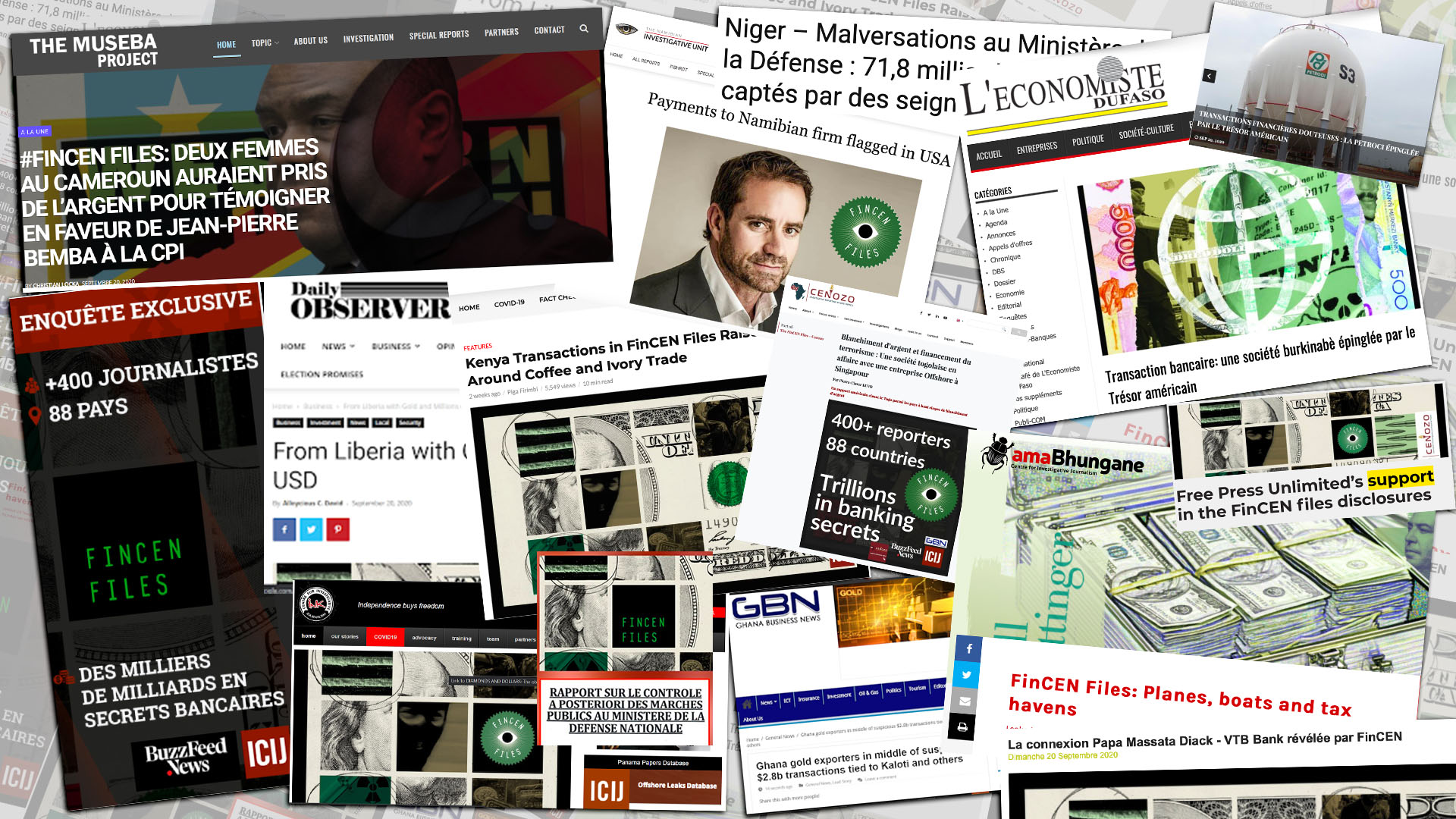

From Botswana to The Gambia, African reporters collaborated with the International Consortium of Investigative Journalists on the FinCEN Files investigation in record numbers.

ICIJ and 108 media partners, including news outlets in 18 African countries, spent months investigating secret bank reports shared by BuzzFeed News. The reports were prepared by banks and sent to the Financial Crimes Enforcement Network, known as FinCEN, a financial crime agency within the U.S. Department of Treasury.

Journalists in Africa revealed suspicious money transfers tied to arms companies, the ivory, gold and diamond trades, and business moguls under investigation for corruption.

The FinCEN Files exposés from Africa involved reporting on some of the continent’s most powerful people and corporations. Journalists investigated former presidents, millionaires with well-paid attorneys and those accused of crimes. Some explored detailed documents submitted to the U.S. Financial Crimes Enforcement Network, a U.S. financial crime fighting agency. Other reporters began with just a few words, one bank wire or one row in a spreadsheet.

From there, reporters requested official records at courts and at company registries, contacted sources, spoke to experts and knocked on doors, made phone calls and sent emails. Some reporters were even threatened for doing their work.

ICIJ partnered with Cenozo, a Burkina Faso-based nonprofit organization that promotes investigative journalism. Cenozo secured funding from Free Press Unlimited to provide reporters with editorial and legal support from French and English-speaking experts and grants for reporting costs.

“The economic environment is not very favorable for investigative reporting in Africa,” said Leon van den Boogerd, FPU’s program coordinator for sub-Saharan Africa. “So with small support and a simple stipend to cover some travel costs for 18 journalists, the impact is overwhelming.”

One week after journalists published the first FinCEN Files stories, a United Nations report found that more than $88 billion vanishes from the continent each year in illicit financial flows – almost double the amount sent in aid to African countries. Government employees, anti-corruption units and other officials have since contacted FinCEN Files reporters in Botswana, Burkina Faso, Niger and Tanzania to learn more.

Benin

Banouto in Benin explored the little-known gold company, Trading Track Company. ICIJ reporting established that the company was of interest to U.S. officials who suspected it was involved in laundering drug money through gold. The company denied wrongdoing.

Banotou’s reporting also focussed on the origins of gold bought and sold across West Africa, a concern given that gold worth billions of dollars is smuggled out of Africa each year. Trading Track Company’s director declined to help. “I don’t ask that of people,” the company’s director told Banouto. “It’s gold, not tomatoes.”

Botswana

Reporters at the INK Center for Investigative Journalism in Botswana reported on transactions involving diamond companies, important economic players in the mineral-rich country. In one document cited by INK, JP Morgan Chase reported to FinCEN “wire transfers and check activities indicative of layering between diamond/jewelry entities related to negative media regarding money laundering, racketeering, and war crimes allegations.” The companies involved denied wrongdoing.

“The language in the documents was striking,” said Ntibinyane Ntibinyane, INK’s co-founder. “I have worked on several ICIJ projects that exposed illicit financial flows and corrupt activities of the rich and powerful, but I have never come across such strong language.”

Burkina Faso

L’Economiste du Faso published an investigation into a little-known Burkinabe arms company that wired money to a company in Serbia. Journalists discovered that the Burkina Faso company, Aranko Security, was managed by a former pop singer known as King Cyriaque.

Sandrine Sawadogo collaborated with ICIJ’s Serbian media partner, Krik, which tracked down documents and interviewed an employee at the Serbian company. “It was as if she was in my heart and in my head,” Sawadogo said about Serbian journalist, Dragana Pećo. “It was like I was there doing the interview myself. Despite borders, despite our differences, investigative journalists are in many ways the same.”

Cameroon

The Museba Project, an investigative center in Cameroon that focuses on Central Africa, exposed new details about payments involving former Democratic Republic of Congo vice-president Jean-Pierre Bemba and others who were convicted of witness tampering in 2016.

“The reaction to my story from Congolese media and civil society showed me that the message reached its target audience,” said Christian Locka, founder of The Museba Project’s founder. “It was an unprecedented experience for The Museba Project to be part of this family of media organizations that promote investigative journalism around the world.”

Le Monde Afrique published a new chapter in the Magnitsky Scandal, which centers on the death of a Russian tax lawyer who had accused officials of fraud. Le Monde Afrique revealed that a U.K. shell company allegedly involved in the fraud paid money to Russia’s honorary consul in Douala, Cameroon.

Reporter Josiane Kouagheu waited outside the Russian honorary consulate to speak to the consul. “Someone at the consulate told me that the building wasn’t taking any visitors, especially not journalists,” Kouagheu said. “Yet I saw people enter. So, for two days, I kept watch outside. Keeping watch allowed me to speak to the honorary consul when, at one point, he got into his car.”

Côte d’Ivoire

Côte d’Ivoire’s state-owned oil company, Petroci, received millions from a company in the tax haven Seychelles, according to L’Elephant Dechaine. Bank of New York Mellon signalled some payments to Petroci as potentially suspicious because “they involve fictitious entities that cannot be identified by open source searches and therefore the source of funds and/or the purpose of transactions is unknown.”

Gambia

Reporter Lamin Jahateh, who published widely across West Africa, showed that officials in Gambia were unaware that two companies registered in the small nation were subjects of a suspicious activity report submitted to FinCEN due to possible connections to terrorism. Jahateh debunked Deutsche Bank’s fears, but his reporting revealed the uneven state of global information sharing when it comes to alleged financial crime.

“While Najah and Kiram fell under the radar of FinCEN in America, in their home country of The Gambia, the Financial Intelligence Unit did not have any information on them,” Jahateh wrote about the companies.

Ghana

Ghana Business News exposed more than $100 million in potentially suspicious payments connected to gold companies in the West African country. Ghana’s gold industry faces significant challenges in enforcing the law, according to one expert who spoke to Ghana Business News.

“When we met in Hamburg, Gerard [Ryle, ICIJ’s director] while addressing the partners said something that has stuck with me,” said Emmanuel Dogbevi of Ghana Business News. “He said something like ‘the greatest resource you have on this project is sitting next to you.’ And that proved very significant for me while I worked on FinCEN Files.”

Dogbevi said that the CEO of a gold company “started ranting and raving and calling me ignorant” when Dogbevi asked the CEO for comment on FinCEN Files reporting. “I told him I am a journalist and doing my job.”

Kenya

Africa Uncensored in Kenya reported on unusual transactions that U.S. banks submitted as potentially suspicious. Some wires involved possible ivory sales by an unknown company, which one expert said was a red flag because he was unaware of any legal ivory trade involving Kenya.

The “most important takeaway,” said Kenyan reporter Purity Mukami, was to not give up “when doing something in the public interest.”

Liberia

Alloycious C. David, a freelance journalist with Liberia’s Daily Observer, reported on more than $11 million in suspicious transactions involving a local gold company called Golden Vision Trading. Standard Chartered Bank filed a report in 2013 in part because some transactions were in round dollar amounts, which the bank wrote is a “known vehicle for money laundering.” A spokesperson for the Liberian company said there was no reason to suspect these wire transfers or the company’s business.

Malawi

One FinCEN Files investigation from Malawi reported on suspicions by Barclays Bank about companies and individuals reportedly involved in a procurement deal made under former President Joyce Banda. Reporters from amaBhungane in South Africa also worked on a story about the Paramount Group, an arms company. A Hong Kong shell company suspected by Malawian officials of involvement in money laundering also appeared in ICIJ’s revelations that HSBC continued to move dirty money for criminals even while under a deferred prosecution agreement with the U.S. Department of Justice.

“This was my first ever participation in cross-border journalism of such magnitude hence every step of the way, from preparations to execution, was a learning opportunity,” said Golden Matonga, a reporter with The Nation. “The local media really took up the story.”

Namibia

The Namibian reported on the connection between a Windhoek airline company and Palladino Holdings Ltd., a company that was once investigated in the United States for corruption. There is no suggestion the Namibian company is involved in wrongdoing.

“The most important thing is that we constantly need to keep building conscience around financial methods,” said Lazarus Amukeshe, a reporter with The Namibian. A financial exposé can sometimes “feel very far away from people, but in fact, it’s not,” he said.

Niger

L’événement in Niger used FinCEN Files documents, including two short references to shell companies created in the United Kingdom, to tie the global investigation to a corruption scandal that has rocked the country since early 2020.

Nigeria

Nigeria’s Premium Times newspaper published a series of FinCEN Files stories since the project’s launch last month. One story examined payments involving the wives of former Nigerian vice-president Atibku Abubakar. Abubakar was investigated in Nigeria for financial wrongdoing in 2006, but has never been charged. He denies wrongdoing.

“Our story has caused a renewed scrutiny of the country’s big politician Atiku Abubakar, who may be a top contender in the country’s next presidential election,” said Taiwo Hassan Adebayo, a senior investigative reporter with Premium Times.

Senegal

Momar Dieng, a reporter with Senegalese news website Impact.sn, collaborated with ICIJ partners in France, the United States and Japan to expose FinCEN Files connections to corruption at the heart of global athletics. Banks flagged more than 100 transactions connected to Lamine Diack, his son and his son’s company, according to documents. Days before publishing FinCEN Files, a court in Paris sentenced Diack and his son to jail for corruption offenses.

“This affair is a vast plot of which you ignore the underside,” one of Dieng’s contacts told him when contacting one of the subjects of his investigation.

Tanzania

Simon Mkina, an investigative journalist in Dar es Salaam, reported on a company registered in Tanzania that banks said suspiciously moved $620 million. However, Mkina was unable to find any trace of the company at its listed address or in official company registers inside Tanzania.

“Without collaborative journalism, I could spend a lot of time and money and only have a slim chance of obtaining information from overseas,” Mkina said about the value of collaboration.

Togo

Reporter Pierre-Claver Kuvo examined payments between a little-known Togolese trading company and a company based in Singapore, a powerful tax haven.

“FinCEN Files wasn’t easy for me because the suspicious activity reports only contained about 20 or 30 words on Togo,” said Kuvo. “I started with a tiny bit of information and dug deeply to give context to the story on a national and global level” with the help of experts who explained the role of tax havens, he said.