An ICIJ Investigation

Mauritius Leaks

Multinational companies use the tiny tax haven Mauritius to avoid paying taxes to countries in Africa, Asia, the Middle East and the United States.

DATA JOURNALISM

ICIJ Publishes List of Mauritian Companies Used by Conyers’ Corporate Clients

By Delphine Reuter

July 23, 2019

- New leak reveals how multinational companies used Mauritius to avoid taxes in countries in Africa, Asia, the Middle East and the Americas

- Law firm Conyers Dill & Pearman and major audit firms, including KPMG, enabled corporations operating in some of the world’s poorest nations to exploit tax loopholes

- A private equity push into Africa backed by anti-poverty crusader and rock star Bob Geldof benefited from Mauritius’ treaties that divert tax revenue away from Uganda and elsewhere

- Multi-billion dollar U.S. companies Aircastle and Pegasus Capital Advisers cut taxes through confidential contracts, leases and loans involving Mauritius and other tax havens

- Officials from countries in Africa and Southeast Asia told ICIJ that tax treaties signed with Mauritius had cost them greatly and that renegotiating them was a priority

MONEY LAUNDERING

Jun 28, 2024

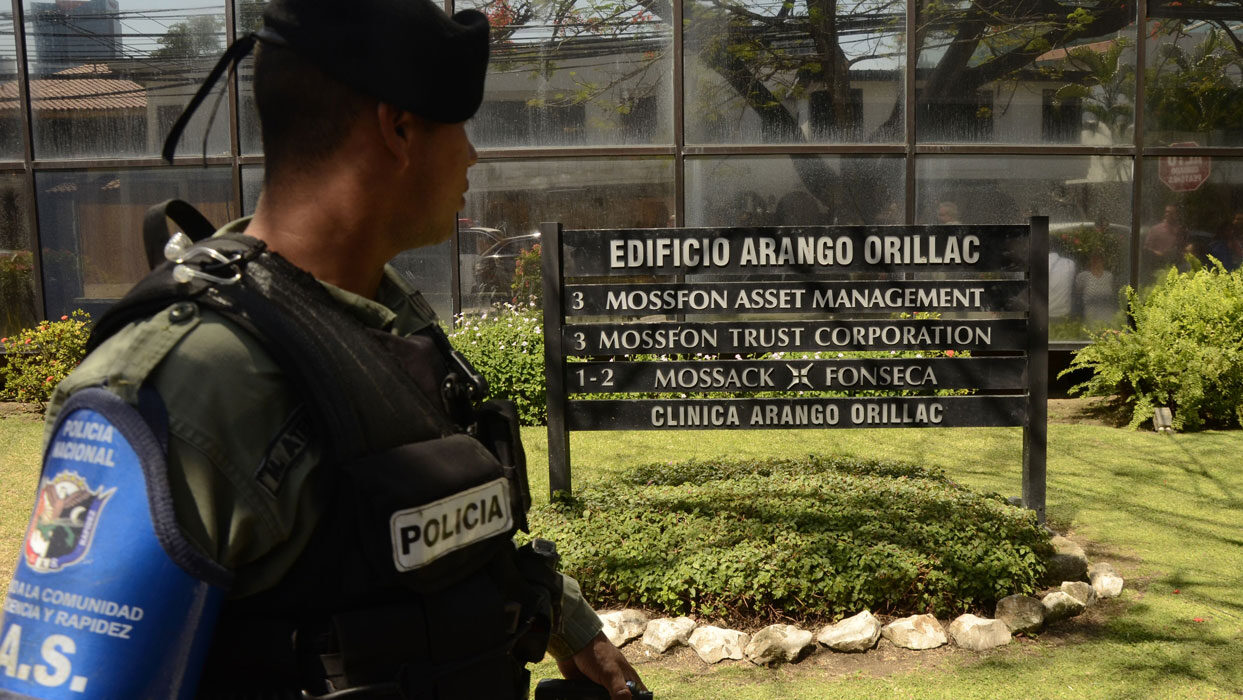

Panama Papers trial concludes with all defendants acquitted of money laundering

IMPACT