A Massachusetts accountant should spend up to nine years behind bars for helping U.S. residents to evade taxes and launder money over almost two decades, prosecutors told a New York City courtroom on Friday.

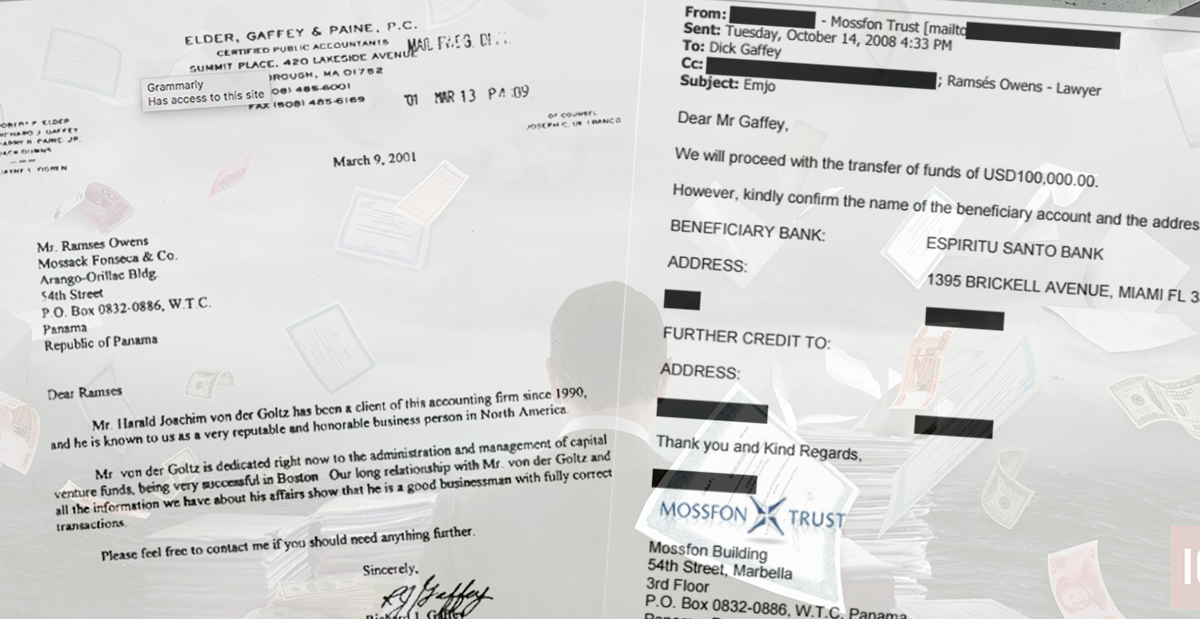

Richard Gaffey, who turns 76 in April, pleaded guilty to eight felonies and agreed to forfeit $5.3 million, the latest chapter in a criminal case brought by prosecutors following the 2016 Panama Papers investigation.

Gaffey, who initially pleaded not guilty, reversed his position and admitted to crimes that include conspiring with multiple U.S. taxpayers to evade taxes, commit wire fraud and launder money.

Gaffey, wearing glasses, a grey suit and dark blue tie, admitted before District Judge Richard M. Berman that he helped “devise an artifice to defraud” the United States and the Internal Revenue Service between 2000 and 2018. In a quiet, emotionless voice, Gaffey apologized to the court and to his country, friends, family and clients.

Gaffey could spend up to nine years in jail, according to sentencing guidelines. He will be sentenced on June 29, 2020.

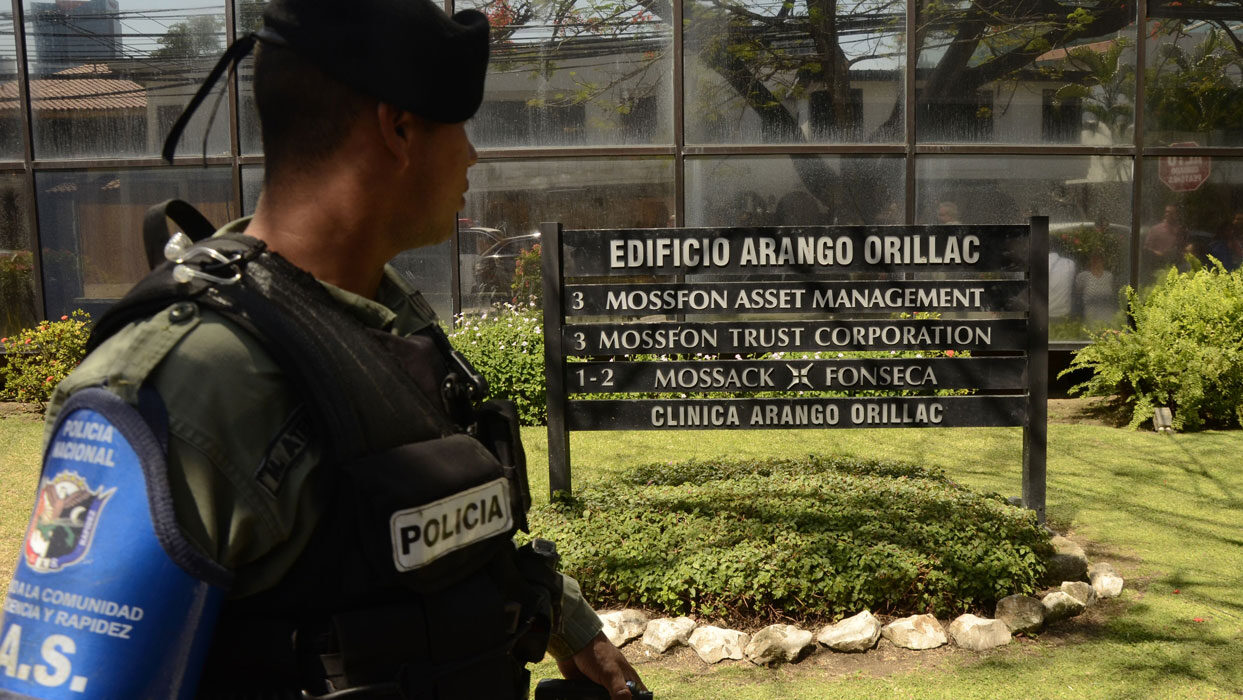

The Panama Papers – millions of confidential documents from the Panamanian law firm Mossack Fonseca – were first revealed in April 2016 by the German newspaper Sueddeutsche Zeitung in collaboration with the International Consortium of Investigative Journalists.

Gaffey’s guilty plea is the second victory this month for U.S. prosecutors who launched an investigation into Mossack Fonseca clients following the ICIJ investigation. One of Gaffey’s former clients, Harald Joachim von der Goltz, pleaded guilty last week to similar charges. Two former Mossack Fonseca employees, Dirk Brauer and Ramses Owens, have denied charges against them in the same criminal case, which U.S. authorities describe as a “decades-long criminal scheme.”

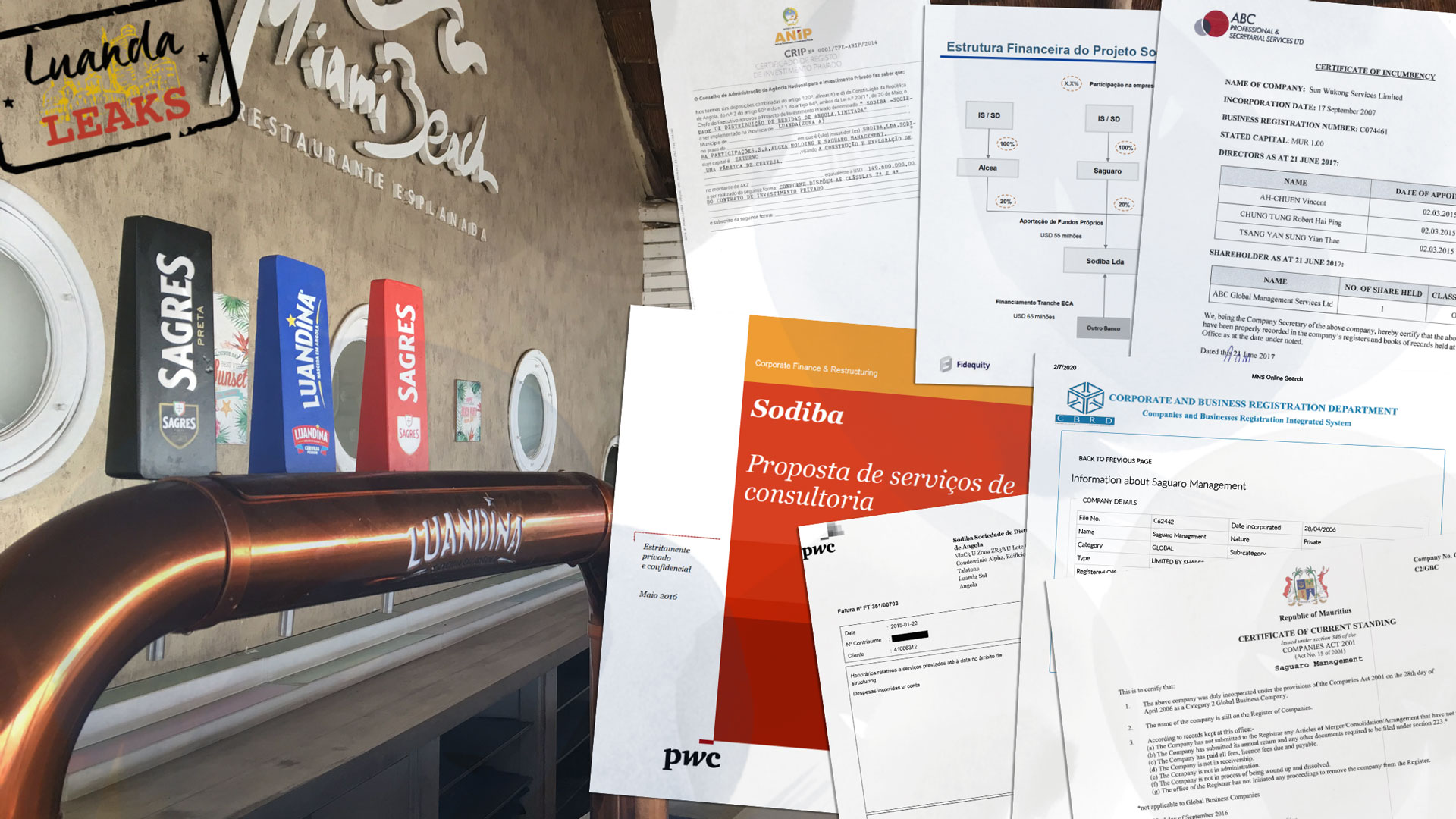

Coordinated and reported by ICIJ in collaboration with dozens of media outlets from Uruguay to Japan, the Panama Papers investigation revealed the secret offshore holdings of politicians, criminals and the world’s wealthiest one percent.

ICIJ does not share documents with prosecutors or government officials. U.S. authorities obtained Panama Papers documents from foreign governments and other sources, according to court filings.

ICIJ is following the case as it develops. For the major court filings, visit here. For rolling coverage, visit here.