The Canadian parliament has paved the way for the creation of a national register of company owners, passing key reforms to curb corporate secrecy and end so-called “snow washing” — the laundering of dirty money through Canada’s financial system.

Unlike the United States’ long-awaited beneficial ownership registry, the Canadian database will be publicly searchable and include a mechanism for whistleblowers to discretely flag incorrect or fraudulent information.

Transparency advocates welcomed the landmark reforms, which passed into law on Nov. 2 under an amendment to the Canada Business Corporations Act, following a years-long push for a legislative means to tackle money laundering and tax evasion.

“Money laundering is the lifeline for criminal activity, the fentanyl crisis, and foreign interference,” said Sasha Caldera, the beneficial ownership campaign manager at Publish What You Pay Canada, in a statement.

“Canada will soon have a powerful tool that will strengthen the integrity of its economy.”

Her Excellency the @GGCanada has granted Royal Assent to Bill #C42, which will take effect once the @HoCChamber has been advised: https://t.co/4jcz73fHgt#SenCA #CdnPoli pic.twitter.com/wVuMl5ToMo

— Senate of Canada (@SenateCA) November 2, 2023

The new registry will require companies to publicly disclose beneficial ownership information of federally registered companies — a move experts say will help expose criminals and tax cheats who anonymously create companies or purchase property. The Canadian government must now reach an agreement with provinces and territories over whether they will feed the information into the federal registry, or create their own using the federal standard.

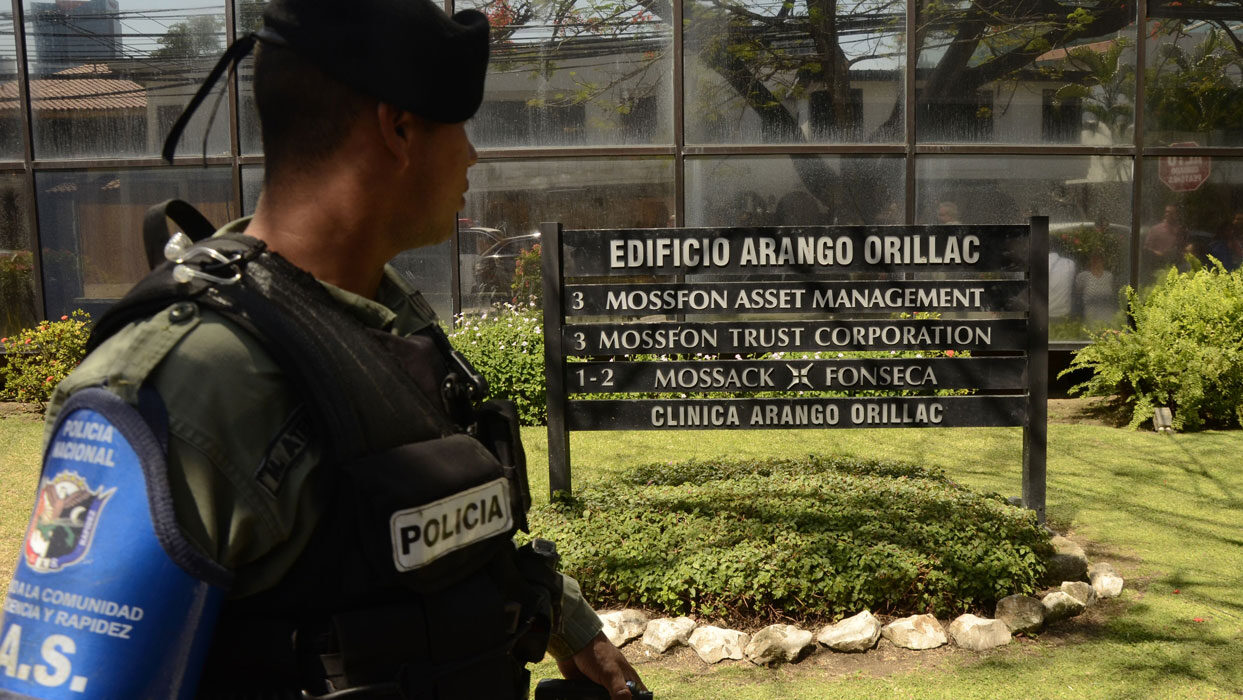

In 2017, an investigation by the Toronto Star and the Canadian Broadcasting Corporation, based on ICIJ’s Panama Papers dataset, revealed how Canada had emerged as a popular tax haven, touted by corporate service providers as a “reputable” destination to hide wealth.

“You’ve got this entity in Canada, banks or other parties in other countries are going to presume that it’s legitimate and OK — pure as the driven snow of the great white north,” tax lawyer Jonathan Garbutt told the Star.

In 2021, ICIJ’s Pandora Papers investigation revealed the extent to which wealthy Canadians also exploit financial secrecy at home and abroad to dodge taxes. The investigation was based on a trove of millions of leaked documents that disclosed assets of hundreds of politicians and high-level public officials in more than 90 countries and territories.

ICIJ partners identified more than 500 Canadians in the data, including figure skating star Elvis Stojko and professional racing driver Jacques Villeneuve, according to the CBC. As part of the project, reporters at the Toronto Star exposed links between a Lebanese-Canadian businessman’s offshore company and a Saudi military official, a U.S. defense contractor, and a Serbian arms manufacturer.

Canadian authorities have also used ICIJ’s investigations to close in on tax dodgers. Federal auditors with the Canada Revenue Agency found that nearly $78 million in taxes are owed in the country, based on the Panama Papers leak.

“We have completed 285 audits and we have reassessed the taxpayers for $77.5 million in taxes owing,” said Cathy Hawara, assistant revenue commissioner, during an Oct. 18 Senate hearing.

The CRA is still conducting multiple audits and two criminal investigations are ongoing, according to Hawara.

“With respect to the Paradise Papers, which were leaked in 2017, we have completed our risk assessments of all of the taxpayers who were identified, just shy of 3,000 taxpayers. We’ve got 35 audits completed and we have assessed $1.8 million in taxes owing, and we have 26 audits underway,” Hawara said.

As of 2021, governments around the world had recouped more than $1.36 billion in back taxes and penalties as a result of the Panama Papers.

Canada’s planned registry follows pushes for similar transparency reforms in more than 130 countries, including the U.S. and the European Union.

“The use of Canada as a secrecy jurisdiction to engage in ‘snow washing’ is coming to an end,” Noah Arshinoff, the interim executive director of Transparency International Canada, said in a statement.

“This bill makes it harder for money launderers to hide behind federal corporations to wash their dirty money.”

Glacier Media reporter Stefan Labbé contributed to this article.