Journalists from across Africa have published stories based on a trove of nearly 12 million secret documents exposing a shadowy offshore financial system that allows the wealthy and powerful to enrich themselves, often at the public’s expense.

Those documents, which come from a group of 14 offshore services providers with offices from Samoa to South Dakota, are the foundation of the Pandora Papers, an investigation by the International Consortium of Investigative Journalists and a global network of reporting partners.

The Pandora Papers is ICIJ’s biggest collaboration ever, with more than 600 journalists from 117 countries participating. It is also one of the largest collaborations of African journalists in history, with 53 reporters from the continent contributing stories on the offshore activities of powerful figures in their countries.

Several of those journalists were partnering with ICIJ for the first time, like Makanday Media Centre, a nonprofit newsroom established in Zambia in 2016. They reported on a once-powerful politician who opened a company in Dubai and made big-ticket purchases at Louis Vuitton and a helicopter travel service.

The stories have sparked inquiries by governments around the world into the figures reported on as part of the Pandora Papers. In Nigeria, the government has opened an investigation based on the reporting done by ICIJ media partner Premium Times on figures like Peter Obi, a former governor who admitted to not disclosing his offshore assets while in office.

Here are some Pandora Papers highlights from ICIJ’s African partners.

Botswana

The Ink Center for Investigative Journalism found that Ramachandran Ottapathu, the CEO of the multinational African supermarket chain Choppies, owned a stake in a company registered in the British Virgin Islands in 2016. Covering Concepts Global Ltd., set up with the help of offshore provider Trident Trust, was listed as an “investment vehicle” for Ottapathu and two business partners based in Dubai.

Ottapathu denied holding a stake in the company, telling Ink Center that he simply made a loan to a similarly-named company based in Dubai to help his business partners. But the files they reviewed include Ottapathu’s passport and a reference letter from Choppies confirming his residential address.

Burkina Faso

Reporters from L’Economiste Du Faso revealed that lawyer and businessman Arouna Nikièma, who owned a security company in Burkina, also set up a company in the Seychelles, Bayoure Ltd., intending to transfer profits from his African company offshore.

Nikièma told L’Economiste Du Faso that he did not declare Bayoure Ltd. to Burkinabè tax authorities because the company, which was incorporated in 2012, never ultimately received any money.

Cameroon

Le Monde Afrique uncovered that the wife of Cameroon’s former mining minister received shares in an Australian mining company while her husband was in office and responsible for granting mining permits. The Australian company owned a Cameroonian company that held the permit for one of the major iron ore exploration projects underway in the country at the time.

“This affair is emblematic of the opacity that reigns in the raw materials sector,” a commodity network investigator told Le Monde.

Comoros

CENOZO, a regional investigative journalism center covering West Africa, worked with Comorian reporters to delve into Olifants Ltd., a Dubai-registered consulting company owned by Nour-El-Fath Azali — President Azali Assoumani’s son and an economic adviser to the presidency since 2019.

Azali’s business partner and lawyer, who helped him set up the company in 2018 with the assistance of offshore provider SFM, told ICIJ that he “always ‘promotes business in the Emirates’ for his friends and clients.”

Cote d’Ivoire

In Cote d’Ivoire, CENOZO partnered with a reporter from the news outlet L’Elephant Dechaine to investigate a consulting company owned by Prime Minister Patrick Achi. Achi used a secretive trust arrangement to hide his ownership of Allstar Consultancy Services Ltd., a company incorporated in the Bahamas in 1998.

Julien Tingain, the president of the Ivorian nongovernmental organization Social Justice, criticized Achi and other prominent officials who stash their wealth offshore.

“Even if the creation of a company in a tax haven is not illegal in Cote d’Ivoire, it still calls into question the values of ethics and responsibilities of these public authorities towards citizens because of what they represent for the country,” he said. “A company created means jobs created, families lifted out of poverty and economic growth for the country.”

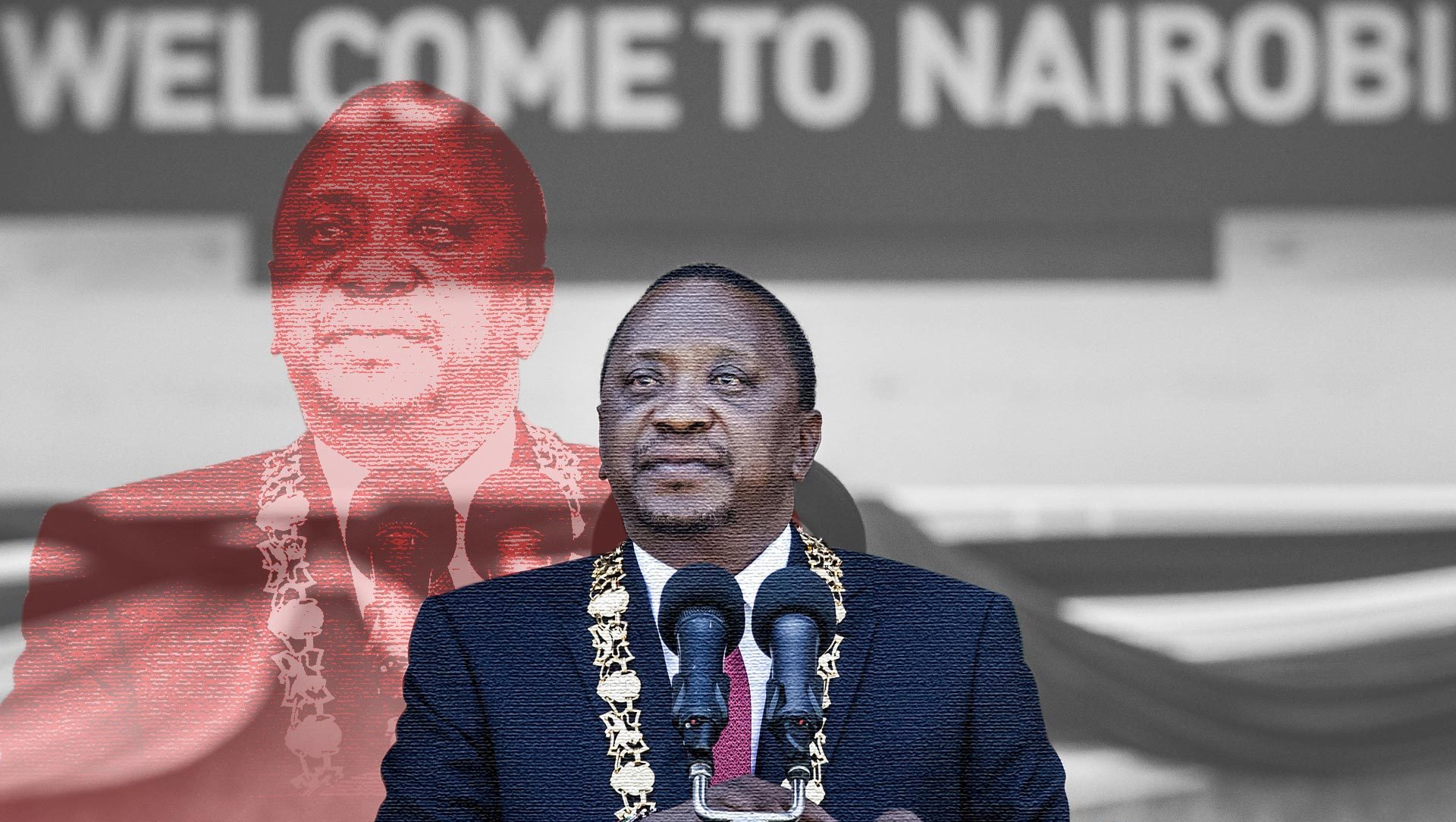

Kenya

Africa Uncensored, an investigative newsroom based in Kenya, partnered with Finance Uncovered to investigate the offshore empire of the family of President Uhuru Kenyatta. The son of Kenya’s first president, Kenyatta has pledged to fight corruption and promote transparency.

But Africa Uncensored found that members of his family have held stakes in offshore companies and trusts dating back even before his first presidential run in 2002. Offshore companies linked to the Kenyatta family have held tens of millions of dollars in assets, and records show that his sisters used a company registered in the British Virgin Islands to buy an apartment in an upscale London neighborhood.

Liberia

Liberian newspaper Front Page Africa dove into the tax avoidance case of Robert Baines, a British national who used a nominee shareholder to obscure his ownership of a shell company based in the Seychelles. One of the sources of funds for that company, according to leaked documents, was “assignments done through RB Group in Liberia.”

In 2016, RB Group was one of more than 50 companies that had shipping containers seized at a port in Monrovia for non-payment of taxes. Tax authorities in Liberia told Front Page Africa that the previous year, RB Group appealed against its tax bill, asserting that the government had improperly calculated the amount it owed — more than $600,000. Authorities said the case is still before Liberia’s Board of Tax Appeal.

Mauritania

In another first-time ICIJ collaboration, the pan-Arab news organization Daraj Media reported on businessman Mohamed Abdellahi Ould Yaha, who invested millions of dollars in companies registered in Dubai and the Canary Islands, including one linked to Maurilog, a Mauritanian logistics company that Yaha owns.

In 2018, the Securities and Exchange Commission alleged that a Canadian gold mining company violated the Foreign Corrupt Practices Act, “as they were forced – by a very influential person – to work with a certain Mauritanian logistics company.” William Bourdon, the former head of a French anti-corruption organization, said that it was likely that the “very influential person” was former president Mohamed Ould Abdel Aziz, and that the logistics company was Maurilog.

Niger

Moussa Aksar of L’Evenement worked with CENOZO to investigate a Russian-owned company that obtained several mining contracts in Niger. Semmous Lion Mining Ltd., incorporated in the British Virgin Islands in 2007 by Russians Sergey Matveev and Dmitry Bakaev, received 10 mining exploration permits that year. Those permits were transferred by other companies who seemingly negotiated for the permits in violation of Niger’s mining code.

According to Aksar’s reporting, Matveev is also the head of Pan African Minerals Ltd., which was granted (through a subsidiary) four mining exploration permits for “uranium and related substances.”

Senegal

Senegalese reporters partnered with CENOZO to report on three childhood friends of former government minister Karim Wade, who was imprisoned for corruption from 2013 until he was pardoned in 2016. In 2015, Mamadou Pouye, Ibrahim “Bibo” Bourgi and Karim Bourgi were found guilty of helping Wade — who is now in exile in Qatar — hide a fortune of more than $200 million in various companies and accounts in tax havens.

Panamanian law firm Alemán, Cordero, Galindo & Lee (Alcogal) helped Pouye and the Bourgi brothers set up three Panama foundations, which can help protect assets in legal disputes by obscuring ownership, shortly before the presidency of Wade’s father, Abdoulaye Wade, ended in 2012. Menzies Afrique S.A., a Luxembourg company linked to the group of friends, also set up several subsidiary companies in the British Virgin Islands, Panama and Hong Kong.

South Africa

South African investigative outlet amaBhungane revealed Singapore-based offshore services provider Asiaciti Trust’s role in creating complex offshore structures for controversial Zimbabwean business tycoon Billy Rautenbach and his family.

In 2013, while Rautenbach was still on the U.S. sanctions list for his association with then-Zimbabwean president Robert Mugabe, the businessman transferred millions of dollars of assets to his wife, Jenny, as part of a marriage settlement. Two years later, his wife founded the Bonsai Business Trust, but in leaked documents, “Asiaciti’s administrators identified Rautenbach as the ‘effective controller… from the onset due to his donation of assets to his wife.’”

Togo

In Togo, CENOZO reported on a former British honorary consul who set up two Seychelles companies that entered into contracts with the Port of Lomé. Rodney Cooper Wade founded Gander Consulting Ltd., which took over security at the port, and Centurian Consulting Ltd., which provided access permits for the port through a Togolese subsidiary.

CENOZO also delved into the offshore affairs of beer magnate Pierre Castel, who owned a group of Togolese breweries through a holding company registered in Gibraltar. Castel acted as the guarantor for his partner shareholder, a French national who wanted to take a loan from a Swiss bank that experts say may have constituted tax evasion.

Uganda

Ugandan newspaper Daily Monitor investigated the offshore holdings of retired Maj. Gen. Jim Muhwezi, the country’s security minister. Muhwezi was a shareholder in companies registered in Cyprus and the British Virgin Islands until 2015 and 2016, respectively. Muhwezi denied involvement in offshore companies.

In 2018, Alcogal, which had been the registered agent of Muhwezi’s BVI company, Audley Holdings Ltd., filed a suspicious activity report with regulators in the BVI, saying that it suspected Audley had been used for money laundering, fraud and tax evasion.

See more Pandora Papers reporting from Africa and stories from your country here.