Want to see how global companies can avoid billions in taxes by routing their profits through Luxembourg? All the information is there in the leaked documents, but understanding the complex structures companies set up is not an easy task. Here are a few tips on how to read the documents and knowing what to look for.

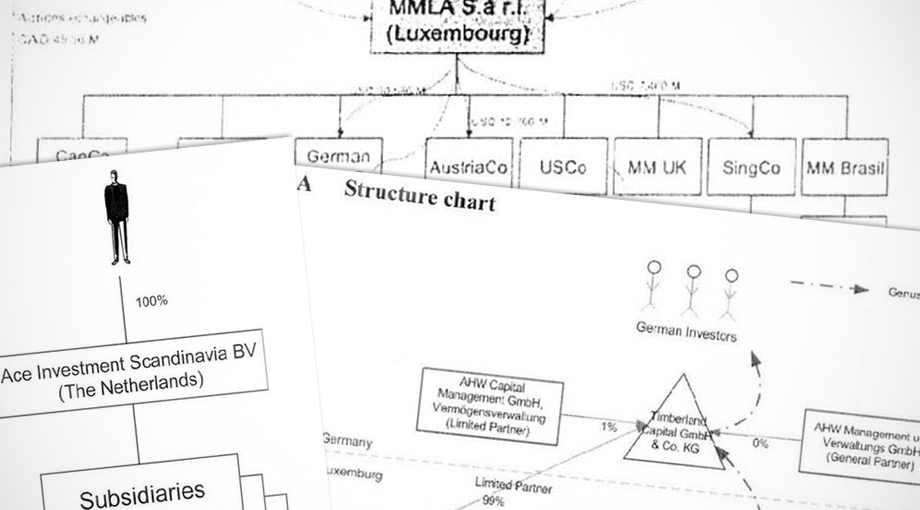

1. Start with the pictures (graphs and charts)

In every ruling there’s a simplified structure chart of the company and the relevant entities they use to lower their tax bill. In most cases there are actually two charts: the current structure and the one the company wishes to set up. These don’t include every subsidiary in every country. But that’s why they’re so helpful: they will usually only show the subsidiaries that are relevant for the Luxembourg tax authorities. So now you know where to look when tracking what the company is doing to avoid taxes.

There’s a catch though: in a lot of these documents the advisors of PricewaterhouseCoopers use code names for subsidiaries, especially those outside of Luxembourg. For example, if a Dutch company is part of the structure, the standard code name would be DutchCo. Even though you wouldn’t have the name of the company, you know there’s a trail going from Luxembourg to The Netherlands.

Don’t worry yet if the structure chart doesn’t seem to make any sense, or just blows you away with its complexity, because now it’s time for step two…

2. Back to the start

When you have a basic idea of the structure, go back to the first page of the document. This is where the tax advisors introduce the company and explain step by step the structure they want to set up. When laying out a certain step – for example, the company wants to give out loans from Luxembourg to subsidiaries around the world – the advisors will then explain how they think the tax authorities should view this. It’s not an easy read, but in their own way they will explain why it makes sense to set up the structure as proposed.

One of the main benefits of the Luxembourg tax system is the treatment of interest. Companies registered in Luxembourg are exempt from tax on interest income. So it makes sense for multinationals to structure their operations in such a way that profits from other countries can flow into Luxembourg as interest.

Look for signs that foreign profits get transformed into interest when going into Luxembourg. A clever way to do this is by so called hybrid loans. These have all the characteristics of equity – and are treated as such in most countries – but Luxembourg approves these as debt for tax purposes. A lot of companies use profit participating loans, where a variable interest rate on the ‘loan’ is set to be as high as annual profits of the subsidiary.

4. Royalties

Another perk of the Luxembourg tax system is an 80 % tax exemption on all income from intellectual property. Look for brand names, patents, and production and distribution rights in the documents. Foreign subsidiaries will have to pay for the use of these, and the advisors from PwC explain in the document why it makes sense to charge for it.

5. Take a step back

Is your head spinning already? Remember that these documents were written by highly specialized tax advisors who know all the ins and outs of different national and international tax laws. It’s impossible to understand everything in them, unless you team up with an expert in international tax.

When things stop making sense – take a step back and think about the company proposing these structures. What are they making and selling? Is it logical for them to be in Luxembourg or to have money routed there? The details of tax planning are very difficult, but the general idea is simple: move your money away from places with high tariffs into places with lower tariffs or a much smaller tax base.

One final tip: for just a few euros you can access the annual accounts of Luxembourg companies via the corporate registry. These documents are useful to see how the planned investments have turned out for the company and what the effective tax rate is.