Jul 08, 2024

Ten years after an ICIJ exposé, Danish authorities charge Nordea bank with money laundering violations

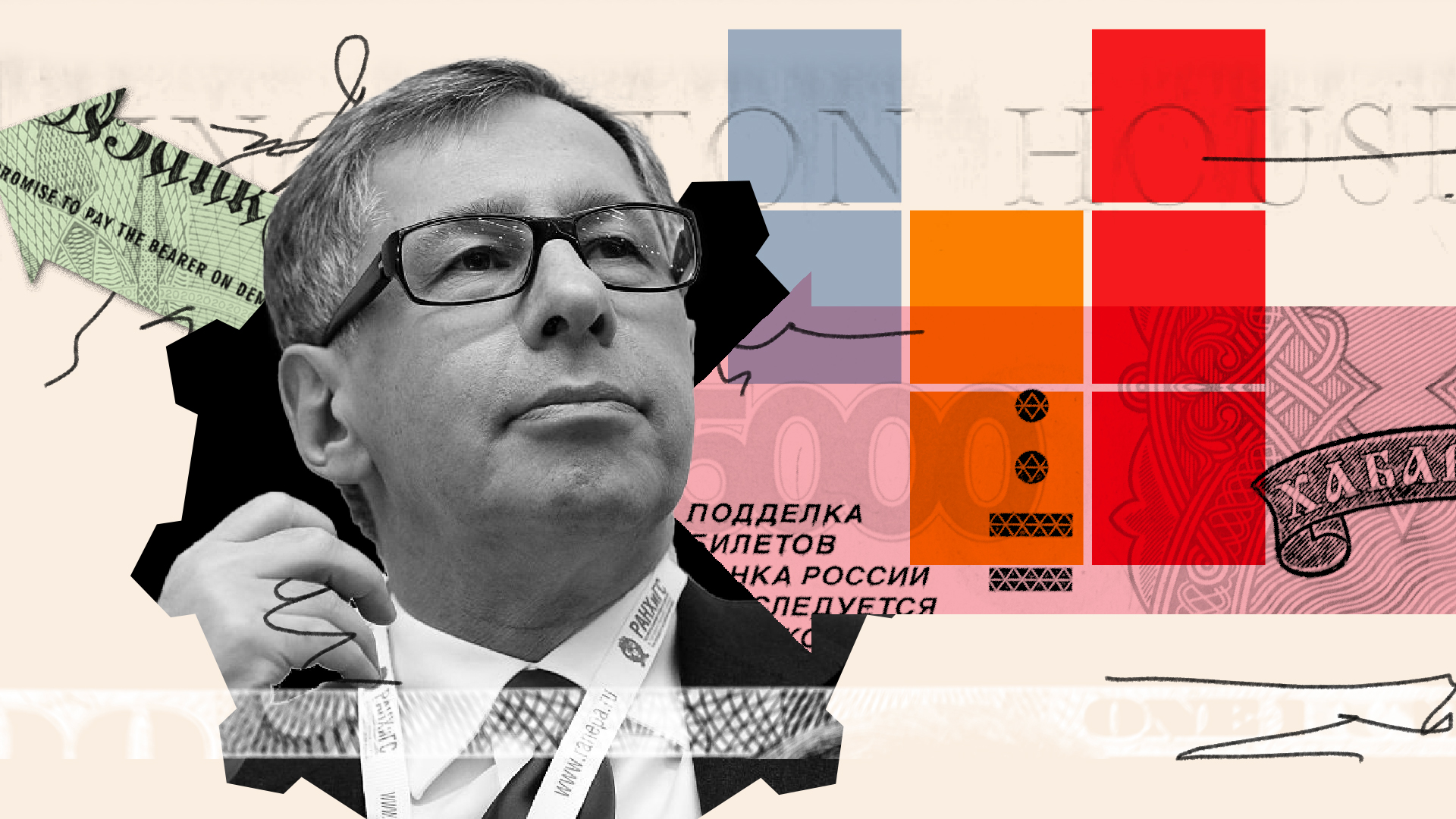

In 2013, ICIJ media partner Politiken revealed that Russian nationals and others used the services of Nordea’s Copenhagen branch to maintain about 100 offshore companies.