The European Commission has announced it will tighten the European Union’s anti-money laundering rules and increase transparency requirements for companies and trusts, putting the financing of terrorism and tax evasion in its crosshairs.

The anti-money laundering proposal is the first official measure taken after the Commission announced its Action Plan to tackle terrorist financing back in February, and parliamentarians have credited the Panama Papers “scandal” with helping “focus minds and speed up this work.”

The announcement lays out a series of anti-money laundering objectives, which include the automatic sharing of information between national tax authorities, expanding existing directives to cover virtual currencies such as Bitcoin, and a common black list of opaque jurisdictions.

It also suggests increased protection for whistleblowers, a week after the two French PricewaterhouseCoopers employees who leaked tax documents used in ICIJ's LuxLeaks investigation were given suspended prison sentences and fines by a court in Luxembourg, to the outrage of transparency advocates worldwide. ICIJ also condemned the sentences.

“The recent leaks exposed loopholes that still allow tax evaders to hide funds offshore,” said Pierre Moscovici, EU Commissioner for Economic and Financial Affairs, Taxation and Customs. “These loopholes must be closed and our measures to stamp out tax abuse must be intensified.”

The transparency measures will now be reviewed by the European Parliament and the European Council before a decision is made on whether to adopt them.

The announcement came the day after ICIJ partner Le Monde published new Panama Papers-based exposés on the offshore dealings of two prominent European businessmen, Formula 1’s British chief executive Bernie Ecclestone and Fashion TV’s Polish founder and boss Michel Adam Lisowski.

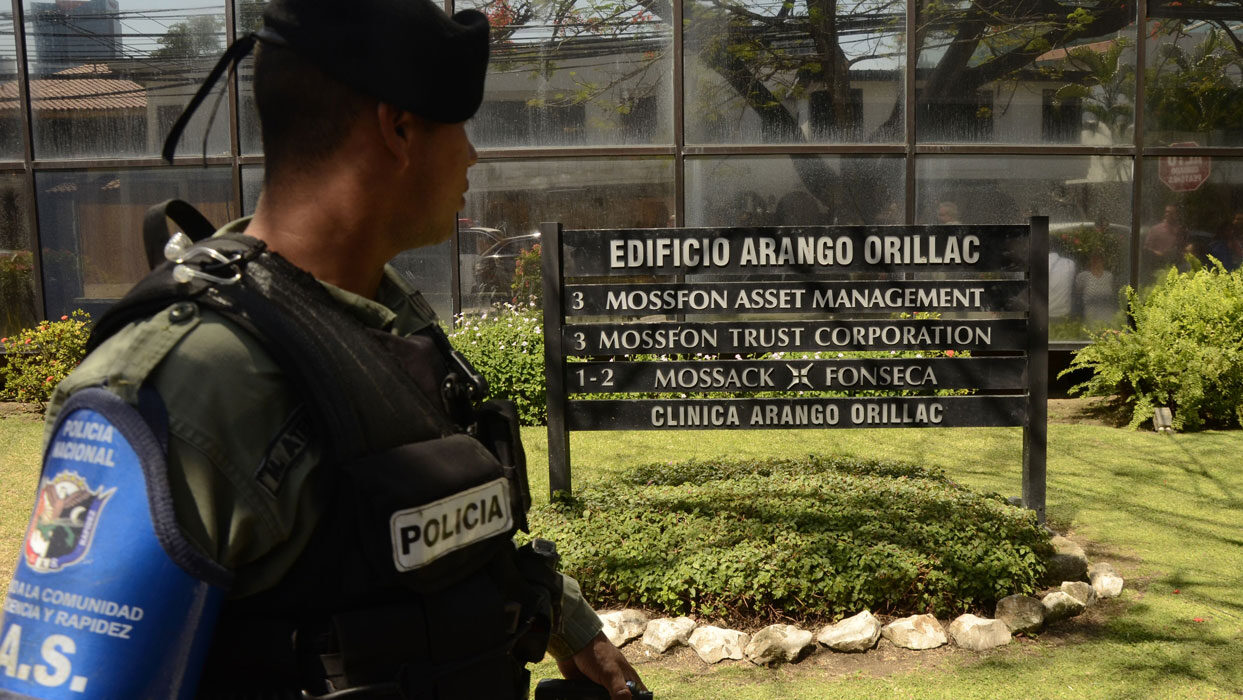

The French paper found that Valper Holdings, a company controlled by Ecclestone which he used to pay millions of dollars to the heads of several Formula 1 teams to ensure they all signed a lucrative agreement with Ecclestone’s Formula One Group, was originally established through Mossack Fonseca in 1994.

The payments had been mentioned in a German lawsuit, which Ecclestone settled for $100 million in 2014 without admitting wrongdoing, but Mossack Fonseca’s role in the scheme had not been made public.

Le Monde’s investigations also revealed tight links between a company established by FashionTV’s Lisowski in the British Virgin Islands, and real estate holding companies controlled by Lisowski’s brother Gabriel. According to Le Monde, Michel Adam Lisowski used these structures to avoid paying “almost any taxes” on Fashion TV’s estimated $250 million a year revenue.

In Spain, a court also sentenced soccer star Lionel Messi and his father Jorge to 21 months in jail and multimillion euro fines for defrauding the Spanish government of 4.1 million euros in taxes between 2007 and 2009 (worth about $5.6 million at the time). Both men denied having any knowledge of the scheme, which hid image rights revenue from authorities through offshore companies, and have blamed tax advisors. Messi had already made a voluntary tax arrears payment of 5 million euros after the case first came to light in 2013, and it is unlikely he or his father will spend time in a cell as Spanish law allows sentences shorter than two years to be served on probation.

Messi's name also appeared in the Panama Papers, which revealed Mossack Fonseca were hired as the registered agent for another offshore company linked to the player.