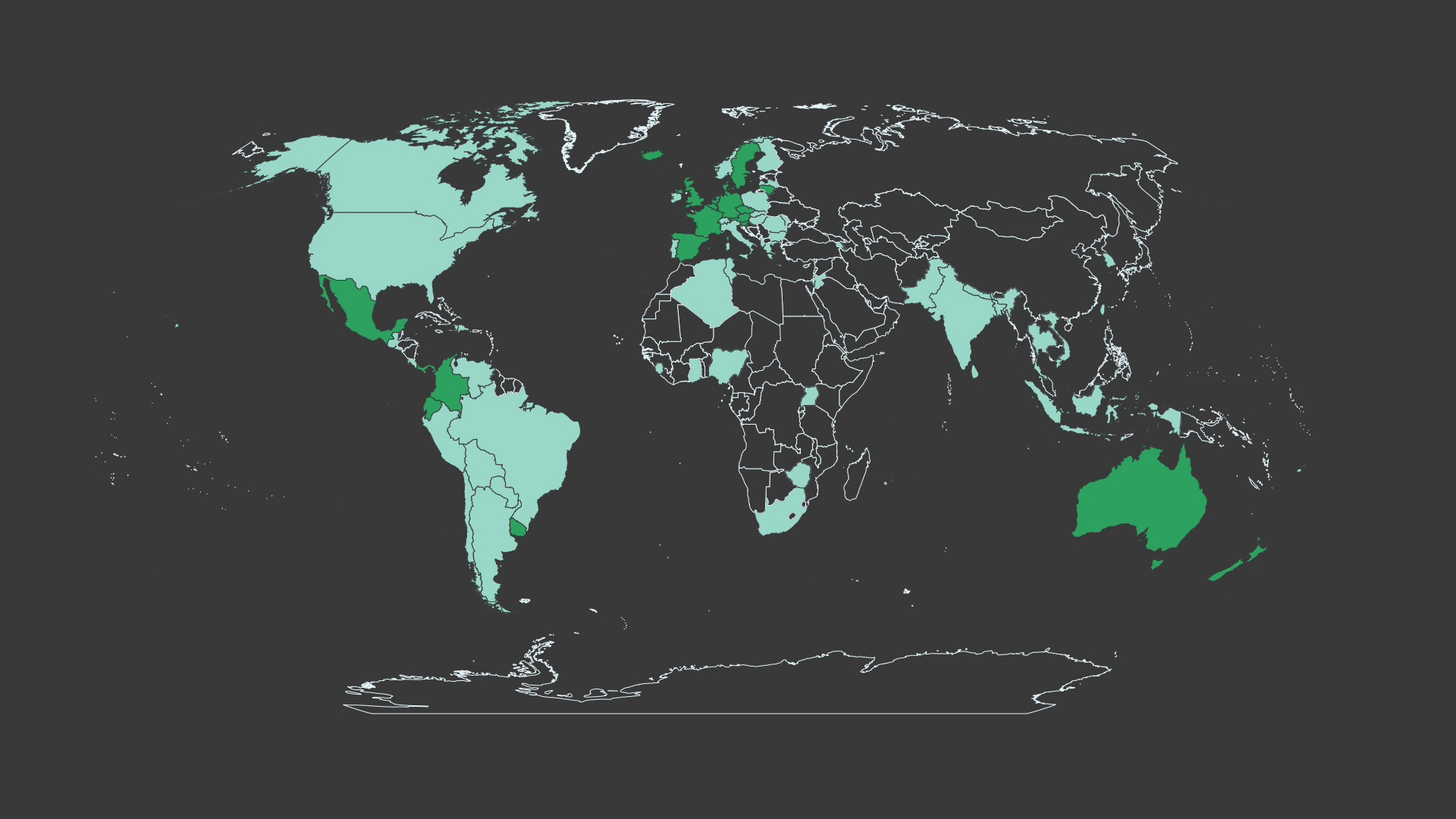

Investigations were sparked in more than 82 countries.

Feb 2017

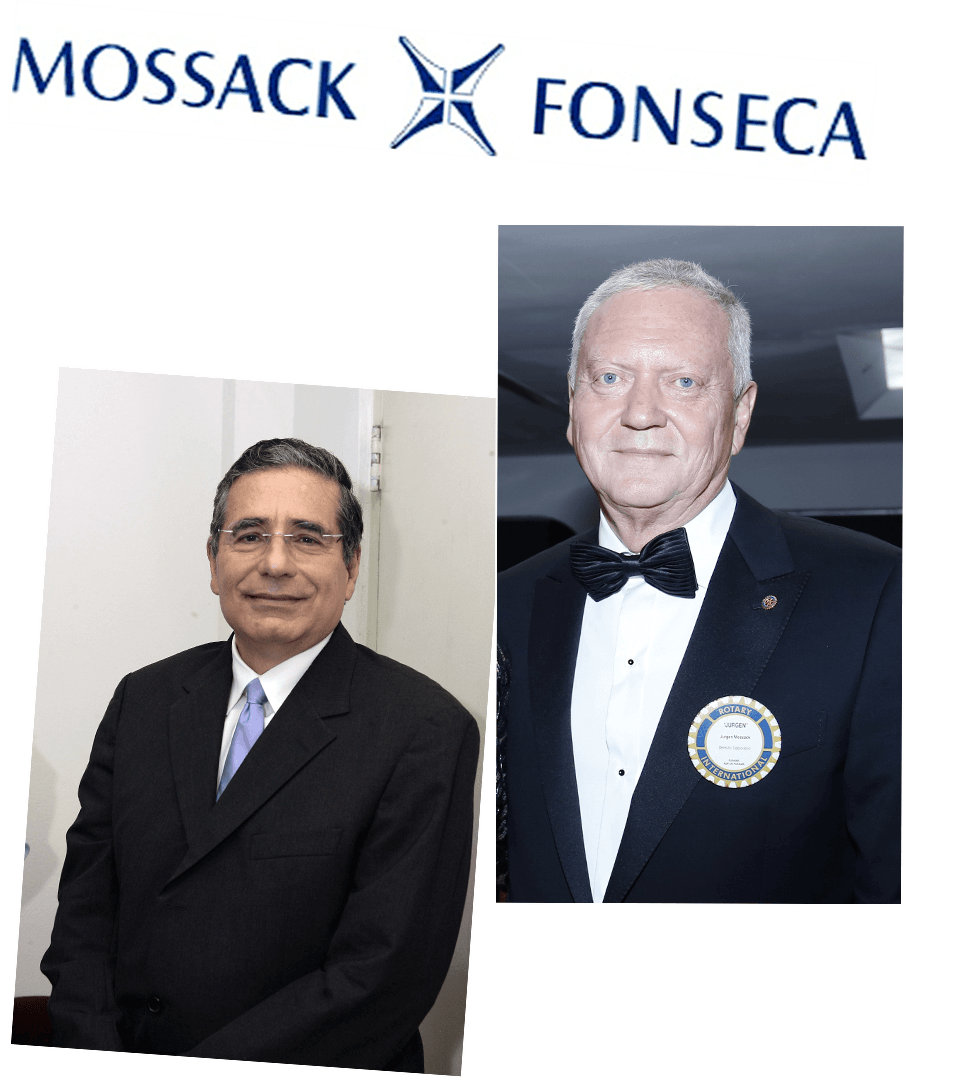

Panama responds with arrests

In Panama, police raided law firm Mossack Fonseca and arrested its founders on charges of money laundering. Jürgen Mossack and Ramón Fonseca spent months in jail.

July 2017

Laws change, and so do behaviors

In New Zealand, an inquiry called the country’s trust laws “inadequate” and parliament strengthened laws to fight tax evasion and money laundering. The number of foreign trusts in New Zealand fell by three-quarters.

August 2017

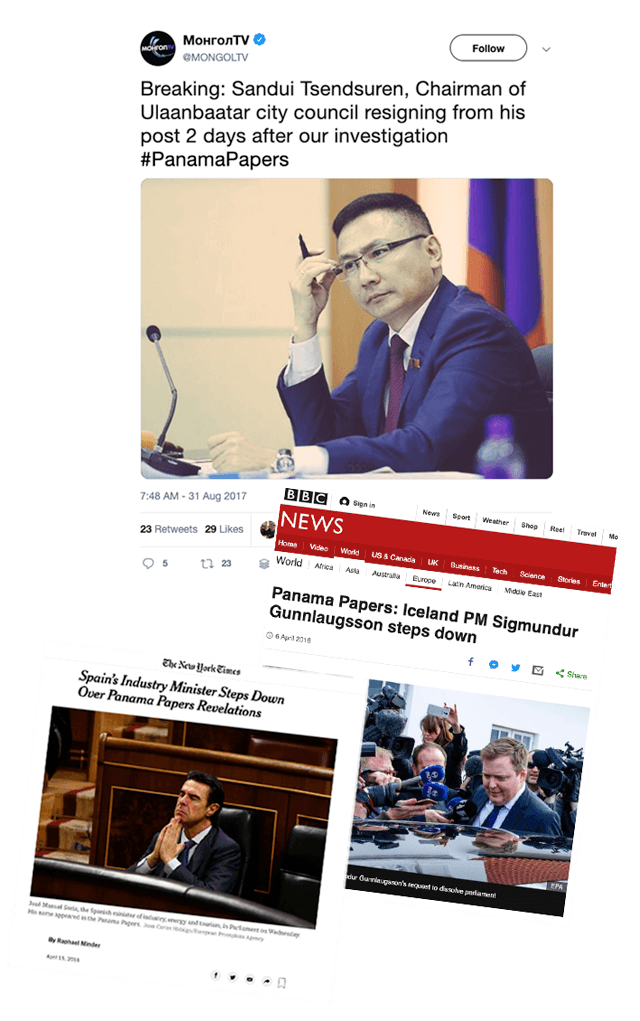

More resignations

In Mongolia, MongolTV reported the resignation of capital city council chairman, Sandui Tsendsuren. He joined a list of political casualties from Iceland, Pakistan, Spain and beyond.

October 2017

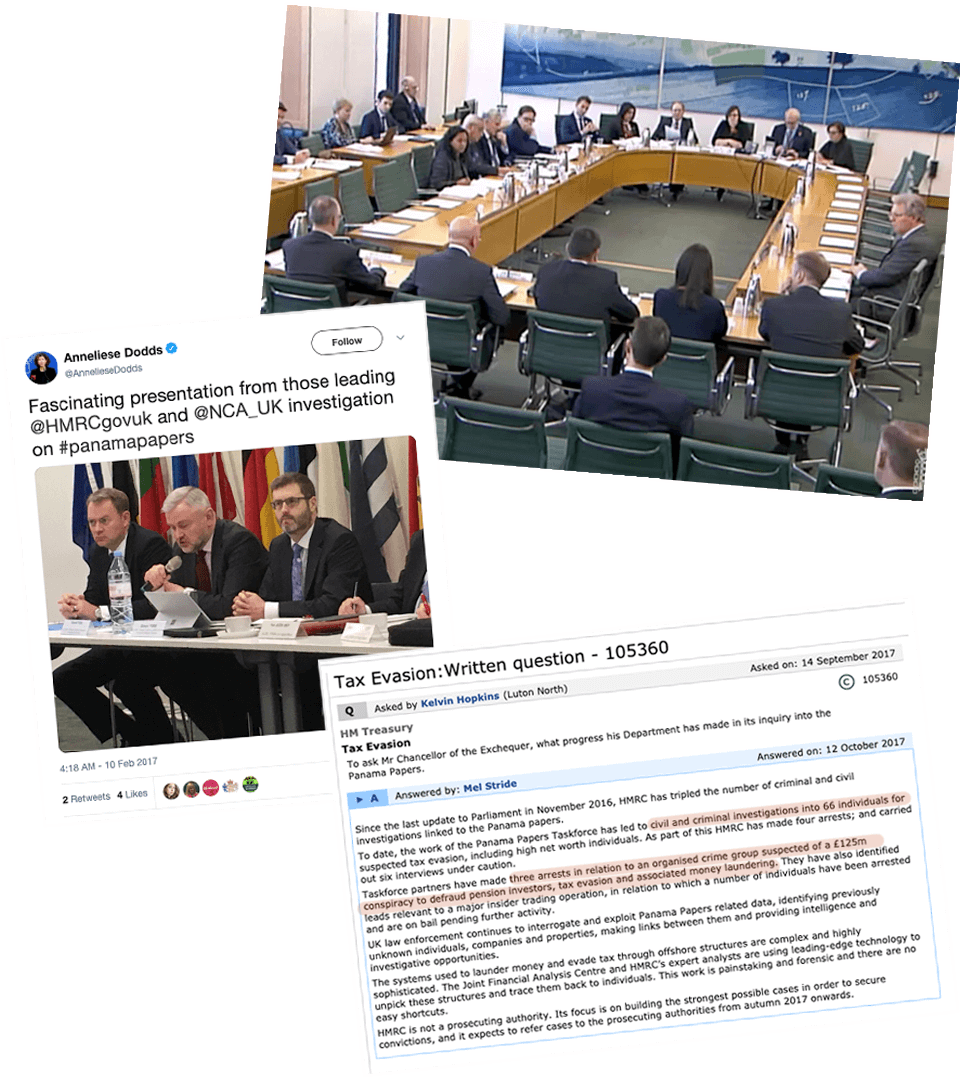

Investigators start to see results

In the U.K, a taskforce told parliament that it had investigated dozens of people for tax evasion, arrested four others and would recover $252 million in backtaxes and fines.

December 2017

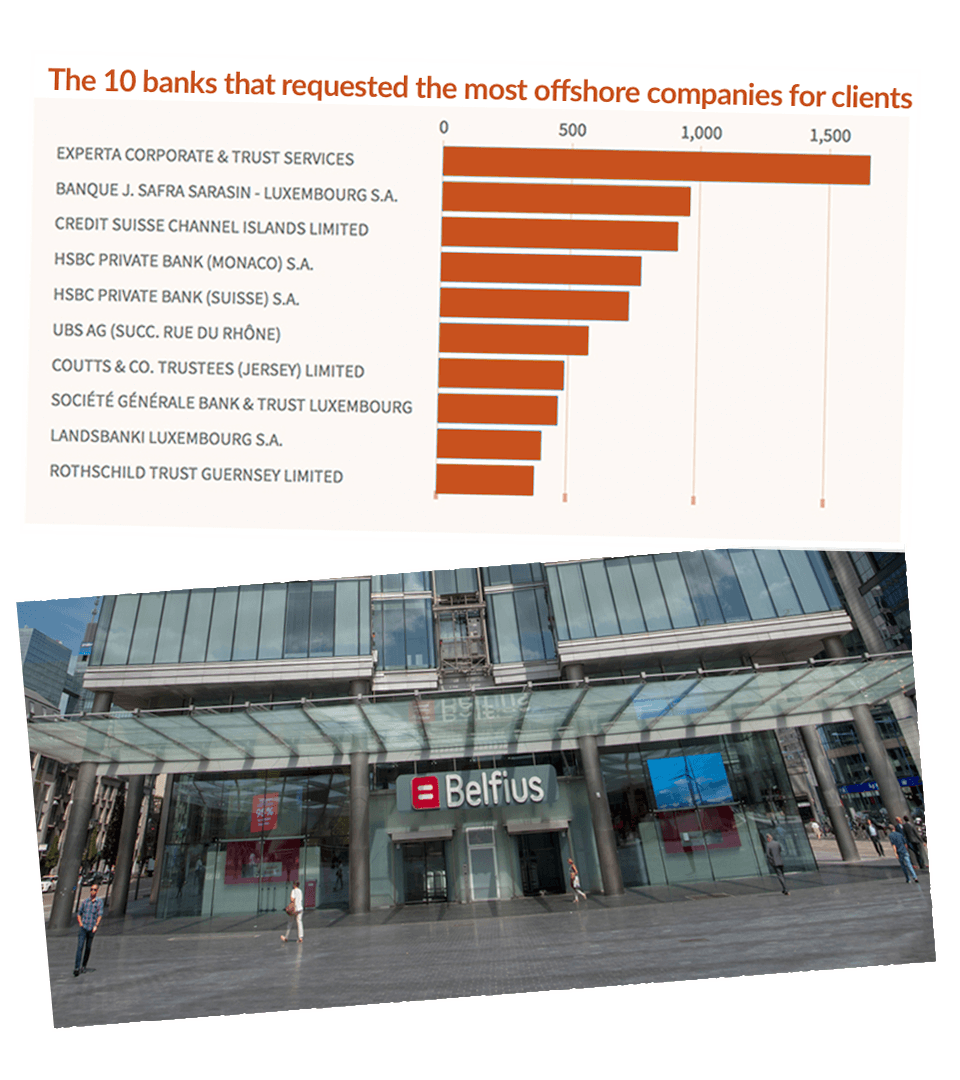

Authorities target the enablers

In Belgium, police raided a state-run bank whose former subsididary helped clients set up more than 1,500 offshore companies.

March 2018

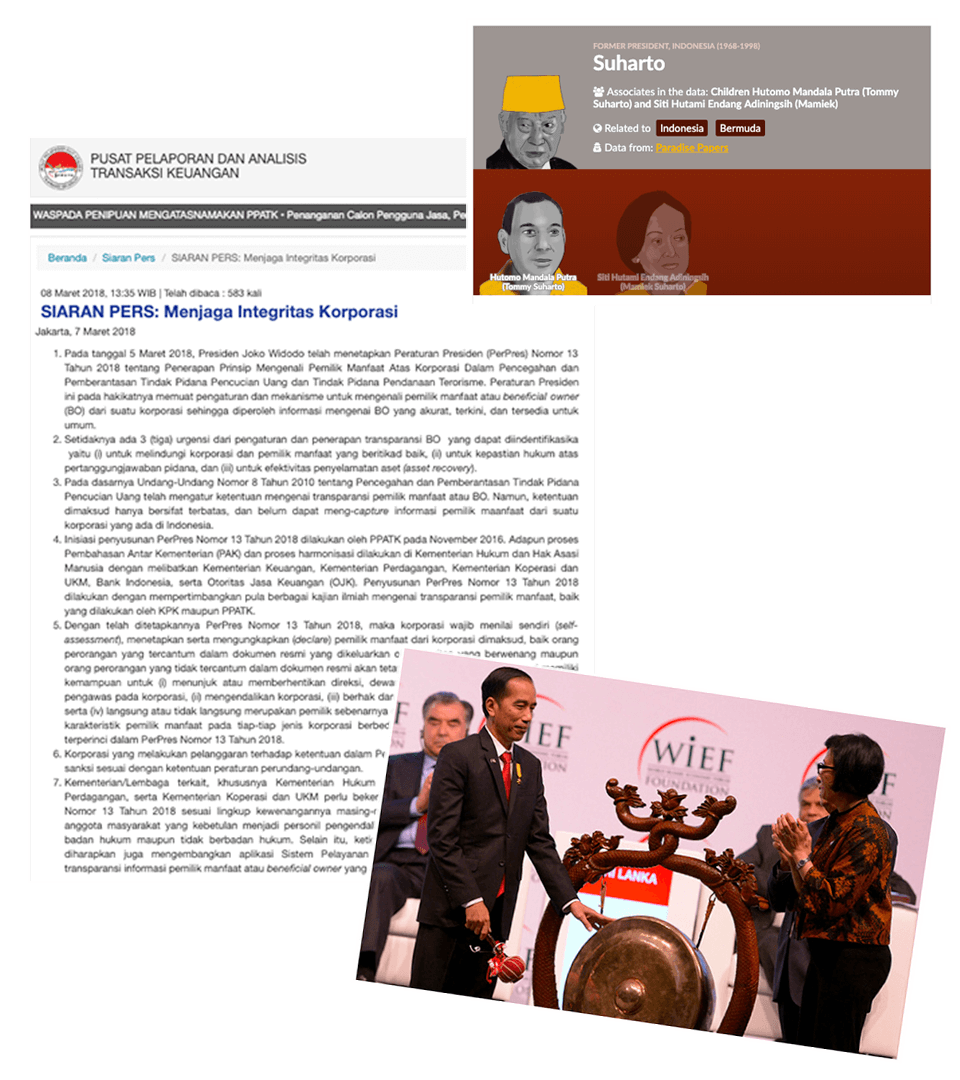

New rules force corporate transparency

In Indonesia, the government decreed that all companies must reveal their true owners. The country was one of a number that introduced new rules to combat corruption and other illicit activities.

March 2018

“One of the enduring benefits of the Panama Papers is that we now have the laws, and we have the government buy-in and commitment to support us.”

Chris Jordan, Australian Tax Office

June 2018

Reporting continues, new scandals emerge

In Côte d’Ivoire, the ruling cabinet sacked a city mayor for alleged embezzlement after new investigations by ICIJ’s partners.

June 2018

Another Mossack Fonseca leak

The chaotic scramble by Mossack Fonseca to survive was revealed in a second leak. It also shed light on unknown criminal investigations and revealed new findings about the world’s global elite.

The new 1.2 million files from the #PanamaPapers reveal the back-and-forth correspondence between Mossack Fonseca and various intermediaries. https://t.co/IGZkFqpV4X pic.twitter.com/PhDNzvUsjN

— ICIJ (@ICIJorg) June 20, 2018

“This email will, probably, be intercepted like 11,600,000 other documents. I don’t care.”

One Swiss intermediary in July 2016

July 2018

Cross-border investigations launched

In Algeria, prosecutors opened a money laundering probe into a milk mogul and sought Switzerland’s help to obtain bank records.

November 2018

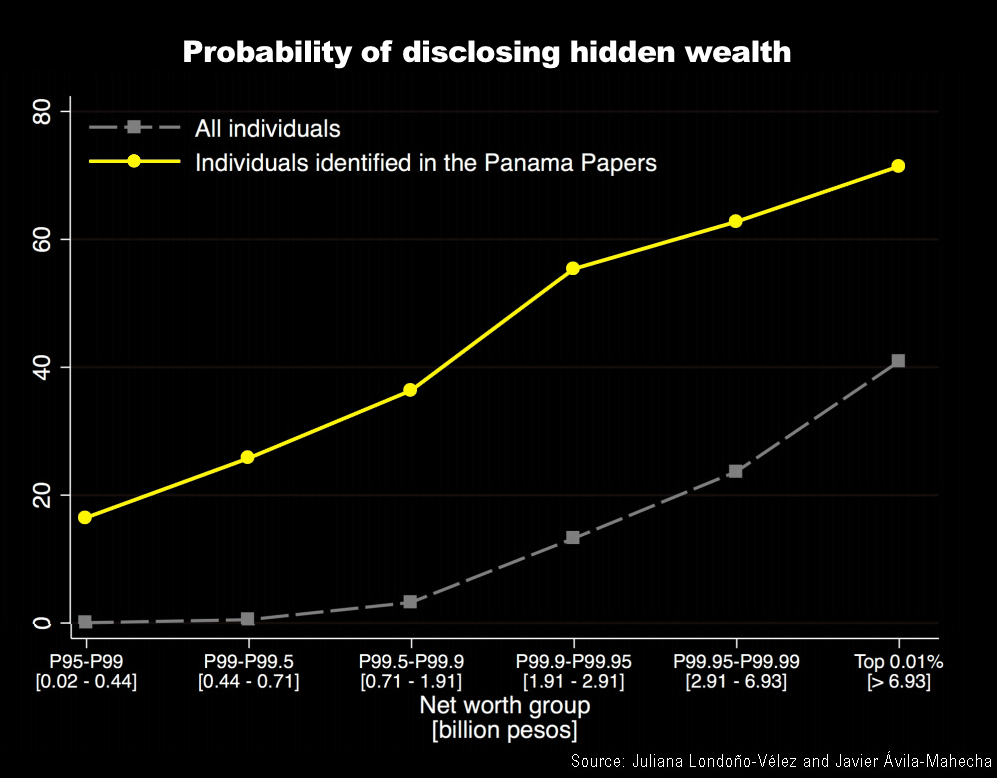

Taxpayers change their ways

In Colombia, the tax office doubled its revenue collection after the Panama Papers encouraged citizens to report hidden assets.

“I think it is fair to infer that this shows leaks can have a massive impact on tax compliance, through deterrence and fear of being detected.”

Juliana Londoño Vélez, researcher at University of California

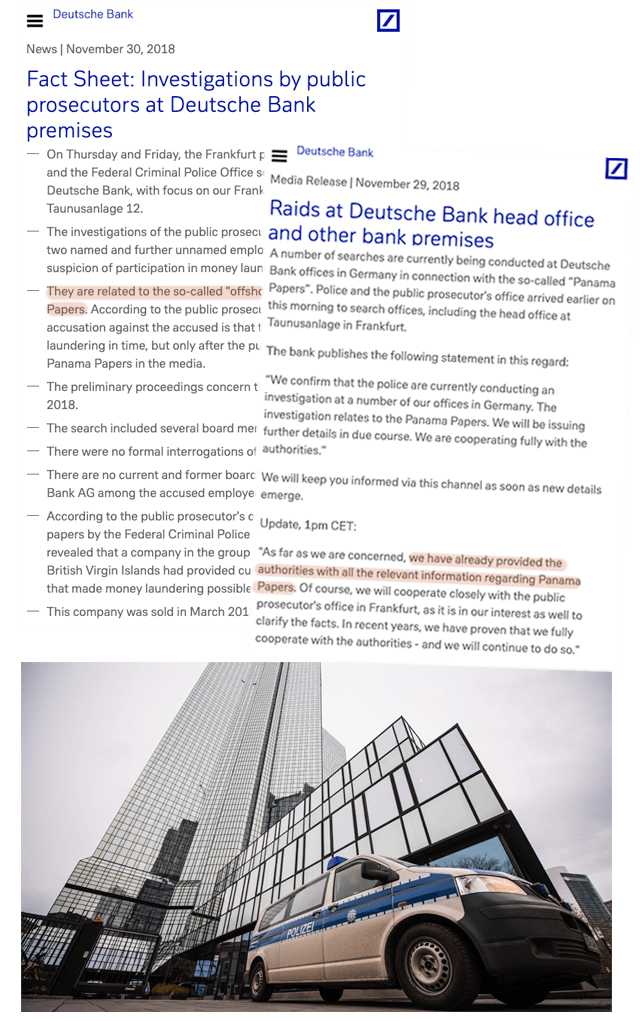

November 2018

Banks are forced to respond

In Germany, 170 police raided the headquarters of Deutsche Bank as part of a money laundering investigation. The probe focused on whether the bank, Germany’s biggest, helped clients set up offshore accounts to transfer money from criminal activities.

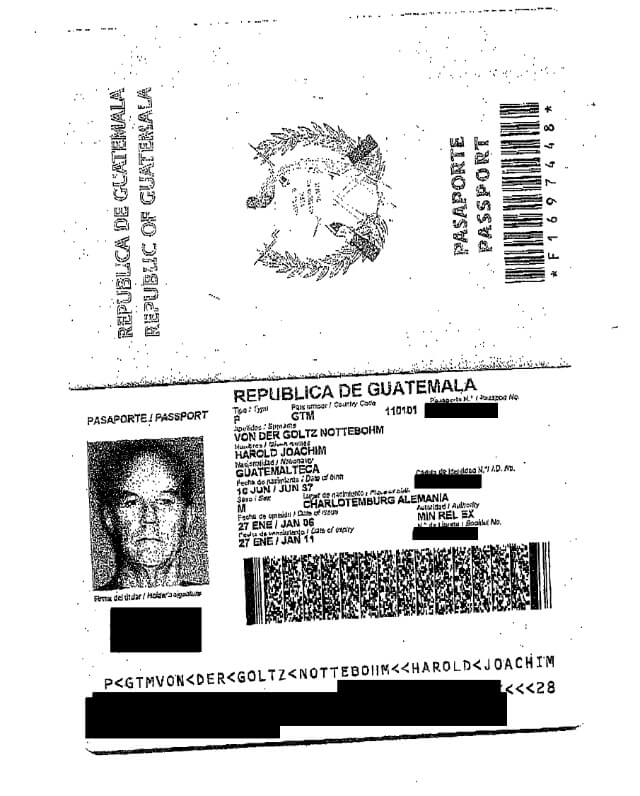

March 2019

New criminal cases launch

In the United States, authorities arrested the first known taxpayer for his involvement in an alleged “decades-long criminal scheme.”

March 2019

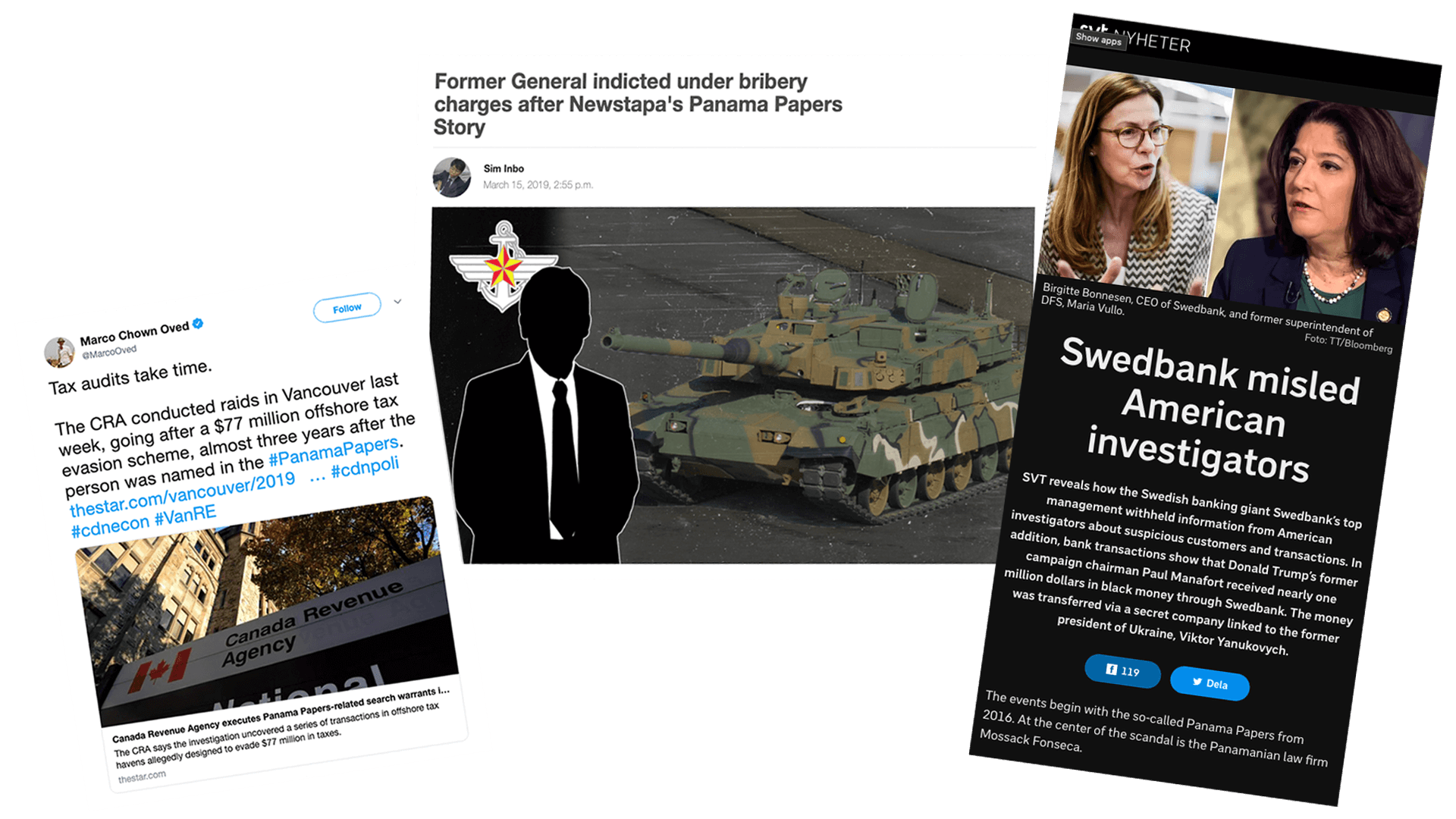

And more investigations are opened

In South Korea, prosecutors opened a bribery case into contracts with a Turkish arms dealer. In Vancouver, the Canada Revenue Agency executed search warrants as part of a $77 million tax evasion probe. In Sweden, banking giant Swedbank’s top management reportedly withheld information from American investigators relating to the Panama Papers.

Your money is clawed back.

More than $1.2 billion has been recouped in 22 countries. Investigations were sparked in more than 82 countries.