Facing sanctions by the European Union and other powers in the wake of Russia’s Ukraine invasion, Alexei Mordashov — a 56-year-old industrialist who tops the Forbes list of Russia’s richest moguls — made a countermove that created a $1.4 billion international mystery.

Who was the owner of the secrecy-guarded shell company in the British Virgin Islands to which he transferred control of his ownership stake in TUI Group, a German conglomerate that operates airlines, hotels and travel agencies around the world?

TUI said it had no idea.

But an analysis of Pandora Papers documents by the International Consortium of Investigative Journalists sheds light on the mystery.

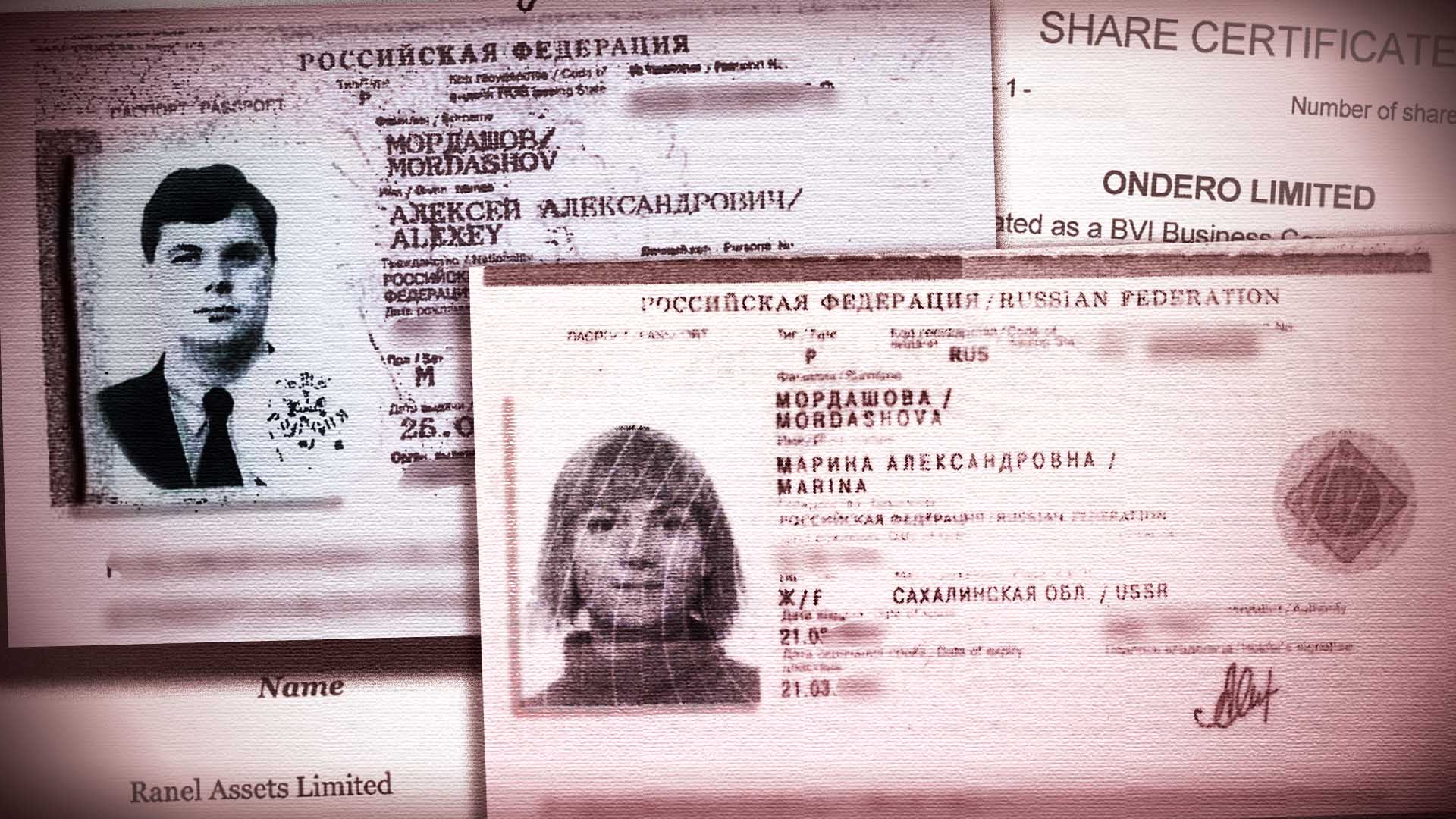

The records show that Marina Mordashova — a woman previously reported to be either the industrialist’s wife or his “life partner” — controls the Caribbean shell company, which is called Ondero Ltd. One of the secret documents identifies her as “the mother of his children” but doesn’t say whether they are married.

Last Thursday, according to TUI, it was informed for the first time about who controls the shell company that is the new TUI shareholder.

On Friday, TUI posted a public notice that said: “Ms. Marina Mordashova is the controlling shareholder of Ondero.” The statement said the information came from a new regulatory filing.

Alexei Mordashov is one of hundreds of Russian business people or government officials who have been sanctioned by Western powers in response to Russia’s war on Ukraine.

The questions surrounding TUI’s new ownership show the challenges facing regulators and investigators tasked with identifying, freezing or seizing the assets of powerful Russians deemed responsible for propping up Russian President Vladimir Putin’s authoritarian regime.

It is also another example of how Western governments’ inability to put an end to the secrecy provided by the offshore financial system has allowed the ultra-wealthy to find new ways to protect their funds and avoid public scrutiny and legal actions.

The world’s “tolerance for anonymous ownership” has the potential to defeat everything from taxation to regulation and, of course, sanctions, said Alex Cobham, executive director of the anti-corruption group Tax Justice Network.

The Pandora Papers, a leak of 11.9 million confidential records obtained by ICIJ, show that Marina Mordashova has long owned Ondero’s parent company, another British Virgin Islands entity named Ranel Assets Ltd.

Alexei Mordashov did not comment on the deal nor on Marina Mordashova’s involvement. “I also can’t confirm or deny Marina Mordashova’s status,” his spokesperson said.

In response to other questions from ICIJ and its partners, the spokesperson said that Mordashov has never been involved in politics and has never had any relationships with the Russian authorities. The spokesperson added that Mordashov “has always conducted his activities in Russia and abroad strictly following Russian and international laws.”

ICIJ was unable to reach Marina Mordashova.

Far-reaching investments

Mordashov, whose fortune is estimated at $29 billion, is the majority shareholder and chairman of Severstal, one of the world’s largest steel companies. Through the firm’s parent company, Severgroup LLC, he is also a shareholder of Rossiya Bank, described by the U.S. government as “the personal bank for senior officials of the Russian Federation,” including Putin’s inner circle.

The bank was blacklisted in 2014 by the United States after the Russian annexation of Crimea. Mordashov was sanctioned in February by the EU, the U.K. and other countries. Documents laying out the EU sanctions said he has a history of benefiting from “his links to Russian decision-makers.”

Through a Cyprus-based company, Unifirm Ltd., Mordashov also has stakes in coal mining, media and other sectors.

Unifirm has been a shareholder of TUI, a London-listed company with headquarters in Germany, for about 15 years, according to TUI. It became TUI’s largest shareholder last year as the travel conglomerate struggled to recover from the economic blow of the COVID-19 pandemic.

In February, the sanctions imposed by the EU and the U.K. against Mordashov forced the Russian oligarch to resign from the TUI board and sell his 34% stake.

Unifirm — the TUI shareholder — transferred a 4.1% stake in TUI to Mordashov’s Severgroup conglomerate. At the same time, the Russian investor transferred ownership of his Unifirm group to a British Virgin Islands company named Ondero, which then became a 29.9% shareholder of TUI. The stake is valued at about $1.4 billion.

TUI publicly announced the move March 4 but said that it didn’t know the identity of Ondero’s true owner.

What TUI and German regulators apparently didn’t know at that time was that Ondero is controlled by yet another shell company, which belongs to Marina Mordashova.

Mordashova, 42, lives in Moscow. She set up the company, Ranel Assets, in 2018, the Pandora Papers show. Its purpose, according to leaked records, was “investment of earned income into financial instruments (deposits, options, forwards) in order to earn income in the form of interest,” which is tax-free in the British Virgin Islands, one of the world’s leading offshore tax havens.

Marina Mordashova’s shares in the shell company were worth about $40 million at the time. The source of funds was “Mr. Alexey Mordashov,” the leaked records show.

The Pandora Papers reveal that, shortly after Ranel Assets was incorporated, the company became the sole shareholder of Ondero.

In a statement sent to ICIJ, a spokesman for Germany’s Ministry of Economy and Climate Protection said that it is reviewing TUI’s ownership as part of the agency’s mandate to ensure that foreign ownership in German companies doesn’t create national security risks.

Margot Gibbs, Petra Blum, Philipp Eckstein and Mauritius Much contributed reporting.