Most European Union members have failed to implement new measures designed to counter the corporate secrecy underpinning international money laundering and terrorism financing, according to research by advocacy group, Global Witness.

Despite having more than two years to comply, just five of 27 countries had set up publicly available centralized registers of beneficial owners by the January 10 deadline under Europe’s 5th Anti-Money Laundering Directive.

Only Bulgaria, Denmark, Latvia, Luxembourg and Slovenia had established free public registers. Three of these – Denmark, Latvia and Luxembourg – were the subject of recent high-profile money laundering or tax avoidance scandals.

“It would seem that scandals and public pressure have played a useful role in pushing countries to become more transparent more quickly,” the report said.

Although some other countries have set up public registers, they have opted to impose paywalls. The report notes this will likely discourage investigation as complex financial research usually involves requests for multiple documents, which can make this a costly process.

The Global Witness report confines itself to the availability of the information – it does not cover other key elements of the Directive such as the registration of the beneficial ownership of trusts or the quality of the company data provided.

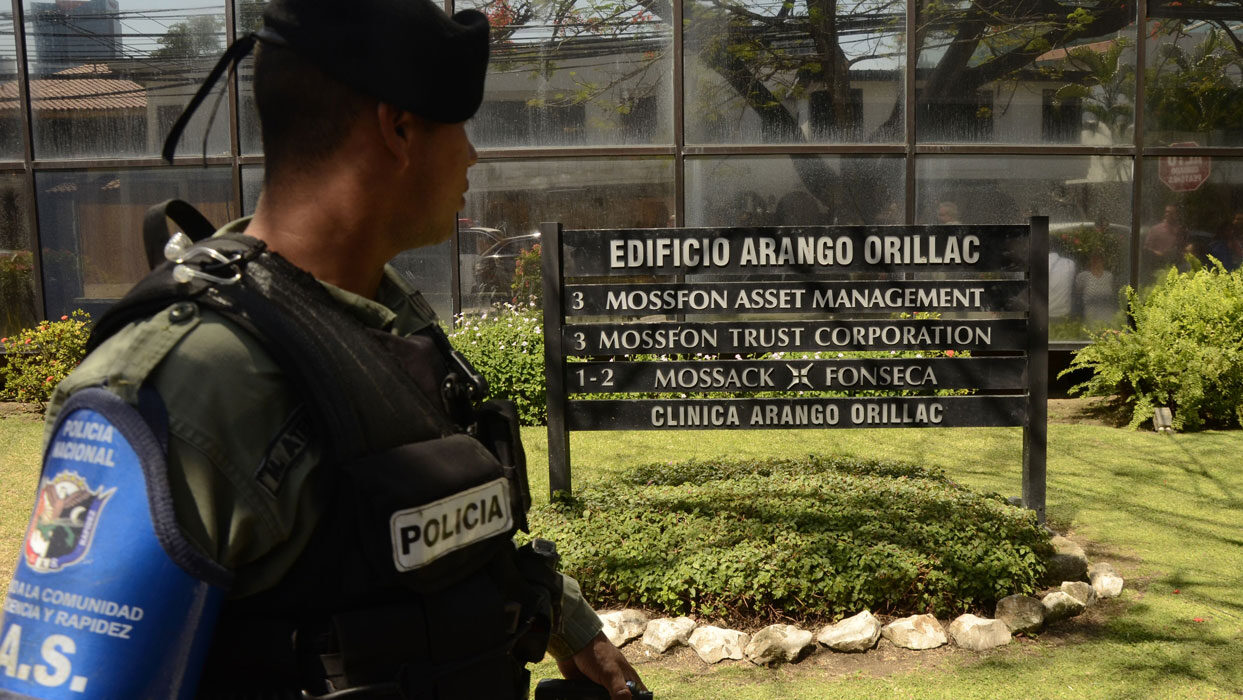

The European Union directives are a response to the 2016 publication of the Panama Papers, an investigation led by the International Consortium of Investigative Journalists, which revealed how certain rich and powerful figures use anonymous corporations to hide their money and evade tax.

Information from the leak, first obtained by ICIJ’s German partner Süddeutsche Zeitung, exposed fraud, corruption, money laundering and other criminality. To date, it has also helped tax officials across the world to recover more than $1.2 billion in fines and back taxes.

ICIJ Senior Reporter Simon Bowers described the widespread lack of compliance detailed in the survey as “disappointing” but said it should come as no surprise.

“Let’s not forget that member states have a poor record when it comes to implementing European Union rules to combat international crime,” Bowers said.