This is part of our ongoing coverage of the first Panama Papers trial in the United States. Bookmark this page for the rolling updates.

Here’s how the criminal case began, and here are more details we were able to uncover from sifting through the original trove of leaked Panama Papers documents.

August 28, 2019: Panama Papers not reliable, charged lawyer claims

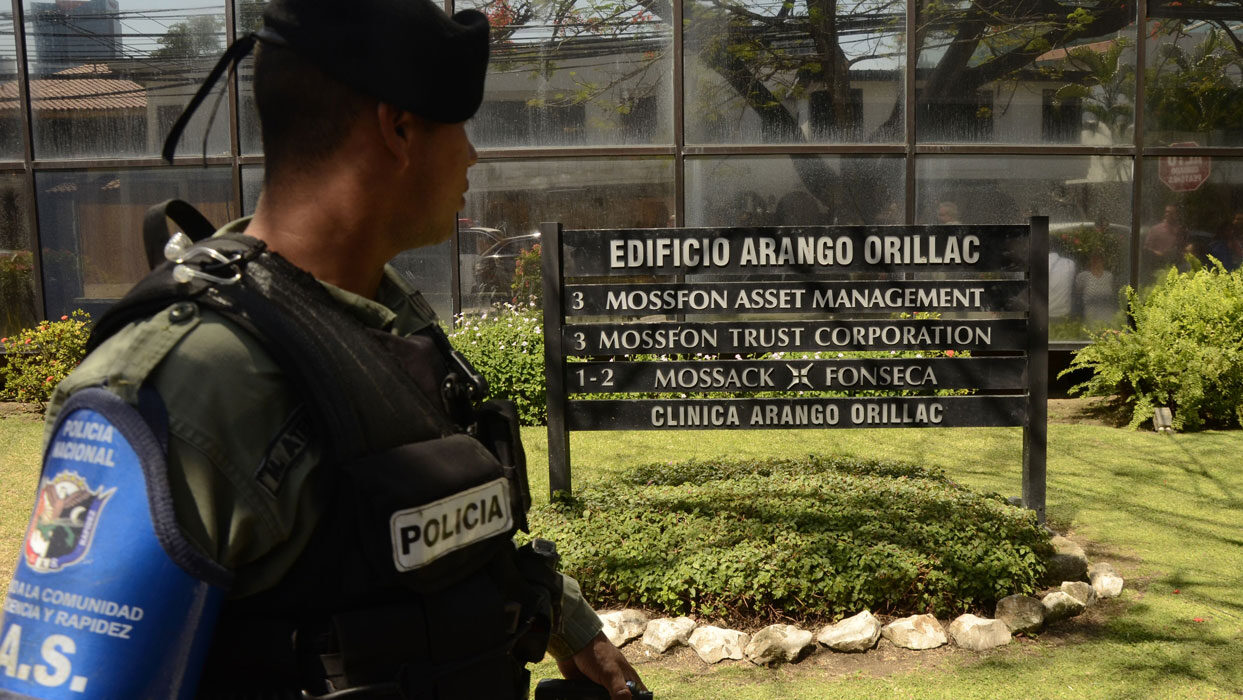

Ramses Owens, a former Mossack Fonseca employee charged with conspiring to defraud the United States, objected to U.S. government attempts to the use of vast troves of leaked and legal documents.

Owens, who remains in Panama and whom U.S. prosecutors consider a “fugitive from justice,” accused U.S. officials of unfairly depicting him as Mossack Fonseca’s sole lawyer.

Owens claimed the U.S. government had not shown that he and Mossack Fonseca provided legal advice to further a crime.

Lawyers for Owens also asserted that the U.S. government should not be allowed to rely on media reports as part of its case.

The “so-called ‘Panama Papers’ are not reliable enough to serve as a basis for sanctions,” Owens’ lawyers wrote. The lawyers cited a narrow March 2019 court decision in Nevada that focused on a case in Argentina.

Don’t forget, in Australia last month mining giant Glencore failed in an attempt to force the Australia Taxation Office to surrender Paradise Papers documents which it claimed would breach the secrecy of communications with its lawyers.

Sham.

Sham.

Sham.

Sham.

Sham.U.S. govt makes clear what it thinks of the shell companies used by a former US taxpayer and allegedly helped by a Panama lawyer.

Here is the latest #panamapapers criminal case filing, part of @ICIJ‘s rolling coverage. https://t.co/UQnYGkkHBn

— Will Fitzgibbon (@WillFitzgibbon) September 13, 2019

September 9, 2019: Don’t listen to him, U.S. prosecutors tell the judge

U.S. attorneys requested the judge dismiss Owens’ request to prevent prosecutors using legal documents.

Prosecutors told Judge Richard M. Berman in New York that it considers Owens a fugitive from justice and should not accept his request. Owens denies being a fugitive.

Prosecutors also argued that Owens did not sufficiently address the charges against him.

According to prosecutors, Owens helped U.S. clients “create and manage sham foundations…to conceal, from the IRS and others, the ownership of foreign accounts and the income generated from those accounts.”