The European Commission is considering action against a former top official following revelations of an undeclared link to an offshore company in the Bahamas.

The Commission’s announcement is among a number of global reactions to the Bahamas Leaks, the latest massive leak of tax haven information by ICIJ, Süddeutsche Zeitung and media partners that reveals new details about politicians, fraudsters and corporate giants.

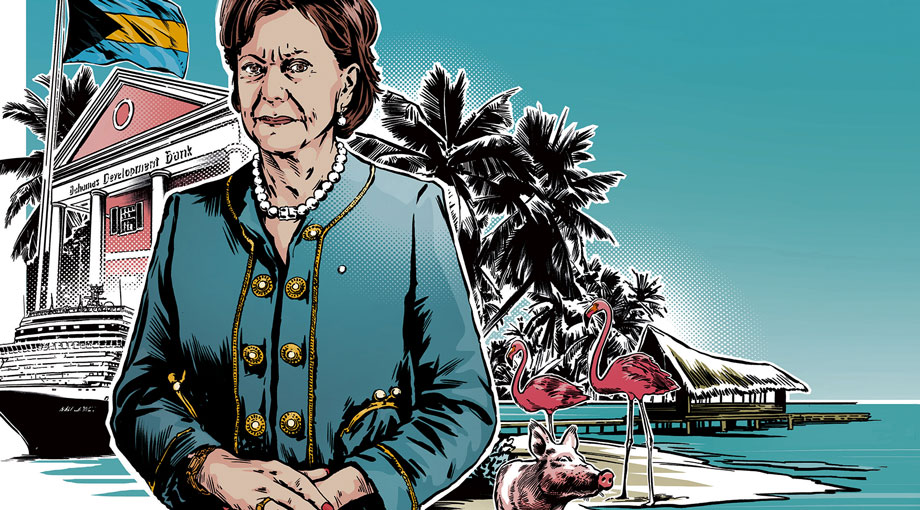

Neelie Kroes, a former Dutch minister and Europe’s former commissioner for competition, was a director of Mint Holdings Ltd., a company that entered ultimately unsuccessful negotiations for a $6 billion deal with energy giant Enron.

Kroes’ involvement with the Bahamas-registered Mint Holdings was not previously known. After receiving questions from ICIJ partners, Kroes admitted she had not disclosed her directorship to authorities and reported her mistake to the European Commission’s President, Jean-Claude Juncker.

The European Commission said on Thursday it was looking into whether to take action against former EU commissioner.

In a press release shared by her lawyer on Thursday, Kroes repeated that she informed Juncker of the “clerical error” immediately.

“Neelie Kroes regrets this chain of events but has always acted in good faith. Except for a formal violation, she has always acted conscientiously,” the press release stated.

Vicky Cann, researcher with the Corporate Europe Observatory, a leading advocacy organization, said the revelations about Kroes show “the need for an urgent overhaul of rules relating to the ethics of commissioners, including on their declarations of interest and on revolving doors.”

More than 40 news organizations from Europe, Asia, Africa and the Americas published revelations, now known as the Bahamas Leaks, from a trove of leaked documents from the Caribbean tax haven’s corporate registry.

Other high-profile revelations from the Bahamas Leaks include two companies tied to the United Kingdom’s Home Secretary, Amber Rudd, and an investment of the family holding company of Argentina’s President, Mauricio Macri.

Bahamas Leaks continue to be front page stories, leading television news and editorials across Europe on Thursday.

Tax agencies and officials in Norway, Denmark, Mexico and Pakistan reportedly announced investigations into citizens and companies that appear in the Bahamian files.

Jeppe Kofod, a member of the European Parliament committee set up to investigate the Panama Papers revelations published earlier this year by ICIJ and its media partners, tweeted that he would seek to expand the inquiry to also cover the Bahamas.

The Bahamas itself continued to come under fire as Pierre Moscovici, the European Commissioner for Economic and Financial Affairs, posted on Twitter: “Scale of tax avoidance and evasion is simply unacceptable” and urged European nations to adopt a list of tax havens.

“The Bahamas is a classic secrecy jurisdiction – it allows people to set up secret shell companies and makes it difficult and expensive to get any information about who’s really pulling the strings. This secrecy allows crime and corruption to fester hurting all of us,” said Robert Palmer of transparency advocacy organization Global Witness.

The cache of documents from the Bahamas corporate registry provides names of directors and some owners of more than 175,000 Bahamian companies, trusts and foundations registered between 1990 and early 2016.

ICIJ added details of these companies to its existing Offshore Leaks Database, which now contains information on almost 500,000 offshore entities and makes it one of the largest online repositories of offshore information.

Read more about the impact from ICIJ’s investigations, and find out how you can support ICIJ’s work

Find out first! Receive ICIJ’s investigations by email