Offshore entities played a key role in a network of companies owned by a rich and powerful shrimp merchant in the African island nation of Madagascar, according to documents from the International Consortium of Investigative Journalists Panama Papers investigation.

ICIJ collaborated with non-profit environmental science and conservation news organization Mongabay to explore emails, contracts and company records that showed how magnate Aziz Ismail moved millions of dollars among offshore companies.

Ismail, a French citizen born in Madagascar, entered Madagascar’s shrimp industry in 1973. His company, Unima, is now managed by his son Amyne Ismail and has subsidiaries around the world.

The company is the largest player in Madagascar’s $75 million shrimp industry, which has been criticized for damaging the environment, on the island nation where three in four people live on less than $1.90 a day.

Aziz Ismail also has owned a British Virgin Islands shell company Ergia Ltd. since 2000, according to files dating from 2000 to 2016 obtained from the law firm Mossack Fonseca.

Ismail became the sole shareholder of Ergia Ltd. in 2001 after setting up the company months earlier. Ismail and his son, Amyne, were directors of Ergia Ltd. The company did business in Madagascar and Monaco, according to documents.

The Panama Papers files include a 2014 contract under which Ismail’s company, Ergia Ltd. agreed to perform one year of administration and management services and “strategic thinking” on the development of Unima Europe, a Monaco company. In exchange, Unima Europe would pay Ergia Ltd. $1.32 million, according to the contract, which was signed by father and son.

It is unclear how Ergia Ltd. in the BVI would provide the consulting services described in the contract. The company appears to have no employees and no independent office, according to a slim financial statement of the company sent via to the law firm Mossack Fonseca to comply with record keeping requirements.

In effect, the Ismails appear to have shuffled the money between two companies they owned, from one country to another.

In a January 2016 email, Unima’s wealth managers asked Mossack Fonseca to transfer the $1.32 million owed to Ergia Ltd. under the consultancy agreement to another Ismail family company in Luxembourg.

Jason Braganza, an economist with nonprofit Tax Justice Network Africa, told ICIJ that if the consultancy agreement related to advice given for operations in Madagascar, “the immediate red flags here are that the companies are reporting revenues generated in Madagascar as being tax liable in BVI and Monaco.”

“This is tax avoidance 101,” he said.

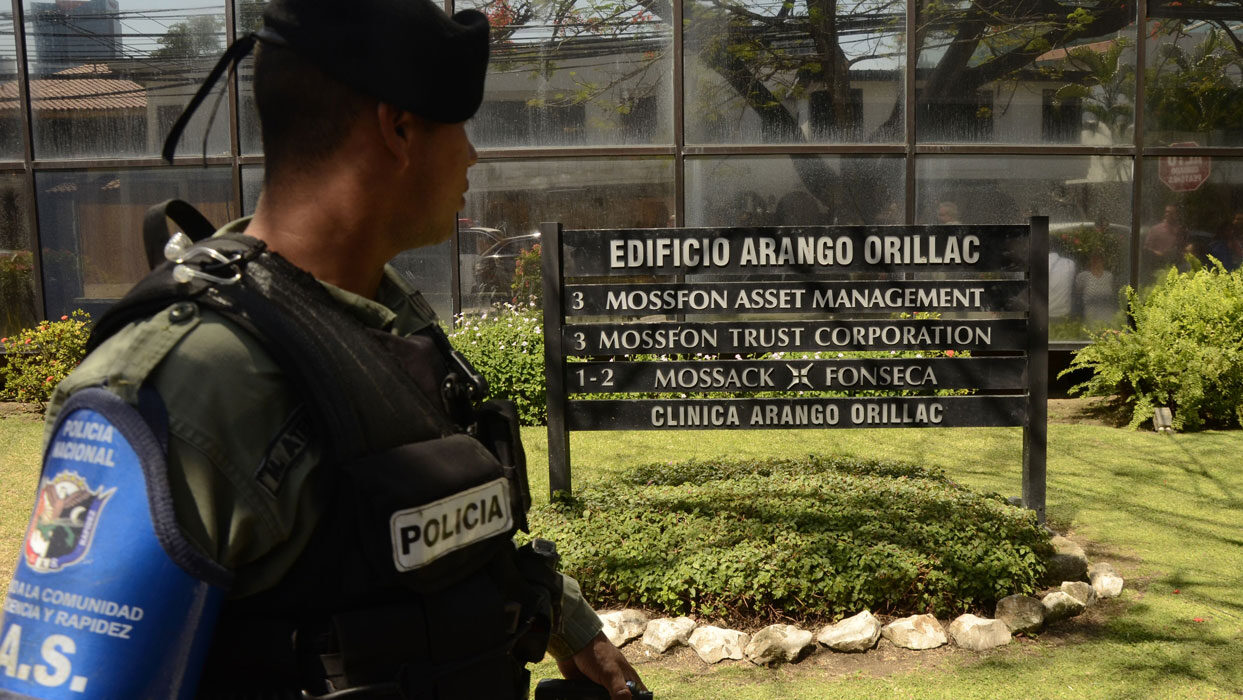

The company produced little paperwork for Mossack Fonseca until 2012 when financial crime regulators in the British Virgin Islands contacted the Panama Papers law firm. The Financial Intelligence Agency did not tell Mossack Fonseca why Ergia Ltd. was under scrutiny. It demanded details on the owner, the company’s activities and its bank accounts, according to a document from the Panama Papers.

Responding to the BVI government’s 2012 request, Mossack Fonseca told regulators that Aziz Ismail owned Ergia Ltd. The law firm provided other information that included confidential financial statements that reveal some of the Unima group’s offshore activities.

At the end of 2010, for example, Ergia Ltd. reported a loss of $7.92 million. The company’s financial statement records no obvious expenses for employees. The documents also show that Ergia Ltd. was owed $7 million by a related company based in another low-tax country, Mauritius.

Tax inspectors from Madagascar and other experts said the use of multiple offshore companies raised the risk of lost taxes for one of the world’s poorest countries.

“In general, the use of two countries with zero tax (the BVI) or low tax (Monaco) is indicative” of an attempt by a group of related companies to pay as little tax as possible on its global activities, said Tovony Randriamanalina, an international tax researcher at Université Paris-Dauphine in France.

“This is exactly how groups avoid taxes in developing countries like Madagascar.”

The Ismails and Unima did not respond to repeated requests for comment, including questions about why government regulators were interested in Ergia Ltd. or why Unima’s Madagascar shrimp export business used offshore companies in the BVI and Mauritius.

Of Indian descent, the extended Ismail family has operated in Madagascar for five generations and is one of the country’s economic titans. Forbes last year ranked one of Ismail’s cousins as among Madagascar’s richest multi-millionaires. Unima’s founder, Aziz Ismail, supported former prime minister Emmanuel Rakotovahiny, according to the regional publication La Lettre de l’Ocean Indien.

Madagascar’s shrimp and prawns are the country’s fifth-most valuable export after vanilla, nickel, cloves and apparel. Every year, Unima sends thousands of tons of wild and cultivated tropical tiger shrimp from trawlers and aquaculture farms to Europe, Japan and the United States. Many of the prized crustaceans make their way to France, where the company’s products were the first from Madagascar to receive the French government’s quality approval.

Environmental scientists and local fishermen have criticized major players in the shrimp industry for depleting Madagascar’s natural resources. Shrimp trawling nets of the kind used by Unima drag along seabed floors in ways scientists have compared to clear-felling old-growth forests, Mongabay previously reported.

When a company profits from techniques that damage the environment and its owners store some of those profits offshore, it can compound the impact on the home country, creating economic losses on top of environmental damage, said Victor Galaz, associate professor at Stockholm University, who recently authored a study on the links between tax havens and environmental degradation in global fisheries.

“If this is part of an aggressive tax planning scheme, it means loss of revenues for the country where the actual economic activities are taking place,” Galaz told Mongabay and ICIJ after reading about the Unima and Ergia Ltd. transactions.