Researchers claim Canadian forestry giant has hidden links to Indonesian deforester accused of destroying habitat

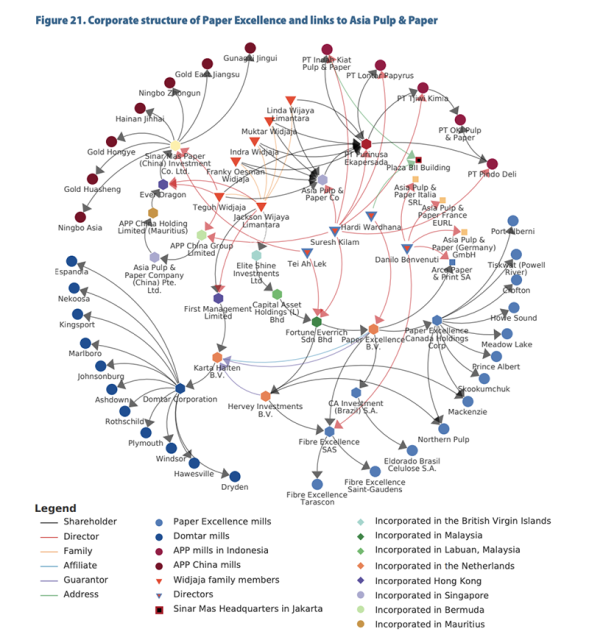

Four environmental watchdogs allege that Paper Excellence and Asia Pulp & Paper used shell companies to conceal corporate control by the same Indonesian tycoons accused of clearing more than 2 million hectares of Indonesian rainforest.

A new report alleges hidden corporate links between a Canadian forest products company and an Indonesian pulp and paper producer accused of causing vast environmental harm, illustrating how even firms with severe reputational problems can use weak financial transparency laws to expand their business.

Researchers from four environmental watchdogs said they found evidence of formal links between Paper Excellence, a Canadian forestry giant that has been expanding globally, and Sinar Mas Group’s subsidiary Asia Pulp & Paper, an Indonesian company accused of deforestation, conflicts with local communities and causing catastrophic fires. The two companies are both controlled by members of Indonesia’s powerful Widjaja family but have long denied any formal connection and maintain they are separately owned and operated.

The environmentalists, including the Environmental Paper Network and Greenpeace, examined business corporate registries from 10 countries and offshore records obtained by the International Consortium of Investigative Journalists and published in the Offshore Leaks database.

In the report titled “Papering over corporate control,” they say that a “nexus of factors such as family ties, overlapping management, and lobbyist filings indicate that Sinar Mas Group controls Paper Excellence.”

Joshua Martin, a spokesman for the Environmental Paper Network, said that “the number and nature of links” between the two companies were concerning.

“Numerous cases have shown how financial and corporate secrecy can shield companies from accountability for deforestation and other environmental issues,” Martin said.

The 70-page report also cites Canadian lobbying records, loan contracts, financial statements and corporate press releases from the mid 2000s, until 2021, which it says appear to show that the two companies are affiliated and even shared some directors.

Both Paper Excellence and APP are controlled by individual members of the Widjaja family, Indonesian business tycoons whose total net worth is estimated at about $10 billion, according to Forbes magazine.

The report says the Widjajas effectively operate the firms in the conglomerate as a “family council.”

But the companies deny any corporate ties. Paper Excellence’s spokesman Graham Kissack told the researchers that the Canadian company “is entirely independent” of the Indonesian paper producer even though its head, Teguh Widjaja, is the father of the owner of the Canadian firm.

“Of course,” Kissack said, “it is well known that Jackson Widjaja, the ultimate owner of PE, is the son of the current leader of APP,” the subsidiary of the Sinar Mas Group, a conglomerate with business interests in agriculture, finance and real estate.

Martin said that the researchers “felt the responsibility” of shedding light on the links between Paper Excellence and APP.

“Opaqueness makes accountability more elusive, if one branch of a conglomerate is causing massive emissions and is in conflict with communities, and another branch is meeting higher standards in order to access markets, investment and accolades, but nobody knows that they are connected,” he said.

In 2007, an international environmental-compliance monitoring body withdrew its certification of APP, the Indonesian paper producer controlled by the Widjajas, saying it was “associated with destructive forestry practices.” That same year, Jackson Widjaja, one of the family heirs, began to expand Paper Excellence’s footprint in Canada and later obtained green certification for the company’s pulp and paper mills, the report said.

Paper Excellence has since bought several mills in North America and expanded its operations in Brazil and France. The company has recently announced the acquisition of the U.S. forestry giant Resolute Forest Products, which, if approved, could transform the Canadian company into a $11 billion multinational, according to the report.

The report also says that, at the center of the complex corporate structure, are shell companies incorporated in the Malaysian territory of Labuan and the British Virgin Islands, two jurisdictions whose stringent secrecy laws prevent the public and foreign courts from accessing information on the true owner of the companies.

The researchers’ review of Dutch corporate records and files leaked to ICIJ shows that a BVI-based firm controlled by Teguh Widjaja, the head of the Indonesian APP and Jackson Widjaja’s father, was the owner of Paper Excellence’s Dutch parent company.

“Paper Excellence’s shareholder companies span multiple offshore jurisdictions, which has the effect of concealing the ultimate beneficial owners,” the report says.

Company spokesman Kissack denied the allegations and said that the use of multiple jurisdictions is common for multinational operators. “There is not, and never has been, an intention to create a corporate structure at Paper Excellence that is intended to hide anything,” Kissack told the researchers.

This is not the first time that the Indonesian conglomerate has been accused of hiding links to related firms. In 2017, an Associated Press investigation found links between APP and nearly all of the 27 plantation companies that it had previously told the outside world were independent. “The company’s apparent aim: to “greenwash” its image for the global market,” the investigation said.

‘Hard to hold companies accountable’

The use of subsidiaries in secrecy jurisdictions is not uncommon for businesses trading commodities potentially exposed to deforestation risks.

In 2017, ICIJ’s Paradise Papers investigation documented how Asia Pacific Resources International Holdings Ltd., known as APRIL, shuffled billions of dollars through a web of offshore companies and used subsidiaries to obtain bank loans. Some of those loans, ICIJ found, financed APRIL’s subsidiaries that local communities have accused of destroying their livelihoods and felling trees in fire-prone areas, contributing to climate change.

More recently, tax justice advocates have accused APRIL of misreporting its wood pulp exports and using subsidiaries in the Chinese territory of Macau, a tax haven, to avoid tax. APRIL denied any wrongdoing in both cases.

Analysts at Profundo and Chain Reaction Research, two independent research firms, have also documented the use of shell companies by palm oil companies operating in some of Southeast Asia’s forest-rich regions.

The analysts dubbed “shadow companies” those legal entities used by palm oil traders and producers to hide ownership of suppliers responsible for environmental and habitat destruction.

Who owns, controls and benefits from the company’s operations? If there is not a simple, straightforward answer to this question, it can be hard to hold companies accountable. — Joshua Martin, Environmental Paper Network

In a 2018 report, the analysts concluded that “corporate entities and opaque ownership structures contribute to the ‘leakage’ of unsustainable palm oil to world markets.”

According to the Environmental Paper Network’s Martin, the opacity of related parties and corporate ownership structure could undermine the efforts of investors and financial institutions demanding disclosure of climate risks.

“The importance of transparency comes down to a fundamental question: who owns, controls and benefits from the company’s operations,” Martin said. “If there is not a simple, straightforward answer to this question, it can be hard to hold companies accountable.”