WASHINGTON, January 31, 2000 — More than 11,000 pages of documents from BAT and its subsidiaries, including the U.S. company Brown & Williamson, were analyzed over a six-month period by the International Consortium of Investigative Journalists (ICIJ), a project of the Center for Public Integrity in Washington, D.C. Part of a depository of about 8 million pages, the documents were selected based on region and subject matter. In some cases, the complete files on a specific country or individual were reviewed.

The selected documents, covering mostly 1990-1995, do not suggest that BAT employees themselves transported contraband cigarettes across customs borders, where taxes would be due. Instead, they show that corporate executives in Britain, the United States, and other locales controlled the volumes, brands, marketing campaigns, timing, and price levels throughout the smuggling distribution networks they exploited. Company officials worked closely with their local agents – giving them perks such as tickets to Wimbledon – and provided incentives to local black-market distributors.

In response to a series of detailed questions prompted by a review of its corporate documents, BAT said: “We do not intend to answer questions or address allegations apparently based on highly selective and out-of-context documents, about matters which are more properly addressed – and in many instances are being addressed with our full co-operation – by governments and customs authorities around the world.” The company said it knew that some of its products “are handled other than through official channels,” but added that “we cannot control the distribution chain all the way to the final customer.”

But the documents clearly show that BAT and its subsidiaries did attempt to control the distribution chain all the way to the final customer and employed a carefully coded language to discuss and plan those operations. Only occasionally did they use such terms as “smuggled” or “contraband.” The preferred euphemisms of company correspondence were “DNP” (Duty Not Paid), “transit,” or “GT” (general trade), as well as “parallel market,” “second channel,” and “border trade.” The euphemisms were used interchangeably and contrasted repeatedly with references to imports that were legal and “Duty Paid” (DP).

Since 1997, three BAT managers have either pled guilty to or been convicted of charges related to tobacco smuggling. Two pled guilty in a scheme that shipped cigarettes marked “Duty Not Paid” and “Not for Sale in Canada” back into Canada from Louisiana, where they had been sent allegedly bound for offshore fishing boats. One of the men left the company before pleading guilty to the charges; the other retired in December 1997, six months after pleading guilty. The next year, a BAT executive in Hong Kong was convicted of taking bribes in connection with a cigarette smuggling syndicate. The judge in that case, Justice Wally Yeung Chun-kuen, said in sentencing export manager Jerry Lui, “that management of BAT (HK) was aware duty-not-paid cigarettes … would ultimately be smuggled in China and other countries. There could be no other explanation for this enormous quantity of duty-not-paid cigarettes worth billions and billions [Hong Kong] of dollars.” The judge, according to Hong Kong press reports in June 1998, commented that BAT’s “irresponsible behaviour amounted to assisting criminals in transnational crime.”

Suspicions about industry involvement in cigarette smuggling have grown since 1997 when researchers demonstrated, by comparing annual global exports with global imports, that about one-third of all cigarettes entering international commerce each year could not be accounted for. The industry’s sanguine reaction to apparently losing a third of its inventory annually only fueled those suspicions.

But proof remained elusive until last year, when millions of pages of corporate documents, unearthed during numerous health-related lawsuits, became publicly available as part of the tobacco industry’s November 1998 settlement with the U.S. states.

The information contained in those documents could prove far more costly to the companies than the $246 billion U.S. settlement because BAT, as well as its multinational rival Philip Morris, has focused on expanding business into international and newly emerging markets – precisely the areas where smuggling seems to have flourished.

BAT reported 1.01 billion pounds ($1.8 billion) in profits in 1998 on its worldwide cigarette business, according to its latest available annual report. Of BAT’s six regional operating groups, its Latin American sales volumes were the highest. Philip Morris, the world’s largest international cigarette company, reported tobacco profits of $6.5 billion (3.9 billion pounds) in 1998 — $5 billion of that in non-U.S. sales, which represented a 10% increase over the previous year. Both companies’ bottom lines were reduced in 1998 for payouts to the U.S. national tobacco settlement, and profit margins were expected to be higher for 1999.

Although tobacco companies now face health-related lawsuits involving about 20 countries, proof of involvement in tax evasion or smuggling schemes could trigger a host of new prosecution, civil and criminal. There are already signs that may be happening.

A majority of Colombia’s state governors and the mayor of Bogota have retained U.S. lawyers to prepare lawsuits in the United States against British American Tobacco and Philip Morris, said Jose Manuel Arias Carrizosa, executive director of the Federation of Colombian Governors. He added that the 21 governors and the mayor of Bogota were seeking “an indemnification for damages caused through contraband of cigarettes into the country.” He would not say exactly how much would be demanded of the two companies.

“We think there are two markets, one legitimate that pays its duties and taxes, and the other much bigger, illegal,” Arias said in an interview. “That cannot be happening without the knowledge of the producing companies.” A lawyer hired by the Colombians, who spoke only on condition that neither he nor his firm be identified, said the governors had “a viable cause of action” under civil provisions of the Racketeer Influenced and Corrupt Organizations Act, or RICO.

Canada filed a civil RICO lawsuit against R.J. Reynolds and its related tobacco companies in New York state in December 1999 for smuggling across the U.S.-Canadian border. Several people, including a former RJR senior sales manager, have already been convicted on U.S. criminal charges stemming from that same smuggling operation.

Speaking of Smuggling

The BAT documents make two points clear -– ranking executives of BAT and its subsidiariesexploited smuggling as part of their overall strategy to increase market share, and they employed a series of euphemisms to plan and mask their activities.

In order to understand the company’s involvement, its corporate dialect must first be decoded.

The documents, especially as they relate to company operations in Latin America, repeatedly identify legal imports as either “Duty Paid” (DP) or “Duty Free” (DF), for traditional duty-free stores. Those phrases are consistently used in opposition to terms such as “DNP,” “transit,” or “GT,” and those contrasting terms appear regularly throughout the memos, letters, charts, and graphs of import/export data and sales figures.

For example, a memo from the early 1990s, entitled “Venezuelan Market Definitions and Assumptions,” explained that “Duty Paid” goods owed the government legal excise taxes of 50%. No such requirement was noted for the “Duty Not Paid” goods, which were identified as cigarettes produced in Venezuela, exported mainly to the free-trade zone on the nearby island of Aruba, and then re-entered into the Venezuelan market as “transit.” The memo came from the file of Keith S. Dunt, then BAT’s regional director for Latin America who is now the company’s chief finance officer.

In another memo, a Feb. 16, 1993 fax to BAT headquarters in Britain, its Venezuelan subsidiary explained: “The fact is that since November 1992 the transit (DNP) products into Venezuela have been very low due to tighter border controls.”

During a fierce trademark dispute with Philip Morris over which company had the right to use the Belmont brand name in Colombia, a Feb. 22, 1995 memo outlined contingency options should BAT lose. One was to “launch new brand in DP and maintain Belmont in GT channel.” However, a noted drawback of keeping Belmont in the GT channel was that the company “cannot support Belmont in GT via advertising.” Advertising for a product that had no government-registered imports apparently would raise questions.

A January 1993 status report on Peru stated that BAT’s “basic strategy has been to set up a local importer/distributor to handle legal exports rather than rely on transit sales.”

Jon Ferguson, former senior counsel for the Washington state attorney general’s office and head of its antitrust division, used BAT corporate documents in his 1998 prosecution of tobacco companies to recoup state costs of treating smokers. He said the term “Duty Not Paid,” or DNP, obviously referred to smuggled cigarettes. “That’s clearly my understanding of what ‘Duty Not Paid’ means,” Ferguson, now in private practice, said in an interview.

Les Thompson, the RJR senior sales manager who pleaded guilty in 1999 to money-laundering charges stemming from the U.S.-Canadian smuggling operation, said that DNP was also a euphemism his company used to talk about smuggling. “It’s an industry-wide term,” Thompson told the Center. “It’s essentially a long-winded term used by senior folks when they’re talking around the topic of smuggling.” Other euphemisms for smuggled cigarettes, Thompson said, were “re-entry” goods, the “parallel market,” and “transit.”

Thompson, who is to begin serving a 70-month sentence in mid-February, said he knew of other tobacco companies involved in smuggling and that he was cooperating with federal investigations in the United States and Canada.

In response to a request for comment on both the civil and criminal cases, an RJ Reynolds Tobacco Company spokeswoman said the company was not involved in the “day-to-day business operations of any international operations,” and that the company had not been implicated in the criminal investigations. But she did not comment on the allegations in the civil RICO suit.

Ironically, the most glaring exception in the records to BAT’s carefully coded language involved its Canadian subsidiary, which was not named in Canada’s recently filed smuggling lawsuit. In a June 3, 1993 letter to Ulrich Herter, BAT’s managing director, Don Brown, the president of Imperial Tobacco Limited, wrote:

to Ulrich Herter, BAT’s managing director, Don Brown, the president of Imperial Tobacco Limited, wrote:

“As you are aware, smuggled cigarettes (due to exorbitant tax levels) represent nearly 30% percent of total sales in Canada, and the level is growing. Although we agreed to support the Federal government’s effort to reduce smuggling by limiting our exports to the U.S.A., our competitors did not. Subsequently, we have decided to remove the limits on our exports to regain our share of Canadian smokers. To do otherwise would place the long-term welfare of our trademarks in the home market at great risk. Until the smuggling issue is resolved, an increasing volume of our domestic sales in Canada will be exported, then smuggled back for sale here.”

In reply to questions about that letter, Brown said, “My comments in my letter to Mr. Herter were simply of the nature of a factual observation. … Our company never knowingly sold cigarettes to smugglers. We only dealt with legitimate buyers, who had all of the appropriate government permits to purchase cigarettes from us.”

to questions about that letter, Brown said, “My comments in my letter to Mr. Herter were simply of the nature of a factual observation. … Our company never knowingly sold cigarettes to smugglers. We only dealt with legitimate buyers, who had all of the appropriate government permits to purchase cigarettes from us.”

The documents show that BAT executives were aware of the “sensitivity” of the issue. One of them, Delcio Laux who was then president of C.A. Cigarrera Bigott, Sucs., BAT’s Venezuelan subsidiary, wrote in an April 21, 1992, faxed memo to Dunt that “it is clear that Bigott can’t be seen as a clean and ethical Company by continuing with DP and DNP in parallel.” Dunt later recommended Laux’s replacement, noting among other things that his “exceptional” ethical norms had been exploited by the Philip Morris competition.

In June 1992, Dunt wrote Eduardo Grant, president of BAT’s Argentine subsidiary, Nobleza-Piccardo, about the “DNP market” there. “We will be consulting here on the ethical side of whether we should encourage or ignore the DNP segment. You know my view is that it is part of your market and to have it exploited by others is just not acceptable,” Dunt said.

Notes on the conclusions of a meeting in Colombia in late February, which Dunt attended, said it had been agreed that “the Bogota office will be clean by Q3/94 in reference to DNP information. Management of DNP will be in Caracas.” Another memo in Dunt’s files said “documents dealing with DNP have been separated and should now be forwarded to Caracas. A good quality safe and shredder are required.”

Setting the Pace

Aside from the euphemisms, what stands out most in the documents is how senior management of BAT and its subsidiaries factored smuggling into their overall market strategy and sought to control where and to what extent it occurred.

As far back as 1971, BAT was positioning itself in the “transit” market. A 1983 memo described the creation of a new office in Hamburg, Germany, after a BAT study on “transit in Europe” showed that the company “was years behind the competition in transit.” Although BAT already had a headquarters in Hamburg, a separate office was opened in 1972 in the same city. “One of the main reasons for establishing this office independent from a B.A.T. company was, that due to the delicate business the customers could visit Hamburg-Office without involving a B.A.T. Company directly,” the memo explained.

The full extent of BAT’s involvement in Latin America was made clear in a stern note from Dunt to his fellow directors questioning the wisdom of allowing BAT’s wholly owned Brazilian subsidiary, Souza Cruz, to smuggle cigarettes into Argentina, where they would cannibalize the sales of BAT’s majority-owned Argentine subsidiary, Nobleza-Piccardo.

to his fellow directors questioning the wisdom of allowing BAT’s wholly owned Brazilian subsidiary, Souza Cruz, to smuggle cigarettes into Argentina, where they would cannibalize the sales of BAT’s majority-owned Argentine subsidiary, Nobleza-Piccardo.

“I am advised by Souza Cruz that the BAT Industries Chairman has endorsed the approach that the Brazilian Operating Group increase its share of the Argentinean market via DNP,” Dunt wrote in the May 18, 1993 memo. “As the Director entrusted with responsibility for the management of Nobleza-Piccardo I need to advise you of the likely volume effect on N-P of this decision and of course the financial impact.”

At the time, Sir Patrick Sheehy was the chairman of BAT Industries, Plc, then the name of the cigarette group’s parent company and one of Britain’s largest multinational concerns, a position he held until 1995.

Another memo found in Dunt’s file, summarizing a Feb. 23-24, 1994 visit to Colombia, indicated that BAT wanted to control the timing and products it entered into the DNP market. Regarding BAT’s Kent Super Lights brand, the memo noted that “DNP product should be launched two weeks after the DP product has been launched.” As for the Lucky Strike brand, it was planned “to withdraw from the DNP market the 20’s and 10’s versions.”

Tobacco companies contend they have little control over the end use of their product once it’s legally sold to distributors. But on June 25, 1992, Dunt wrote to the director of BAT’s Venezuelan subsidiary, saying he disagreed with plans to limit the number of cigarettes bound for BAT’s Aruban distributor and for the Colombian end market. “I notice … the intention to limit Romar’s sales to Maicao to 18,000 cases per month. I would not wish for any reason for sales to be limited … unless it is a proven strategic necessity.”

Further examples include a “restricted” note of a Chief Executive’s Committee meeting on Feb. 7, 1994, which said that a new marketing unit for Latin American countries aimed to achieve annual cigarette sales of 50 billion, “including duty not paid.” The meeting was chaired by Barry D. Bramley, then chairman of BAT’s tobacco operations. And BAT’s Latin American “Marketing Guidelines for Company Plan 1995-1999” instructed local managers in Colombia that “your plan should cover the launch of variants on the DP and DNP markets.”

The documents also show that BAT sought to use the presence of legal imports, however small, as an “umbrella,” or cover, to advertise its brand of cigarettes, which would reach the market in far larger quantities via DNP.

“It is recommended that BAT operate under ‘Umbrella’ operations,” Dunt wrote in August 1992 to Bramley. “A small volume of Duty Paid exports would permit advertising and merchandising support in order to establish the brands for the medium/long term, with the market being supplied initially primarily through the DNP channel.”

One year later, in a Sept. 1, 1993, memo to Nick Brookes, then a director of New Business Development at B.A.T. Industries, Dunt said in an industry analysis of the Colombian market, “DNP now represents ±50% of the local cigarette industry (vs. ±35% in 1989). DP imported product now possible due to freeing up of import restrictions, however although tariffs reduced from 63% to 5% this only constitutes 1.5% of market share, it being apparent that multinationals are using the DP route for imports as an umbrella operation to facilitate publicity campaigns etc.”

Brookes, now chairman and CEO of Brown & Williamson, told reporters in Washington, D.C., on Jan. 11, that B&W wanted to host a forum on “the growing risk of black market cigarettes and illegal sales across state lines. We don’t believe government officials, legislators and others have focused enough attention on this critical issue, and we hope to change that.” Brookes did not respond to a request for comment.

Smuggled cigarettes, by evading import, sales, and other forms of taxes, usually are sold more cheaply than legally imported cigarettes. That makes them affordable to a greater number of people, increases corporate profits, and secures future markets. But because smuggling puts cigarettes in more hands, especially younger ones, it’s not just an issue for government tax collectors. The World Bank last year predicted that by 2030 smoking would kill one in six adults to become the single leading cause of death in the world. With smoking rates in the United States and other Western countries declining, the Bank warned that smoking deaths increasingly would occur in low- and middle-income countries, least able to afford the costs of treating smoking-related illnesses. The Bank recommended raising taxes on tobacco, and therefore the price of cigarettes, as a way to reduce consumption.

The Aruba-Colombian Connection

Colombia – a country wracked by decades of civil war and cocaine trade, with a long history as a crossroads of contraband – proved to be fertile ground for cigarette smuggling.

The BAT records show that millions of cigarettes were shipped from BAT subsidiaries in the United States, Venezuela, and Brazil to BAT’s distributor in the free-trade zone of Aruba, an island in the Caribbean just off the coast of Colombia that historically had been a mecca for contraband. From Aruba, the cigarettes would be sold to dealers who would bring them by boat to Colombia’s La Guajira region, an isolated and lawless haven along the Caribbean coastline. The Guajira peninsula, which straddles the northern border of Colombia and Venezuela, has itself been a smugglers’ paradise since colonial times.

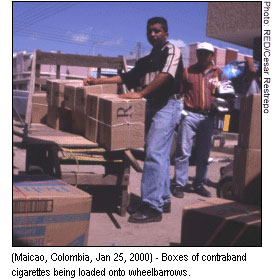

Maicao is a town in La Guajira that was given special customs status in 1991 in order to spur job growth. The government’s intent was to allow raw materials to enter the zone untaxed, have workers there turn them into finished product, and then re-export the finished goods outside Colombia. The law allowed for a certain amount of goods to pass from Maicao into the Colombian interior, but only if they were declared to customs officials and duty was paid on them.

BAT records indicate, however, that its cigarettes moved outside the Maicao special customs zone “duty not paid” and from there into the black market. A “DNP Distribution” diagram in Dunt’s files showed DNP cigarettes traveling from Aruba to Maicao and from there westward to the “consumer” in Barranquilla.

Another document in the files showed that officials from BAT and its subsidiaries supplying Colombia – Brown & Williamson, Souza Cruz, Cigarrera Bigott – agreed at a Miami meeting in January 1992 that Souza Cruz would give a 5% “free goods incentive in Maicao and in the San Andresitos to expand distribution in Bogota and Medellin.” The term “sanandresitos” – from the Colombian island of San Andres that has been a tax-free port since the early 1950s – refers to the clusters of small stalls found in many Colombian cities that for decades have been widely known as locations that sell mostly contraband goods. An attachment to those minutes gives a detailed breakdown of prices per brand for cigarettes as they left Aruba, as they left Maicao, and in the “sanandresitos.”

showed that officials from BAT and its subsidiaries supplying Colombia – Brown & Williamson, Souza Cruz, Cigarrera Bigott – agreed at a Miami meeting in January 1992 that Souza Cruz would give a 5% “free goods incentive in Maicao and in the San Andresitos to expand distribution in Bogota and Medellin.” The term “sanandresitos” – from the Colombian island of San Andres that has been a tax-free port since the early 1950s – refers to the clusters of small stalls found in many Colombian cities that for decades have been widely known as locations that sell mostly contraband goods. An attachment to those minutes gives a detailed breakdown of prices per brand for cigarettes as they left Aruba, as they left Maicao, and in the “sanandresitos.”

Asked if a company doing business in Colombia might not know about “sanandresitos,” Fanny Kertzman, the director of the country’s tax and customs office, responded, “This question is ridiculous. It is obvious, so evident, that if you distribute goods through sanandresitos you know most of the merchandise sold there is smuggled.”

In 1993, corporate records show that BAT subsidiaries imported a total of 3.98 billion cigarettes into Colombia. However, 3.89 billion of those cigarettes entered as Duty Not Paid goods. By BAT’s own estimate, its Duty Paid imports accounted for only 2% of its in-country business that year. BAT’s 1993 figures, showing that across all local and imported brands there was a total of 13.9 billion cigarettes on Colombia’s Duty Not Paid market, match almost exactly a Colombia government report on the contraband cigarette problem.

In 1998, the Federation of Colombian governors circulated a detailed and confidential report to several public officials to draw attention to cigarette smuggling and the underpricing of legal imports. The report estimated that in 1993 there were 13.4 billion cigarettes on the black market. The report further said that by 1997 smuggling accounted for 44% of Colombia’s total cigarette market and 93% of all foreign brands coming into the country. Kertzman echoed that in her June 1999 testimony before the U.S. Congress, saying that 90% of all cigarettes entering Colombia were doing so illegal.

An internal 1999 document from Colombia’s DIAN office, the country’s customs and tax authority, calculated the value of contraband cigarettes coming from Aruba into Colombia to be around $400 million dollars per year.

The BAT documents show that cigarettes also moved from Aruba to Panama’s free-trade zone of Colon as a staging point into nearby Turbo, another special customs zone in Colombia. In addition, some of the cigarettes shipped from Venezuela to Aruba and on to Maicao went back into Venezuela. (The Caracas daily El Nacional estimated in 1998 that Venezuela’s annual loss from cigarette smuggling was around $35.4 million dollars.)

Similar operations went on farther south, too, with cigarettes from BAT’s Brazilian subsidiary Souza Cruz being shipped through Paraguay into Argentina. Notes from a visit to Paraguay in July 1994 show that “excellent work has been done in the border town, which is the main supply point of DNP product for the Argentinean market.” Another notes that BAT’s Brazilian and Argentine subsidiaries “recycle product through Paraguay and back into their respective markets making use of the lower excise rates in Paraguay.”

BAT’s main distributor in Latin America was Romar Free-Zone Trading Co. N.V. of Aruba, run by Roy Milton Harms, Jr., the documents show. BAT’s three wholly owned subsidiaries in the region “use Romar in Aruba as their transit agent into Colombia. … Romar also sells Belmont 70 mm and Consul 70 mm into Colombia with Venezuela as the end market,” Mark Waterfield, then an executive at BAT’s Venezuelan subsidiary Bigott, wrote in a Feb. 12, 1992 memo .

.

The documents paint a close relationship between BAT and its distributor.

In the same letter where Dunt halted attempts to limit Romar’s sales to Maicao, he noted that the issue “was mentioned to me by Harmes [sic] yesterday on his U.K. visit – and with some forcefulness – as you can imagine.”

Harms and his father, Roy Harms Sr., were in London at BAT’s invitation . They were booked into the Carlton Tower Hotel in Knightsbridge, near Harrods, and given two tickets to Wimbledon.

. They were booked into the Carlton Tower Hotel in Knightsbridge, near Harrods, and given two tickets to Wimbledon.

Cousin Bryan Harms said in a March 5, 1998, letter to Colombian authorities that he “personally gave windsurf lessons to Mr. Pat Sheahy [sic], top director of BAT when there was a great meeting of BAT and Bigott in Aruba in those times.”

“Those times” refer to the period before the Harms family split into two factions in 1988, with one side taking the exclusive BAT business.

That family feud prompted Bryan Harms to contact Colombian and Venezuelan authorities in 1998 with allegations that BAT and Romar were in the cigarette smuggling business. Before the family business split, Harms told authorities he had accompanied officials of BAT and its Venezuelan subsidiary several times for “marketing work to Maicao,” the special customs zone in northern Colombia. Romar did not respond to faxed questions and several calls requesting comment. In BAT’s faxed statement, it refused to respond to a list of specific questions, including about Romar.

Bryan Harms confirmed he told Colombian and Venezuelan authorities that he had witnessed high-ranking BAT officials coordinating the shipment of cigarettes from Aruba to the Colombian and Venezuelan coasts. But he refused to elaborate.

Harms Brothers Limited of Aruba, started by Bryan’s father, Lionel, and I.D.F. International Duty Free Trading N.V., which Bryan Harms directed from 1996-1998, were identified in last December’s Canadian RICO lawsuit as being part of RJR’s smuggling operation but were not named as defendants.

Competitors or Bedfellows?

Fierce competition for market share drove many of BAT’s actions in Latin America, the documents suggest. However, they also show that company executives had discussions with representatives of Philip Morris International about “DNP” and “transit.”

At a meeting on Feb. 14, 1992, at John F. Kennedy airport in New York, Philip Morris’ then president for the Latin American region, Peter Schreer and his deputy Fred Hauser met with BAT’s Keith Dunt and David Etchells. “Transit business from Paraguay into Argentina needs to be watched, particularly bearing in mind Industry agreement on quantum level of excise,” said a file memo written by Etchells, summarizing the discussions. The two sides agreed to have “more regular meetings,” and in August 1992, the BAT and PMI representatives met again, this time at the posh Pennyhill Park country club near BAT headquarters outside London, according to a “SECRET” document summarizing their talks. “PMI raised the ‘contraband from Honduras’ issue which was counteracted by BATCo’s raising the price gap argument. No ground conceded on either side,” the notes said.

summarizing their talks. “PMI raised the ‘contraband from Honduras’ issue which was counteracted by BATCo’s raising the price gap argument. No ground conceded on either side,” the notes said.

“BATCo suggested an aggressive price increase to be negotiated at a local level for DNP to be implemented if possible by the end of August,” the notes later said, referring to Venezuela. “Following action on DNP PMI suggested we should pursue a DP price increase. PMI wanted linkage between the DNP increase. This was not supported by us.”

Philip Morris confirmed there were meetings between Schreer and Dunt in 1992 “to discuss general industry issues in Latin America,” but was unable to say “what precisely was discussed.”

Beyond the issues of smuggling, tax evasion, and undermining governments’ attempts to set health policy, there have been allegations that the activities of tobacco multinationals have complemented drug money laundering. The 1998 Colombian governors’ report and two other independent studies said that smuggled cigarettes had become a vehicle for money laundering, and the subject was the focus of a U.S. congressional hearing last summer.

The nexus of cigarette smuggling and drug money laundering in Latin America is known as the black market peso exchange, in which “peso brokers” convert U.S. dollars from drug lords into clean pesos. Their sources of clean pesos are smugglers who need U.S. dollars in order to purchase international goods. James Johnson of the U.S. Treasury Department has called the system “primarily an exchange of currencies” but one that is “perhaps the most dangerous and damaging form of money laundering that we have ever encountered.”

With access to U.S. dollars regulated by Colombian law and administered by banks, requiring proof of legal import, the peso broker “offers a businessman a choice and the drug trafficker an opportunity,” Bonni Tischler, U.S. Customs Service Assistant Commissioner for Investigations, told the June 1999 congressional hearing. She said the cigarette industry was one of the “most affected” by the black market peso exchange. “Some American companies, and I would give Philip Morris as an example, have been accused of implicitly supporting the black market peso exchange in order to increase their market share in Colombia and avoid paying hefty Colombian taxes,” noted the hearing’s chairman, Sen. Charles Grassley (R-IA). “Some Colombians have gone so far as to threaten to sue Philip Morris, arguing that the volume of advertising that Philip Morris chooses to have in Colombia is not justified by levels of legitimate sales.” For over 50 years, Philip Morris’ main distributor in Latin America was the Mansur Free Zone Trading Company, N.V., run by a rich and politically powerful family in Aruba.

Cousins Eric and Alex Mansur were indicted on federal money-laundering charges in August 1994 for allegedly being part of a network that laundered proceeds from the Colombian drug trade. In a Dec. 2, 1996 letter to Congress, President Clinton identified Aruba “as a major drug-transit country,” and took the unusual step of publicly identifying the family, saying that “a substantial portion of the free-zone’s businesses in Aruba are owned and operated by members of the Mansur family, who have been indicted in the United States on charges of conspiracy to launder trafficking proceeds.”

Philip Morris International broke its contract with the Mansurs at the end of 1998 “for business reasons,” company spokeswoman Elizabeth Cho said in an interview. She refused to elaborate. But a source close to the family said the two sides agreed to a $22 million settlement and that the Mansurs continue to work with Philip Morris’ non-tobacco product lines. The Mansur company changed its name last year to Glossco Freezone N.V. following six years of unwelcome scrutiny.

Eric and Alex Mansur, meanwhile, have yet to go on trial, their case initially delayed by years of extradition battles between the United States and Aruba. Now they are in Miami, where U.S. and Colombian sources say they have been offered a plea bargain by U.S. prosecutors that would greatly reduce or eliminate any jail time in return for cooperation with investigations into cigarette smuggling and money laundering. Their lawyer, Robert Josefsberg, refused to comment.

“We will not condone, facilitate or support contraband or money laundering,” Philip Morris International said in its statement . Twice in the last two years, the company has defeated shareholder resolutions that have suggested corporate complicity in smuggling and called for an internal review.

. Twice in the last two years, the company has defeated shareholder resolutions that have suggested corporate complicity in smuggling and called for an internal review.

The BAT documents suggest that its officials were aware of the linkage between cigarette smuggling and money laundering, and they discussed how black market money flows in Aruba affected their business.

On March 8, 1995, Keith Dunt received an e-mail about the “difficulty of obtaining ‘clean’ $” that BAT’s Venezuelan subsidiary had in January. “It was necessary, in December, to reduce the selling price from US $125.00 to US $96.00 per case, ie in line with Belmont HL price (such that Romar could then sell through at US $106.00 per case and receive ‘clean’ US$).”

about the “difficulty of obtaining ‘clean’ $” that BAT’s Venezuelan subsidiary had in January. “It was necessary, in December, to reduce the selling price from US $125.00 to US $96.00 per case, ie in line with Belmont HL price (such that Romar could then sell through at US $106.00 per case and receive ‘clean’ US$).”

Epilogue

The publicly available BAT documents end, for the most part, in 1995.

Since the mid-1990s, legal imports of cigarettes have risen exponentially in Colombia. DIAN figures show that while only $4.6 million in cigarette imports were registered in 1994, that number had leapt to $39.9 million by November 1999. In August 1999, BAT signed a letter of commitment with the DIAN promising, according to director Fanny Kertzman, “that if they have any evidence that distributors to whom they sell their products are, in turn, selling to smugglers, they will stop selling to these distributors.”

In a final desperate attempt to crack down on its contraband problem, Colombia two weeks ago (Jan. 18) announced a new ban on bringing cigarettes, liquor, or home appliances – the three most common types of contraband goods – from Maicao and Turbo into the rest of the country, effective July 1. Despite street protests, President Andres Pastrana vowed, “The government has already bit into contraband and is not going to let go until this scourge is eradicated.”