Governments and banks around the world are doing little to tackle tax abuses, money laundering and corruption in a global financial system that perpetuates inequality and condemns people to endemic poverty, a high-level United Nations panel concluded on Thursday.

The International Financial Accountability, Transparency and Integrity panel, comprised of former heads of state and government leaders, past central bank governors, business and civil society leaders and prominent academics, said in an interim report that outmoded financial controls had failed to keep pace in a globalized, digitalized world.

“Too many banks are in cahoots and too many governments are stuck in the past,” FACTI co-chair Dalia Grybauskaitė and former president of Lithuania, said in a press release about the report. “We’re all being robbed, especially the world’s poor.”

Journalists play an important part of the ecosystems of institutions and actors that generate the sustained national political will needed to create accountable and transparent systems to promote financial integrity.

— FACTI panel

The report calls for a comprehensive approach to tackling widespread abuses that are particularly detrimental to developing countries. COVID-19 only compounded global inequalities and made reform more urgent, it said.

“We need to explore new and creative solutions to make systems more comprehensive and robust, and ultimately build a coherent ecosystem of institutions and frameworks for transparency, accountability and integrity,” the report states.

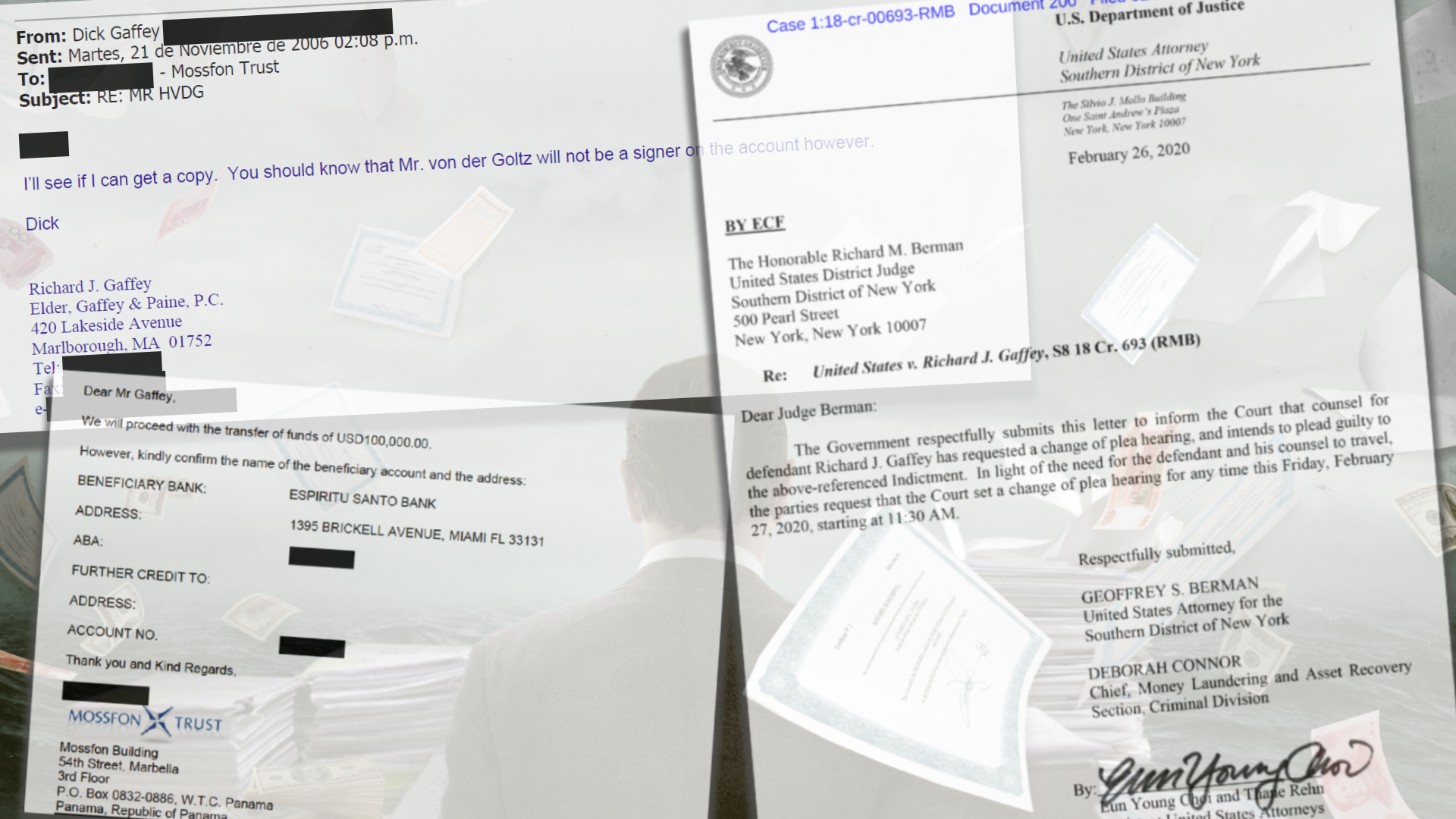

FACTI referenced projects headed by the International Consortium of Investigative Journalists, including this week’s FinCEN Files and the 2016 investigation Panama Papers, as examples of how “the system to regulate dirty money has major gaps.”

“Journalists play an important part of the ecosystems of institutions and actors that generate the sustained national political will needed to create accountable and transparent systems to promote financial integrity,” the report states.

However, even when wrongdoing has been exposed in the past, reform has been slow or non-existent, according to FACTI.

“When every major bank is tainted and complicit, none is likely to suffer reputational damage relative to the rest of the sector,” the report says. “Compliance departments in major banks may flag transactions or customers as risky before major scandals become public, but these warnings may be misunderstood, deliberately ignored, or overruled by bank management.”

The report states that governments lose $500 billion a year through corporate profit-shifting; $7 trillion in private wealth is squirreled away in tax havens; some 10% of the world’s GDP is held offshore; and around $1.6 trillion is laundered every year.

Also referencing the FinCen Files, the chief executive of advocacy group Tax Justice Network, Alex Cobham, welcomed the panel’s call for a comprehensive overhaul and international buy-in.

“Today’s report published on the heels of yet another trillion-dollar finance scandal makes one thing clear: our global tax system isn’t broken, it’s programmed to fail,” he said. “No country can reprogram a global tax system on its own. The FACTI panel confirms that the OECD has proved incapable of delivering genuinely inclusive outcomes: we need a UN tax convention to make sure our global tax system works for everyone.”

FACTI said it expects to publish its final report in February 2021. This would concentrate on providing solutions to the problems detailed in its interim report.