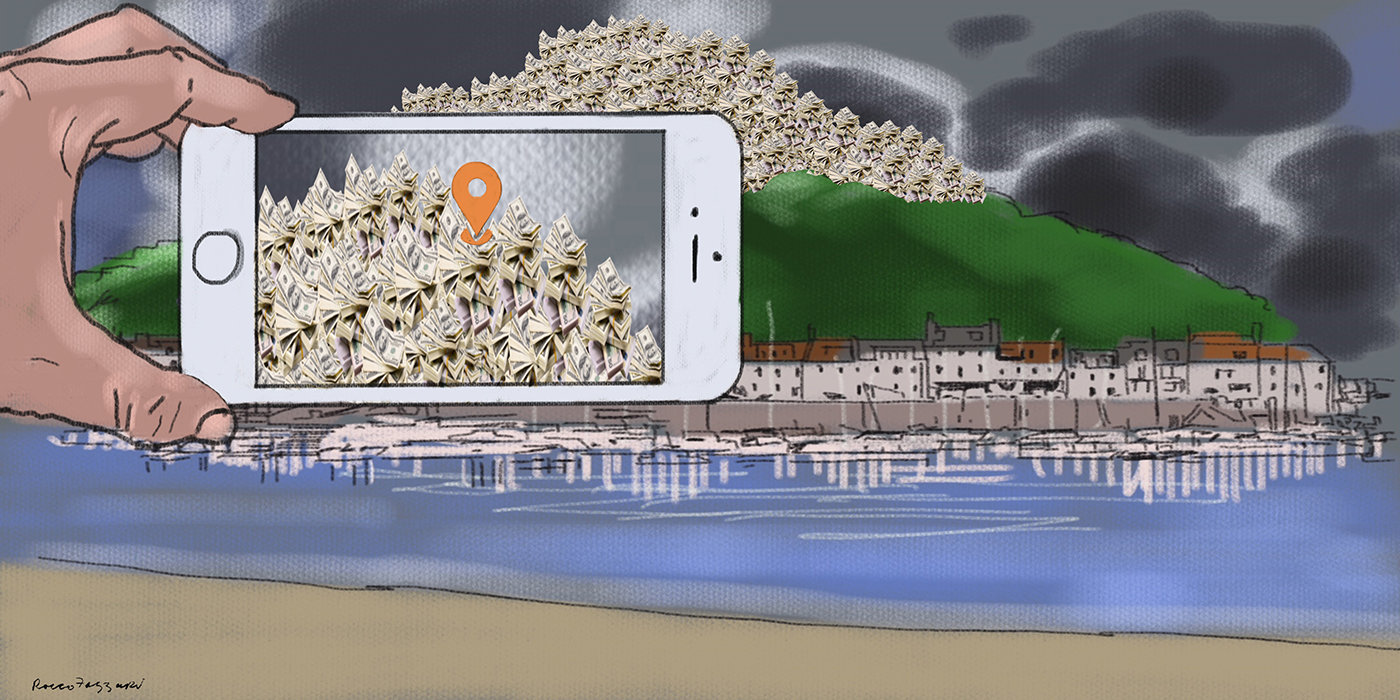

Thirty-five countries should be named and shamed on the European Union’s upcoming list of countries that facilitate tax avoidance and evasion, according to a new report by nonprofit Oxfam.

The EU brought forward discussions on a “blacklist” of tax havens after the Paradise Papers revelations. The list is expected to be published on December 5.

“It’s time that we agree and publish a blacklist on tax havens,” EU tax commissioner Pierre Moscovici said in the days following the release of the Paradise Papers. While European countries currently adopt their own list of tax havens, officials believe an EU-wide list could have greater force in discouraging tax avoidance.

Oxfam’s proposed list of tax havens includes familiar names such as Jersey, Switzerland and Mauritius as well as less familiar names such as Albania, Serbia and Oman.

The proposed list is based on a combination of a country’s tax transparency, its tax rate and its participation in global anti-tax avoidance agreements.

Oxfam’s list includes 10 countries whose corporate registries form part of the Paradise Papers, a leak of 13.4 million documents from two offshore specialists and 19 secrecy jurisdictions.

Oxfam’s list – countries in bold were included in the Paradise Papers leak:

-

- Albania

- Faroe Islands

- Niue

- Anguilla

- Former Yugoslav Republic of Macedonia

- Oman

- Antigua and Barbuda

- Gibraltar

- Palau

- Aruba

- Greenland

- Serbia

- Bahamas

- Guam

- Singapore

- Bahrain

- Hong Kong

- Switzerland

- Bermuda

- Jersey

- Taiwan

- Bosnia and Herzegovina

- Marshall Islands

- Trinidad and Tobago

- British Virgin Islands

- Mauritius

- United Arab Emirates

- Cook Islands

- Montenegro

- US Virgin Islands

- Cayman Islands

- Nauru

- Vanuatu

- Curacao

- New Caledonia

“The recent Paradise Papers showed once again that tax havens are helping big business to cheat countries and their citizens out of billions of dollars in revenue every year,” Oxfam wrote in its report. “It is essential to stop this phenomenon by identifying, transforming and ultimately sanctioning those jurisdictions.”

While the EU has set its sights on tax havens outside the Union, Oxfam cited the Paradise Papers and other investigations in calling on Europe to include Ireland, Luxembourg, Malta and the Netherlands on any blacklist.

The Paradise Papers revealed how Apple and other multinational corporations used Ireland and the Netherlands to reduce tax bills.

Malta and Luxembourg are also low-tax countries that attract corporations, celebrities and politicians around the world who do business in business-friendly, confidential environments.

“The EU should put its own house in order when it comes to fighting tax evasion and tax avoidance and that EU countries should not be left off the list,” Oxfam said.

Earlier this month, European officials told 53 countries and territories that they risked being included on the list, the Financial Times reported.