The United States is the world’s largest enabler of financial secrecy, surpassing notorious tax havens like Switzerland, the Cayman Islands and Bermuda, according to an analysis by the Tax Justice Network released today.

For the first time, the U.S. tops the biennial Financial Secrecy Index, TJN’s global ranking that measures how much each country’s financial system promotes money laundering and the shielding of assets. Rounding out the top three in this year’s index are Switzerland and Singapore.

The U.S.’s refusal to share information about non-residents’ financial accounts with foreign tax authorities was a key factor in its high ranking. Countries that did not meet international standards for information-sharing were graded more harshly in this year’s index, the transparency advocacy group reported.

The U.S. financial services industry also increased the amount of services it provides to foreigners by 21% since 2020, the report states. Last year, a TJN study found that the U.S.’s friendly non-resident tax laws cost the rest of the world nearly $20 billion in lost tax revenue per year.

Alex Cobham, TJN chief executive, said on Tuesday that if the United Kingdom and all its dependent territories were combined, they would outrank the U.S. in fueling global financial secrecy, but the index ranks each jurisdiction separately.

The findings come as global advocates renew calls for beneficial ownership registers, which would reveal the true owners behind anonymous offshore companies, and just ahead of tomorrow’s G-7 meeting in Germany, where finance ministers of some of the world’s wealthiest democracies are expected to reinforce sanctions against Russian oligarchs whose luxury assets are hidden offshore.

Along with the U.S., five G-7 nations are responsible for slashing progress in financial secrecy reform by more than half: the United Kingdom, Japan, Germany and Italy, says TJN.

Meanwhile, the Cayman Islands, which ranked first in 2020, dramatically dropped to No. 14 in this year’s index, after disclosing new data on the financial services it provides to foreigners.

“The G7 must make clear where they stand in the fight against financial secrecy by committing to a global asset register,” Cobham said in a statement. A global asset register would combine public and private beneficial ownership databases to help law enforcement identify the owners behind hidden assets.

TJN determines each country’s rankings based on several measurements, including knowledge of and transparency on beneficial ownership, tax integrity, and international standards and cooperation. A higher ranking does not necessarily indicate that a country has worse financial secrecy laws but that it plays a larger role in fueling global secrecy.

Regulation of trusts

TJN singled out lax trust laws as a major drawback to financial reform in its report.

The U.S. received the worst possible score on trust transparency for its failure to make public information on trusts and other private foundations registered in the country.

Last year, ICIJ’s Pandora Papers investigation brought international attention to the U.S.’s rising role as a financial secrecy haven, revealing a sprawling network of trusts used to hide wealth in the country. Reporting by ICIJ and The Washington Post identified nearly 30 U.S.-based trusts that held assets linked to people or companies accused of fraud, bribery or human rights abuses. One Wyoming-based corporate service provider set up an anonymous trust for Russian oligarch Igor Makarov, who has since been sanctioned by Canada and Australia.

While the U.S. has made efforts to demystify corporate ownership and curb money laundering with the passage of the Corporate Transparency Act, advocates say the law is riddled with loopholes, including the exemption of certain types of trusts from a beneficial ownership registry.

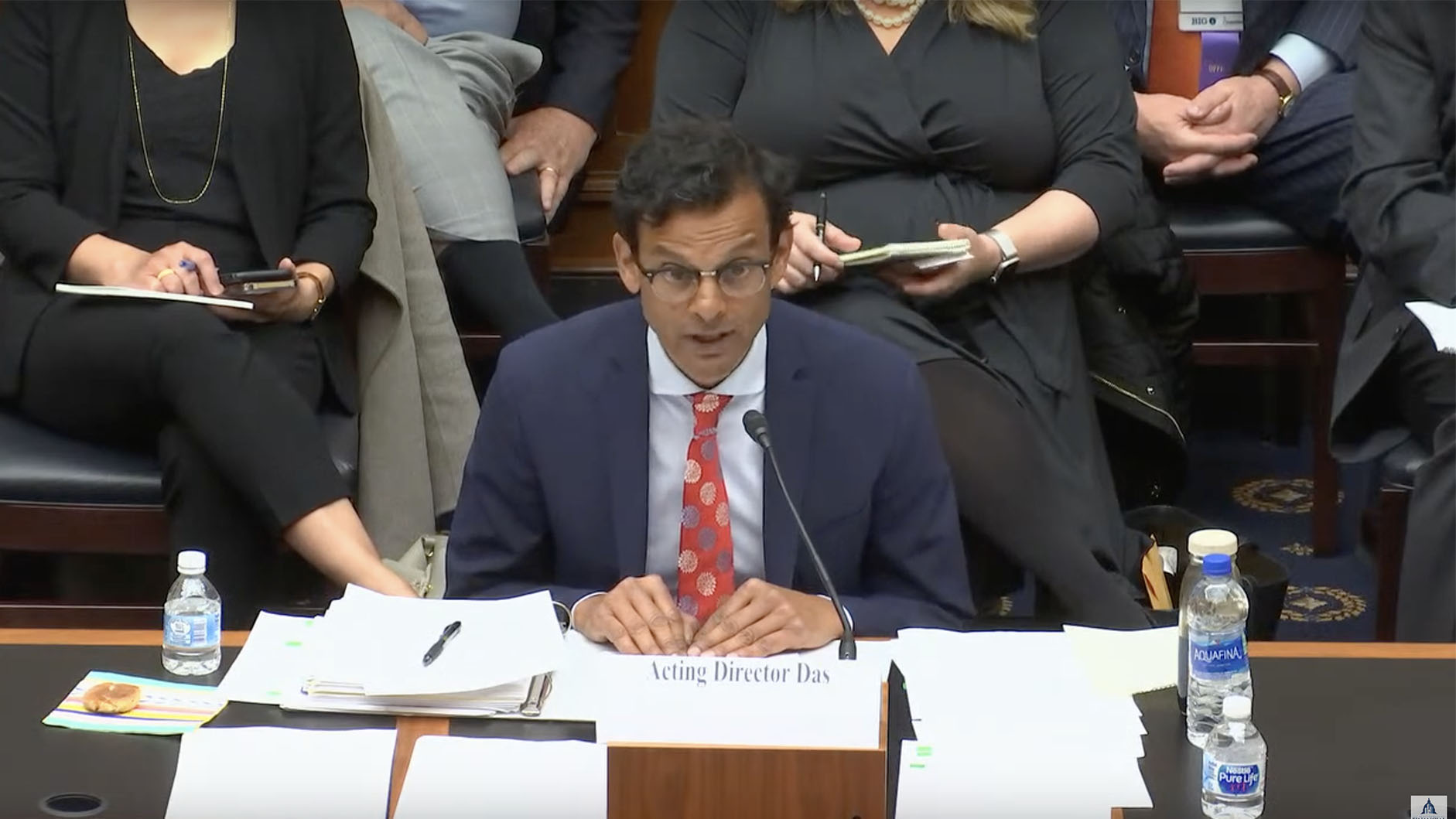

Implementation and enforcement of the law has also hit several delays. A bipartisan group of seven U.S. senators urged officials to expedite rule-making in a letter last week, saying further delay would “undermine American efforts to respond to Russia’s war against Ukraine.”

U.S. lawmaker Carolyn Maloney, a Democrat representing New York who helped write the Corporate Transparency Act, said on a press call Tuesday that she asked the U.S. Treasury to use funding allocated to targeting Russian money laundering to expedite the process.

“I have privately and now publicly urged them to leverage this additional support to also implement this important law which will assist in their efforts,” Maloney said.

Progress in Cayman Islands, Switzerland

Meanwhile, some notorious tax havens, including the Cayman Islands, Switzerland and Luxembourg, have all improved their financial secrecy scores since 2020.

TJN reported that the Cayman Islands disclosed data for the first time that indicates the volume of financial services the British Overseas Territory provides to foreigners is far lower than once believed. The United Kingdom also extended two regulations that tackle corruption and the financing of terrorism to the island country, reducing its secrecy score.

But another British territory, the British Virgin Islands, received the world’s worst “haven score,” which measures how much global corporate tax abuse it enables.

The BVI has featured prominently in ICIJ’s investigations on offshore secrecy. ICIJ found that it was the most popular jurisdiction linked to politicians identified in the Pandora Papers, and popular among hundreds of Russian nationals linked to companies in the leak.

Switzerland and Luxembourg have also decreased their financial secrecy scores, although they still rank highly in the index. Switzerland now requires country by country reporting on Swiss extractive companies, and Luxembourg has decreased the volume of financial services it provides to non-residents.