COLLABORATION

About the FinCEN Files investigation

An ICIJ investigation reveals the role of global banks in industrial-scale money laundering — and the bloodshed and suffering that flow in its wake.

Drawing on a cache of secret financial intelligence reports, the global investigation by more than 400 journalists reveals how banks continue to move dirty money for drug cartels, corrupt regimes, arms traffickers and other international criminals — and how a broken U.S.-led enforcement system perpetuates business as usual.

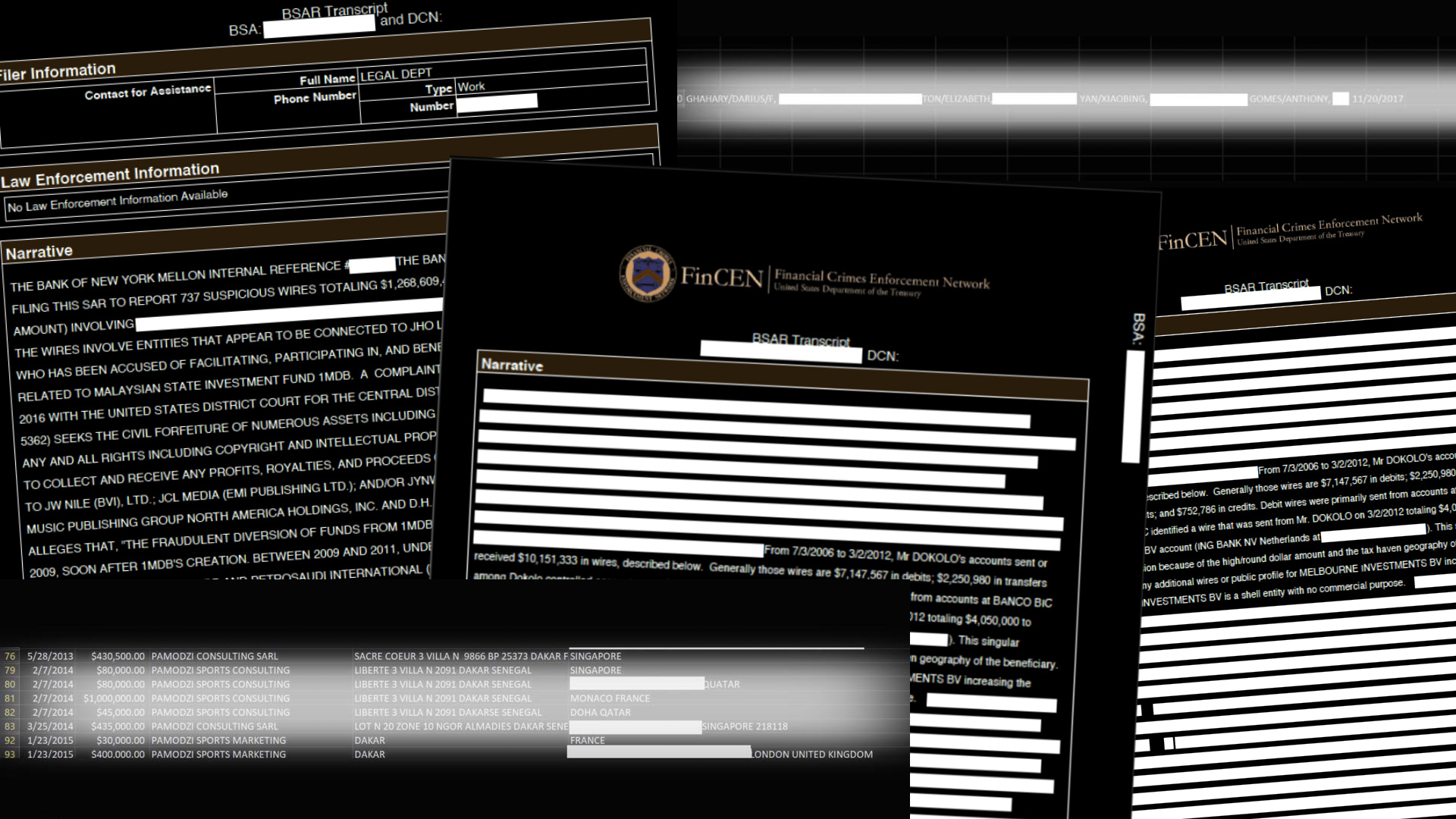

Obtained and shared by BuzzFeed News, the documents include more than 2,100 suspicious activity reports, or SARs, filed by global banks to the United States Treasury Department’s intelligence unit, the Financial Crimes Enforcement Network, known as FinCEN.

The International Consortium of Investigative Journalists, together with BuzzFeed News and 108 other media partners in 88 countries, spent 16 months organizing and analyzing the documents, dubbed the FinCEN Files. ICIJ and its partners collected additional leaked documents from sources, reading through voluminous court and archival records and interviewing hundreds of people, including crime fighters and crime victims.

A former U.S. Treasury Department official, Natalie Mayflower Sours Edwards, from Virginia, pleaded guilty in January to conspiring to unlawfully disclose documents to BuzzFeed News.

BuzzFeed News has not commented on its source.

The FinCEN Files investigation was able to trace banks’ roles in hiding money looted from government treasuries, scammed from pensioners, and generated through drug sales, illegal gold mining and other illegal activities.

The findings expose – from the inside – the consequences of allowing banks themselves to lead the world’s anti-money laundering defenses against kleptocracy, crime and terror, even as they earn huge profits from these same malefactors.

They also show how laundered money provides the lifeblood for corrupt authoritarian regimes and the enemies of democracy worldwide.

The Treasury Department documents reveal how major banks continued to move staggering sums of suspect cash even while on criminal probation after highly touted money-laundering crackdowns by U.S. and U.K. authorities.

The records also reveal financial secrets of a motley collection of politicians and political figures on the run or facing trial for financial crimes. Among them: former Congolese Vice President Jean-Pierre Bemba, convicted for bribing witnesses during his trial on charges that he led soldiers on a rape and looting spree; Samark López Bello, who U.S. authorities allege is the “primary frontman” for Tareck El Aissami, Venezuela’s petroleum minister-cum-alleged drug dealer; Kazakhstan’s former energy minister; Angolan billionaire Isabel dos Santos, who Angolan prosecutors have charged with fraud and money laundering in a bid to recover around $1.1 billion; and Ukrainian presidential adviser Andriy Klyuyev, who is sanctioned by the European Union for allegedly looting state funds.

Because of their access to the U.S. Federal Reserve System, global banks’ U.S. operations serve as switchboard operators for dollar transactions, allowing them to see who is sending what money where and when.

When they see a suspicious transaction, they are empowered to take action to stop it — but they often don’t have to. Instead, they can simply send a SAR to FinCEN at the Treasury Department. The FinCEN Files represent less than 0.02% of the more than 12 million suspicious activity reports that financial institutions filed between 2011 and 2017.

The sweeping, unprecedented leak shows banks moved more than $2 trillion in payments between 1999 and 2017 they themselves believed were suspicious, plus hundreds of spreadsheets, involving financial institutions with flagged clients in more than 170 countries and territories. SARs reflect concerns by watchdogs within banks and financial institutions and are not necessarily indicative of any criminal conduct or other wrongdoing.

An ICIJ analysis found that banks in the FinCEN files regularly processed transactions to companies registered in so-called secrecy jurisdictions and did so without knowing the ultimate owner of the account. At least 20% of the reports contained a client with an address in one of the world’s top offshore financial havens, the British Virgin Islands, while many others provided addresses in the U.K., the U.S., Cyprus, Hong Kong, the United Arab Emirates, Russia and Switzerland.

ICIJ’s analysis found that in half of the reports banks didn’t have information about one or more entities behind the transactions. In 160 reports, banks sought more information about corporate vehicles, only to be met with no response.

The banks could serve as a chokepoint, cutting off the flow of dirty money around the world, or at least to anonymous shell companies. But banks’ financial incentives run toward keeping dirty money moving. And too often, that is exactly what they do.

The FinCEN Files dataset is a sprawling jumble of more than 2,600 files, including 2,100 narrative reports of varying quality that reveal the private concerns of global bank anti-money laundering compliance departments about certain transactions, along with attached spreadsheets of sometimes hundreds of lines of raw transaction data. And many spreadsheets, filled with names, bank names, figures and dates, came unattached to any narrative that would provide a reason for their inclusion.

According to BuzzFeed News, some of the records were gathered as part of U.S. congressional investigations into Russian interference in the 2016 U.S. presidential election; others were gathered following requests to FinCEN from law enforcement agencies.

ICIJ’s collaboration mined the narratives of the FinCEN Files SARs and created more than 55,000 records of data structured into fixed fields that include details on more than 200,000 transactions flagged by the banks in the SARs. The effort resulted in an unprecedented dataset that touches regions across the globe. The leak also includes reports, written by FinCEN, called Kleptocracy Weekly, that provided additional perspective on the SARs.

Key findings

Key findings of ICIJ’s FinCEN Files investigation include:

- Global banks moved more than $2 trillion between 1999 and 2017 in payments they believed were suspicious, and flagged bank clients in more than 170 countries and territories who were identified as being involved in potentially illicit transactions. The figures include $514 billion at JPMorgan Chase and $1.3 trillion at Deutsche Bank.

- The FinCEN Files show that five global banks — JPMorgan Chase, HSBC, Standard Chartered Bank, Deutsche Bank and Bank of New York Mellon — moved illicit cash for shadowy characters and criminal networks even after U.S. authorities fined these financial institutions for earlier failures to stem flows of dirty money.

- In half of the FinCEN Files reports, banks didn’t have information about one or more entities behind the transactions.

- JPMorgan Chase moved money for companies tied to the massive looting of public funds in Venezuela, Malaysia and Ukraine, including under-the-table payments from disgraced Ukrainian officials to Paul J. Manafort Jr., U.S. President Donald Trump’s convicted former campaign manager.

- Deutsche Bank ignored red flags for years and played an integral role in the historic $230 billion money laundering scandal now engulfing Danske Bank’s Estonian operation. The German giant’s automated systems flagged one anonymous U.K.-registered shell company — later revealed as a major laundering vehicle — a dozen times but the bank still processed $2.6 billion and didn’t file a SAR for years until a separate scandal brought the shell company to light.

- Danske Estonia bankers implicated in the scandal ran a secret side company to help set up U.K. shell companies on a wholesale basis for anonymous clients.

- Shadowy entities with ties to the Baltics, known as formation agencies, use a loophole in U.K. corporate law to mass produce anonymous U.K.-registered shell companies and help them set up accounts in corrupt Baltic banks. Nine agencies alone set up 2,447 companies found in the FinCEN Files.

- HSBC continued to transmit money for alleged money launderers and an international Ponzi scheme even while it was serving a five-year probation with U.S. courts.

- In 2014, a U.S. task force recommended that the Treasury Department designate Dubai-based gold conglomerate Kaloti Jewellery Group as a money laundering threat under the USA Patriot Act — but the government didn’t act.

- Banks reported more than $4.8 billion between 2009 and 2017 in suspicious transactions with links to Venezuela. Nearly 70% of that amount had a Venezuelan government entity, such as the Ministry of Finance or the state oil company, as a party.

‘Everyone is doing badly’

FinCEN condemned the leak of the documents, declining to comment on the content of the suspicious activity reports, and saying it had referred the matter to the Justice Department and the Treasury’s inspector general.

“As FinCEN has stated previously, the unauthorized disclosure of SARs is a crime that can impact the national security of the United States, compromise law enforcement investigations, and threaten the safety and security of the institutions and individuals who file such reports,” FinCEN said.

Days before the FinCEN Files investigation was published, FinCEN announced it was seeking public comment on regulatory amendments to require that financial institutions subject to anti-money laundering laws maintain an “effective and reasonably designed” anti-money laundering program. The agency said the changes were intended to “modernize the regulatory regime to address the evolving threats of illicit finance” and improve the “effectiveness and efficiency of anti-money laundering programs.”

Department of Justice Criminal Division spokesperson Matt Lloyd said: “The Department of Justice stands by its work, and remains committed to aggressively investigating and prosecuting financial crime—including money laundering—wherever we find it.”

JPMorgan, HSBC and other big banks deny systematic wrongdoing and say they are working to improve their programs for preventing money laundering and screening out customers involved in criminal activities.

“Starting in 2012, HSBC embarked on a multi-year journey to overhaul its ability to combat financial crime,” said Heidi Ashley, a spokesperson for the bank. “HSBC is a much safer institution than it was in 2012.”

A Standard Chartered spokesperson said U.S. and U.K. authorities had publicly acknowledged that the Group had undergone “a comprehensive and positive transformation over the last several years.”

“In 2019 we monitored more than 1.2 billion transactions for potential suspicious activity and screened more than 157 million transactions for compliance with applicable sanctions requirements. The reality of the global financial system is that there will always be attempts to launder money and evade sanctions; the responsibility of banks is to build effective screening and monitoring systems and we work closely with regulators and law enforcement to bring perpetrators to justice.”

But even top officials concede that whatever its merits, the system just doesn’t work to slow the flood of dirty money.

“Everyone is doing badly,” David Lewis, head of the Paris-based Financial Action Task Force on Money Laundering, acknowledged in an interview with ICIJ.

The ICIJ Team

Director: Gerard Ryle

Project manager & editor: Fergus Shiel

Senior editors: Dean Starkman, Michael Hudson, Ben Hallman

Reporters: Simon Bowers, Sasha Chavkin, Will Fitzgibbon, Kyra Gurney, Spencer Woodman, Tanya Kozyreva, Mike Sallah, Scilla Alecci

Data editor: Emilia Díaz-Struck

Data reporters: Agustin Armendariz, Karrie Kehoe, Delphine Reuter, Mago Torres, Margot Willams, Miriam Pensack, Jelena Cosic, Miguel Fiandor

Associate editor and fact checker: Richard H.P. Sia

Additional fact checking: Spencer Woodman, Margot Williams

Online editor: Hamish Boland-Rudder

Community engagement editor: Amy Wilson-Chapman

Copy editor: Joe Hillhouse

Additional editing: Tom Stites

Video reporter: Scilla Alecci

Web developer: Antonio Cucho Gamboa

Chief technology officer: Pierre Romera

Technology team: Ash Guevara, Soline Ledesert, Miguel Fiandor, Bruno Thomas, Anne L’Hote, Madeline O’Leary, Maxime Vanza

Training manager: Jelena Cosic

Illustrators: Ben King, Alicia Tatone of BuzzFeed News

Confidential Clients designer: Lexi Namer

Digital producer: Asraa Mustufa

Editorial intern: Carmen Molina Acosta

ICIJ worked with a team of more than 400 reporters from around the world. Meet the team.