When Robert Woods, an ex-cop from Liverpool, took a job in early 2006 as a compliance manager for Appleby, the global offshore law firm, he joined an organization that had problems.

Appleby’s Cayman Islands office where he worked, for example, had more than 600 clients on its books whose records were labeled “non-compliant” – meaning that the firm had no current IDs, contact information or other particulars needed to make sure it wasn’t setting up shell companies and other structures for criminals or corrupt politicians.

Five years later, Woods had moved up in the firm, taking over as its director of compliance. But things hadn’t improved much – at least according to a PowerPoint presentation he appears to have put together sometime near the end of 2011.

The 44-page training slideshow, which featured images from the HBO mafia drama “The Sopranos,” recalled lowlights of Appleby’s recent history. Under a slide titled “Terrorist Financing Offences,” the notes read: “We have a current case where we are sitting on about 400K that is definitely tainted and it is not easy to deal with.”

In another case, Woods’ notes indicated, Appleby set up a trust for a client to buy property in London and accepted money on his behalf “without question.” Appleby later learned, the presentation acknowledged, that the trust was owned by a former Pakistani official who had been charged with embezzling public money and had “infiltrated allegedly corrupt funds into our business.”

“Some of the crap we accept is amazing totally amazing,” the presentation’s notes said beneath a slide listing the information Appleby employees needed to know about its clients.

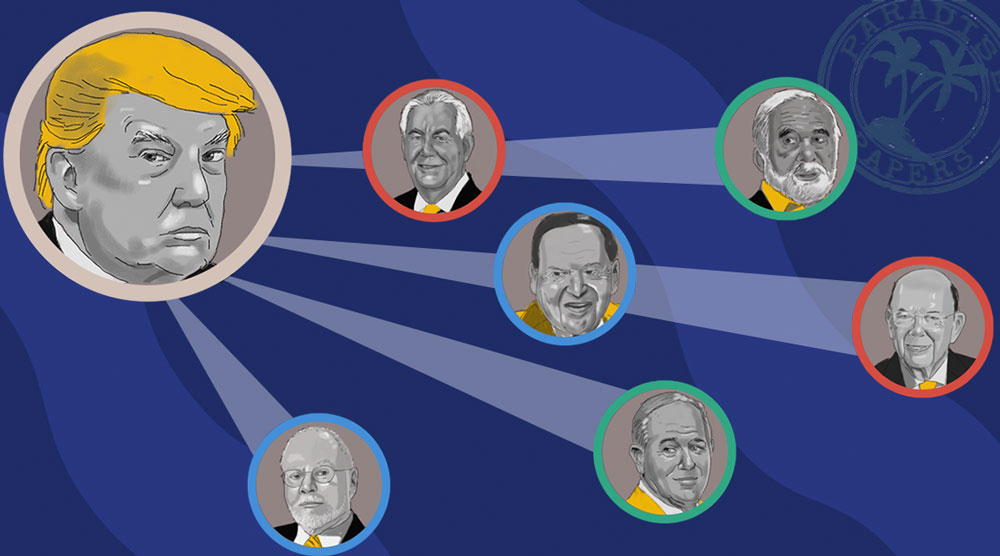

A leak of 6.8 million confidential records reveals, among other things, how Appleby has sometimes failed to keep out questionable clients – before Woods’ 2011 PowerPoint and since then. The documents expose the secret offshore lives of politicians and fraudsters and elaborate tax- avoidance strategies pursued by Apple, Nike and other corporate giants.

The emails, client records, bank applications, court papers and other files were obtained by the German newspaper Süddeutsche Zeitung and shared with the International Consortium of Investigative Journalists and other media organizations. They represent the inner workings of Appleby from the 1950s until 2016. The files include documents from the firm’s corporate services division, which became independent in 2016 under the name Estera.

Appleby did not provide ICIJ with answers to detailed questions. Instead, it released a media statement online that said the firm is committed to high standards. Following a thorough and vigorous investigation, Appleby said, it rejects any allegations of wrongdoing by the company or its clients. Estera did not respond to questions.

Appleby said: “We are an offshore law firm who advises clients on legitimate and lawful ways to conduct their business. We do not tolerate illegal behavior. It is true that we are not infallible. Where we find that mistakes have happened we act quickly to put things right and we make the necessary notifications to the relevant authorities.”

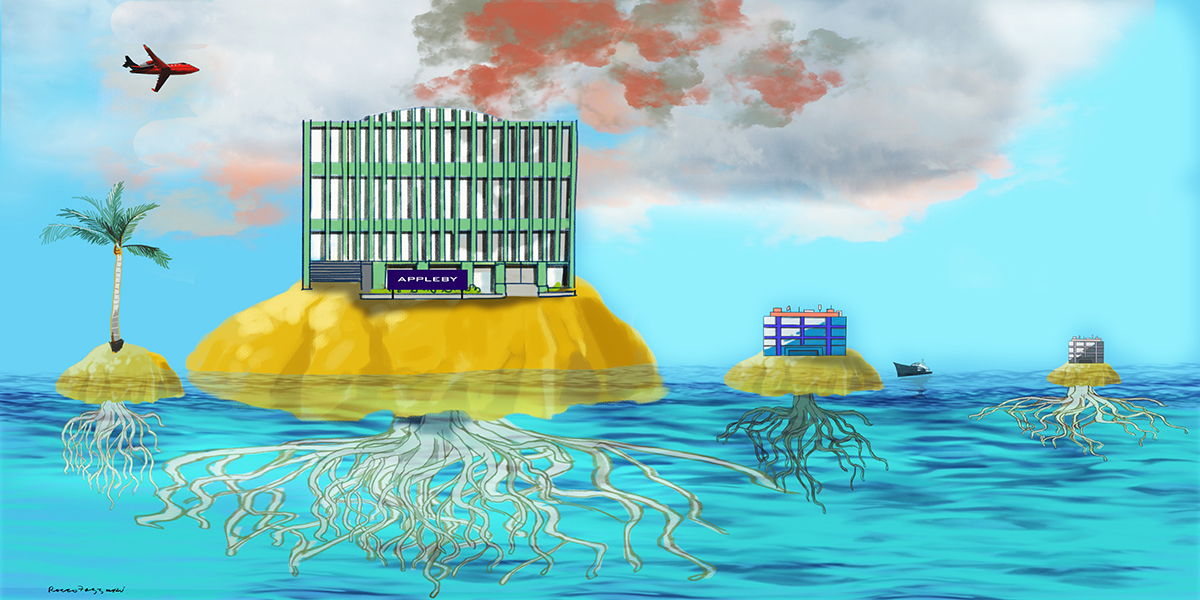

Appleby, which was founded in Bermuda, is one of the world’s most prestigious offshore law firms. Although Appleby is not a tax adviser, the 119-year-old firm is a leading member of the global network of lawyers, accountants, bankers and other operatives who set up and manage offshore companies and bank accounts for clients who want to avoid taxes or keep their finances under wraps.

Along with helping to set up shell companies, trusts and other offshore entities, the firm has various subsidiaries, affiliates and business units that draft wills, represent clients involved in litigation over workplace accidents or divorce and advise corporations. North Americans account for the biggest part of Appleby’s workload; the firm has worked for residents of all 50 U.S. states.

Appleby sees itself as an industry leader, proving to the world that the offshore industry can operate cleanly and professionally. “We provide innovative, timely and ethical advice,” the firm advertises in its eight-page brochure.

Over cocktails, at working dinners and around conference tables, it meets with representatives of major clients, many of which are leading banks and accounting firms such as KPMG, Ernst & Young and PricewaterhouseCoopers. In the Cayman Islands, half of Appleby’s top 20 clients in 2014 were major banks and investment firms, including Citigroup, Bank of America, HSBC, Credit Suisse and Wells Fargo.

When ICIJ and its media partners began publishing the Panama Papers investigation in April 2016, offshore promoters downplayed its significance. They said Mossack Fonseca, the Panama-headquartered law firm at the center of the scandal, was an outlier.

“Mossack Fonseca represents one of the last bastions of a shadowy international financial system that is rapidly ceasing to exist,” the trade magazine Wealth Management reported.

Appleby’s internal files show, however, that that even when offshore law firms invest large amounts of money and effort to stay compliant and reputable, the secrecy and the lure of financial gain at the heart of the shadow economy make it difficult for offshore operatives to avoid doing business with criminals, corrupt politicians and other questionable clients.

“MONEY LAUNDERING IS A DIRTY CRIME,” screamed the notes to Woods’ 2011 PowerPoint presentation, appearing in all caps for emphasis. “THERE IS USUALLY ALWAYS A VICTIM AT THE BOTTOM OF THE PILE AND A RICH PERSON AT THE TOP.”

Woods, who is still Appleby’s director of compliance, declined to comment when ICIJ asked him whether, in his view, the firm had improved its client-screening practices since 2011.

The presentation is one of at least four PowerPoint offerings drafted by Appleby’s compliance team between 2007 and 2015 that raised questions about how well the firm checked out its clients. It is unclear whether these presentations were made before Appleby employees. But in each of them, speaker’s remarks at the bottom of the slides provide unguarded commentary from insiders about Appleby’s compliance fumbles.

“Eighty percent of the battle is won or lost at the gate,” read the text with a slide used repeatedly in Appleby compliance presentations. “If we let in the wrong clients, we set ourselves up for a fall.”

Magic Circle

Appleby was born in 1898 in the British colony of Bermuda as the private practice of Maj. Reginald Woodifield Appleby, a tea-drinking, cricket-playing, rifle-shooting magistrate who became a member of the island’s Parliament and was knighted “for public services in Bermuda.” Such was his status that when a vacationing Major Appleby sailed to England in 1924, The Royal Gazette & Colonist Daily predicted a rise in crime during his absence.

When Bermuda’s legislature met in July 1940 to debate the island’s first income tax, Major Appleby spoke out, aligning himself with “those who look on all income tax as man’s last refinement of torture, to be resisted at all costs,” reported The Royal Gazette. Bermuda has never looked back; it continues to entice locals and foreigners with a zero tax rate.

Since expanding outside Bermuda in 1979, Appleby has transformed itself into a global institution with more than 700 employees spread across nearly every major tax haven – from the Cayman Islands in the Caribbean, to the Isle of Man in Europe, Mauritius in Africa and Hong Kong in Asia. “You seem like a monster – which is a good thing!” one Appleby client responded in a 2013 satisfaction survey.

Appleby collects “Offshore Law Firm of the Year” awards and is cited as part of what insiders call the “Offshore Magic Circle,” an informal collection of the world’s biggest offshore law firms, which jostle for the same business. Former employees serve as members of Parliament, judges and other government officials and at least one low-tax jurisdiction, the Cook Islands, used Appleby’s expertise to draw up its own offshore laws.

Publicly, the firm has burnished its image by sponsoring the America’s Cup, 5K family runs and cake sales. In advertising material, Appleby vaunts its benevolent undertakings, including working to help Nigeria recover money from the family of former dictator Sani Abacha and administering a multimillion-dollar fund to support nurses treating Ebola patients in West Africa.

Its clients include princesses, prime ministers and Hollywood stars. Appleby has worked for some of the world’s wealthiest oligarchs from Russia, the Middle East, Asia and Africa. In the firm’s Bermuda office, more than one in 10 companies had ties to clients with political connections, including politicians, their families or their close associates, according to an internal memo. Many of the highest-profile clients were managed by separate Appleby teams of trust specialists. In April 2016, Appleby announced the launch of Estera, formerly the firm’s profitable fiduciary arm, which manages the companies, trusts, jets and other assets of the global elite. Appleby and the new company remain close; some former Appleby employees now work for Estera from the same office address they occupied before.

Appleby’s recipe for success appears to have worked for the firm and its customers. Appleby books more than $100 million a year in revenue. Clients tell the firm that they find it “hard-working” and “friendly.” One happy fee-payer told Appleby that its “brand is a bit like being stranded in the middle of Africa and seeing a BA [British Airways] plane land – you know you’re going to get out of there.”

Appleby shares its customers’ confidence. Days after last year’s publication of the Panama Papers, Appleby turned down an offer from a risk consulting firm of a “refresher” training course on preventing money laundering. The law firm declined, explaining that it has “extremely robust” controls in place. “We don’t have the need for your sessions this time round.”

‘Steaming turd’

On June 29, 1993, with memories of the Persian Gulf War still fresh, a U.S. House subcommittee convened to discuss Iraq’s nuclear weapons program. Iraq had breached an agreement to allow United Nations inspectors to examine the country’s uranium stockpile, and international concerns were high.

“Iraq continues to flaunt its military power, massacring its own citizens in the North, and Iraqi Shiites in the South,” Rep. Tom Lantos, Democrat of California, said in opening remarks just after 10 a.m. that day.

Lantos read into the record a report from the subcommittee staff. Among its findings was that Crescent Petroleum, a major private oil company, was being investigated by U.S. authorities to determine whether it was a “front company” for Iraqi President Saddam Hussein. Even if Crescent wasn’t manufacturing weapons itself, the report stated, “it was certainly linked to the principal Iraqi organization that was.” Crescent, then as now, denied wrongdoing.

The June 29 hearing was broadcast live in the United States. But it doesn’t appear to have been noticed by Appleby’s office in Bermuda.

Crescent Petroleum, owned by Hamid Jafar, had been an Appleby client since 1984. For nearly 30 years, Appleby’s relationship with Crescent proceeded smoothly, according to the law firm’s files. It was only after Appleby was asked to help restructure Crescent in 2013 that the firm appeared to notice Jafar’s background – including that his brother had headed Iraq’s nuclear weapons program under Saddam Hussein.

“We have had this relationship for some time now,” one Appleby lawyer wrote. “How can we not have known this earlier?”

While rules and regulations vary, in many of Appleby’s busiest offices, great chunks of its work are governed by rules that require offshore providers to keep accurate records on who is using their services, for what purposes and where the money comes from.

The law firm must be cognisant of the fact that whilst they may be ‘raking in the fees’, the Trust company carries the significant risk in administering the subsequent structure. The Trust Co. must be aware that at the end of the day, if it all goes wrong, they will be left holding the ‘steaming turd’!

Another client who appeared to fall through the cracks was Ehud Arye Laniado, director and co-owner of Omega Diamonds, a Belgian company operating on the Antwerp diamond exchange. In May 2013, Belgian news media reported that Omega Diamonds had agreed to pay about $200 million to settle allegations that the company had had not declared income from African diamonds. Omega did not admit liability, and the case did not involve Laniado personally. Months later, Appleby accepted two payments from Laniado worth $5,000, and the money was placed in the law firm’s bank account on behalf of an offshore trust.

Later, when Laniado wanted to create a new trust, an Appleby employee noted news reports about Omega Diamonds’ legal problems but cleared the law firm to do business with him. Appleby created the new trust for him in April 2014.

Woods, Appleby’s compliance director, was upset when he found out about Laniado three months later. “This is a trust structure and the allegations are extremely serious and relate to blood diamonds,” Woods wrote to a colleague in July 2014. “Why was this not brought to my attention before the conflict check was cleared??”

Despite Woods’ concerns, Appleby kept Laniado as client.

Woods agreed that although Laniado was “high risk (due to involvement in the diamond industry), we have enough mitigating factors and information to be comfortable with the business; in fact it should be a good piece of business all around.”

But he told his colleagues that the episode represented a “failure of our processes.” He warned that the firm’s business units, such as Appleby Trust (Cayman) Ltd., shouldn’t let the quest for short-term profits overshadow the need to follow rules that required Appleby to assess the risks Laniado posed and to know who he was and what he wanted to do offshore.

“What’s done is done, but going forward, whilst being commercial, please let us try to ensure that we don’t get carried away with fee earning potential,” Woods wrote. “The law firm must be cognisant of the fact that whilst they may be ‘raking in the fees’, the Trust company carries the significant risk in administering the subsequent structure. The Trust Co. must be aware that at the end of the day, if it all goes wrong, they will be left holding the ‘steaming turd’! (It is Friday and Holding the Bag did not sound strong enough!)”

Appleby was still acting as trustee for the Laniado’s trust as of early 2016, the firm’s internal records show.

Woods and Appleby did not respond to specific requests for comment.

Laniado’s legal counsel substantively responded to ICIJ on his behalf but requested the contents of the response not be published. Laniado has previously stated that he has never had any involvement with blood diamonds.

‘We are exposed’

In day-to-day operations, Appleby uses software designed to reduce human error and identify risky clients. The firm’s manual requires employees to screen potential clients with a thorough online search and update records on anyone connected to politics once every year. The firm and its subsidiaries have carried out internal audits, kept spreadsheets on what it called “problematic” companies, and produced “yellow cards” to ensure that company information was accurate.

The controls worked, for example, when Appleby’s office in the British Virgin Islands rejected business involving Boris Shemyakin, a Russian real estate mogul, after online background checks showed that he had been indicted in Russia on charges involving a multibillion-dollar fraud. He denies wrongdoing.

The law firm also declined work with the global accounting firm Ernst & Young when it approached Appleby for possible help with the purchase of two $20 million Gulfstream jets for two sons of a former government minister in Azerbaijan and a man named Manouchehr Khangah. Appleby checked the WikiLeaks database of U.S. diplomatic cables and learned that one of the U.S. Embassy’s contacts referred to Khangah as the “frontman” for a former politician who headed what the U.S. cables called “one of the most corrupt operations in Azerbaijan.” Appleby declined the work.

Khangah could not be reached for comment. Ernst & Young said it could not comment on individual matters but that it is “committed to financial, legal and regulatory compliance in all of its work.”

Appleby knew the risks. Slap-bang in the center of a PowerPoint slide prepared for a 2012 training session in Bermuda was a gray headstone bearing the name “Arthur Andersen,” a reference to the audit firm convicted of obstruction of justice in 2002 for having destroyed documents relating to an investigation into the collapse of the energy giant Enron. The Supreme Court overturned the conviction, but the firm was unable to recover.

If Appleby didn’t do a better job of monitoring clients, the presentation suggested, employees could find themselves caught up in high-profile financial scandals, like David Duncan, the former Andersen auditor who pleaded guilty to obstruction of justice, and hedge fund manager Raj Rajaratnam, who was pictured in handcuffs as FBI agents arrested him for a multimillion-dollar securities fraud case. He was later convicted.

“We are exposed,” the slide show warned. “This is not the best we can do.”

Between 2005 and 2015, more than a dozen internal and regulatory examinations of Appleby’s offices in the Isle of Man, the Cayman Islands, the British Virgin Islands, Bermuda and London found flaws that could have involved Appleby in litigation and had financial and reputation implications..

After a 2005 review by a regulatory agency, the Bermuda Monetary Authority, Appleby’s trust company was ordered to improve 21 deficiencies in its performance and to obtain fresh, accurate records of its clients’ passports, addresses and sources of wealth. Later, despite improvements, Appleby’s head of compliance then, Ian Patrick, wrote, “I still believe that a huge effort will be required before we can be considered to be an offshore leader from a compliance perspective.”

The next year, an internal audit by Patrick at the British Virgin Islands office looked at 45 client files and found that only one of them met Appleby’s standards. Of the five Appleby offices reviewed around that time, Patrick reported that only the Hong Kong office kept its documents “in good order.”

An internal audit of the Cayman Islands’ trust office in 2008 found the risk of breaking laws and Appleby’s own protocols to be “high” in more than half of all the categories under review. The audit report noted a risk of fraudulent activities and said Appleby “may not be complying” with the law.

A 2012 review by regulators in the British Virgin Islands found holes in Appleby’s procedures for dealing with high-risk politicians and associates. An internal 2015 spot-check of the Isle of Man office revealed other problems, including one offshore company, co-owned by a Palestinian official, for which Appleby’s lacked detailed information about an $11.2 million loan.

When the Bermuda Monetary Authority audited an Appleby subsidiary in October 2014, it found “key or highly significant” weaknesses in nine areas. Nearly half – 46 percent – of the files reviewed by the agency lacked information on the origin of the money Appleby managed for its clients. There was “no evidence” that Appleby identified risks of money laundering and terrorism financing, the agency said, and the firm had not adopted the recommendations from previous audits.

“These omissions have heightened the Authority’s concern about the firm’s regulatory compliance and control environment,” the agency said. In October 2015, an Appleby director disclosed in a confidential document to government regulators in the British Virgin Islands that the Bermuda office had “settled” a fine imposed by Bermuda regulators after it conceded that it had failed to follow up on many of the agency’s recommendations for fixing weaknesses in its anti-money-laundering net. Appleby’s internal records show that the firm set aside $500,000 for the fine, but its existence has never been publicly disclosed. There was “no public censure,” the director wrote, adding that Bermuda’s regulators “agreed to keep the matter entirely private.”

A spokesman for the Bermuda Monetary Authority told ICIJ that it would not confirm or deny enforcement decisions. In 2016, the spokesman said, the authority changed its policy and now publishes details of fines and other sanctions online.

“We are subject to frequent regulatory checks and we are committed to achieving the high standards set by our regulators,” Appleby stated in a press release published one month after first receiving ICIJ’s questions.

“Having researched the ICIJ’s allegations’ we believe they are unfounded and based on a lack of understanding of the legitimate and lawful structures used in the offshore sector.”

Unquestioning

For 33 years, Michael Cannon policed the streets of Toronto. Outside work, Cannon honed his financial skills and put money in investments that he hoped would reduce his Canadian tax bill.

In the mid-2000s, Cannon paid about $20,000 into an offshore scheme marketed as a charitable deduction. It was a tax dodge, Canada’s revenue authority later alleged, that lured investors such as Cannon with the possibility of receiving $10,000 in tax credit in exchange for a $2,500 “donation,” all in Canadian currency.

“He thought it was too good to be true,” a Canadian judge wrote. “It was.”

In 2009, Cannon became the lead plaintiff in a class-action lawsuit in Canada on behalf of almost 10,000 investors, including nurses, teachers and lawyers who had paid more than $100 million into the program. They had lost millions, they claimed, by the time Canada’s tax office ruled the scheme invalid.

The far-reaching legal action sought compensation from the promoters, lawyers and advisers involved. One defendant was Edward Furtak, the so-called mastermind of the charity program. Appleby’s Bermuda office was another.

Lawyers for the investors alleged that Appleby helped transfer hundreds of millions of dollars back and forth in a “circular flow of funds” that netted Furtak and his family $20 million. The investors’ lawyers asserted that “a monkey covering his eyes and ears may not have foreseen” the risks to Canadian investors but that Appleby had no such excuse. In 2010, a judge found that there was a good case that Appleby had harmed people in Canada. Justice Strathy wrote that Appleby “simply did what Furtak” wanted it to do despite its obligations to know where money came from and how it was used.

Furtak was a long-standing Appleby client. Appleby had lent him $2.6 million to buy property on a verdant peninsula in Costa Rica and helped administer at least three offshore trusts for him along with a 34-meter Jamaican-flagged yacht named Takapuna and worth at least $5 million.

The class action against Furtak was settled at an early stage, and Furtak denied wrongdoing. The tax program was designed in compliance with the law, and Furtak continues to believe in its propriety, his lawyers told ICIJ.

The court case against Appleby rumbled on after Furtak settled. In 2013, Appleby’s external lawyers told the firm’s board of directors that the firm’s role in the affair had been “fairly limited, but relatively significant.”

“There is some concern,” the confidential board minutes noted, that the Bermuda office “appears to have affected the various transfers in what has been described as an unquestioning manner.” The lawyers warned that Appleby could be found liable of enriching itself at the investors’ expense.

In the courtroom, Appleby defended its behavior and promised to appeal any judgment against it to the highest court it could. Privately, Appleby had feared a penalty as high as $28.5 million, documents show.

At one stage, an Appleby employee said that one strategy was “to wait this out in the hope that the plaintiffs could run out of gas.”

Cannon didn’t give up, and Appleby settled the case in May 2017 for $12.7 million without admitting wrongdoing.

The cost may be more than financial.

Behind the scenes, some people at Appleby worried that it would take “a really long time” for the firm to absorb the financial and reputational impacts of the case.

Any employee with a copy of the PowerPoint presentations prepared years before by Appleby’s compliance team might have found it a good time to look back at this warning: “Every new investigation that reveals an offshore trustee as a puppet on strings controlled by a criminal” will be another “nail in the industry’s coffin.”

Correction: This story was first published stating that Laniado did not reply to ICIJ’s requests for comment. That has been changed to explain his legal counsel did respond but did not want the response published.