REAL ESTATE

London property tied to Putin ally remains untouched by sanctions

Despite reforms to root out oligarchs who own U.K. real estate, the country has repeatedly overlooked Kremlin-linked assets hidden in plain sight.

A multimillion-dollar London property tied to a high-ranking Russian official was not frozen after the United Kingdom sanctioned him, ICIJ found, as the country struggles with patchy sanctions enforcement.

Since Russia invaded Ukraine in 2022, the U.K. has repeatedly failed to freeze Kremlin-linked funds and assets hidden in plain sight, including the property purchased by an offshore shell company previously controlled by Igor Komarov, an ally of Russian President Vladimir Putin.

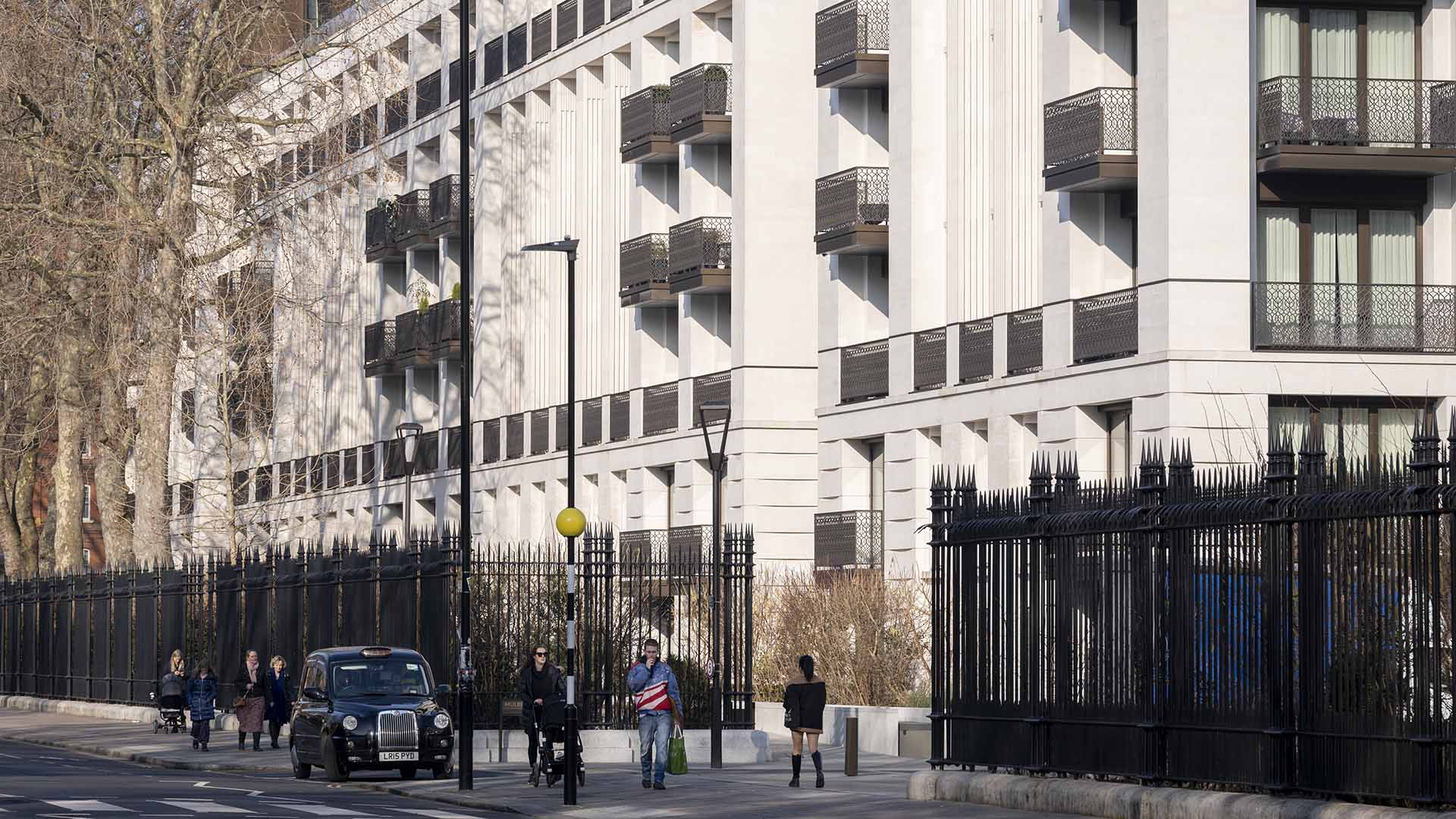

Leaked documents ICIJ obtained as part of the 2021 Pandora Papers investigation, plus U.K. Land Registry documents, reveal the British Virgin Islands-based company, now controlled by a trust, still owns the five-floor, red-brick townhouse on Herbert Crescent, a prime location in central London. The building was purchased for more than $16.5 million in 2007.

At that time there was nothing illegal about the transaction, as Komarov was not sanctioned by the U.K. until 2022. He has also been sanctioned by the U.S., Canada and other countries allied with Ukraine.

Transparency International UK, an anti-corruption advocacy group, warned in late 2023 that the government was failing to trace the U.K. assets of sanctioned people and companies, identifying 33 properties that should have been frozen but remained free from restrictions. The advocacy group attributed authorities’ weak enforcement of financial crimes, including sanctions evasion, to understaffing, lack of resources and gaps in the law.

Komarov, who did not reply to requests for comment, is the former director of Roscosmos, Russia’s national space corporation, which has aided Russia’s Ministry of Defense in launching military satellites since the war in Ukraine began. It has also worked with the Russian army to recruit, fund and equip a militia to fight Ukrainian forces, according to the Financial Times.

Komarov spent years climbing the Kremlin ladder. He now serves on Russia’s Security Council, which is headed by Putin and composed of staunch regime loyalists. It is one of the most important organizations in the Kremlin’s power structure. The deputy leader of the council, ex-president Dmitry Medvedev, has issued multiple threats — including nuclear war — against the U.K. and NATO allies amid the ongoing war.

In its sanctions announcement, the U.K. said that as a member of Russia’s Security Council Komarov was “responsible for, engaged in, provided support for or promoted policies or actions, which destabilise Ukraine and undermine or threaten the territorial integrity, sovereignty or independence of Ukraine.”

‘Government must close this loophole’

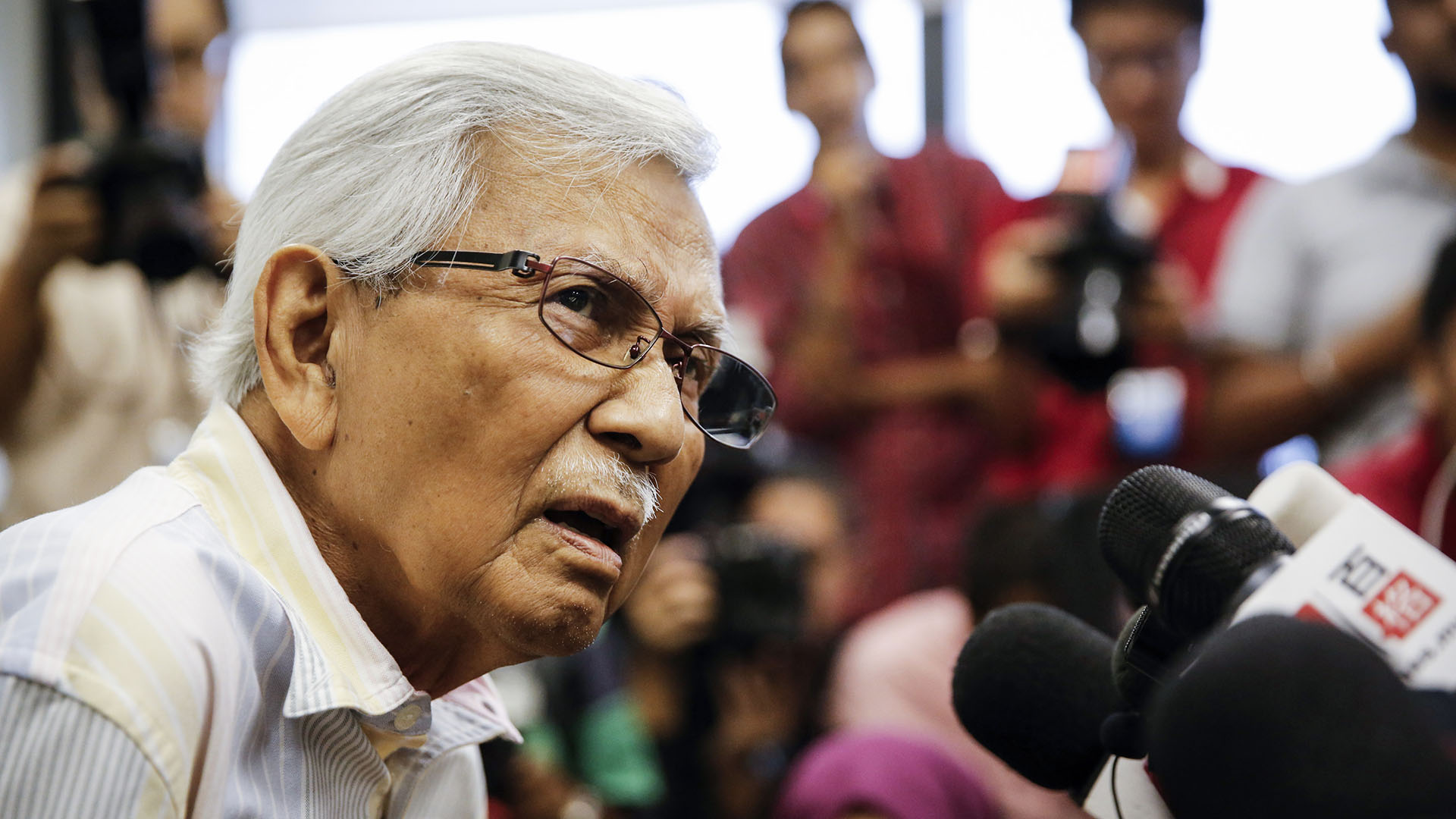

ICIJ has previously uncovered U.K. properties hidden under layers of corporate secrecy by controversial international tycoons, such as a top Ukrainian industrialist and Malaysia’s former finance minister, who is currently the subject of a high-profile anti-corruption probe.

Typically, the U.K. Treasury annotates the public deed, known as the title, of each property that is frozen due to sanctions in order to prevent its sale.

After U.K. and EU sanctions were imposed on Russian billionaire and former Chelsea Football Club owner Roman Abramovich, the Treasury noted the sanctions on the public title register of one of the oligarch’s properties, warning that it must not be sold while he remained “designated,” that is, under sanctions. “This restriction has been entered pursuant to the designation of Roman Abramovich as an asset freeze target listed on the Consolidated List of Financial Sanctions Targets in the UK maintained by [His Majesty’s] Treasury,” the document reads. But no such addition was made to the deed for the property on Herbert Crescent.

The official owner of that house, according to the deed, is the same BVI company named in the Pandora Papers: Wastom Holdings Ltd. A loan offer from a Swiss bank in late 2010 shows that Wastom took out a $5.2 million mortgage secured against the Herbert Crescent property, with Komarov acting as guarantor. The bank has since been taken over by another lender.

The Treasury; Companies House, the U.K.’s corporate registry; and the Land Registry did not reply to requests for comment or declined to comment on the record.

Meanwhile, Komarov’s daughter, Maria Komarova, has an apartment in the nearby Belgravia district of London that was valued at more than $6 million in 2013, according to Russian investigative journalism website iStories, which previously linked Komarov to the Herbert Crescent property. Komarova is a fashion designer based in London, according to The Times, which highlighted the multimillion-dollar U.K. property portfolios of the children of some of Russia’s most powerful officials. Komarova is not under sanctions.

The U.K.’s Register of Overseas Entities, launched as part of a slate of 2022 reforms meant to expose oligarchs and kleptocrats who own properties through shell companies, includes Wastom’s declaration of its property ownership. But the company’s registered beneficial owner is New Zealand Trust Corp. Ltd., not Komarov. Leaked Panama Papers documents show Wastom was a client of Cone Marshall, a New Zealand corporate services provider affiliated with the same trustee company.

Information about trust beneficiaries is not disclosed publicly on the ROE, which transparency advocates and opposition lawmakers have argued is a critical blindspot in the register. The government has said it is considering measures to close the loophole.

“It is shocking that Kremlin cronies can still dodge sanctions by hiding behind trusts and shell companies,” Margaret Hodge, a Labour MP and prominent anti-corruption campaigner, told ICIJ.

“Government must close this loophole for good so we can follow the money and know who really owns properties here in the U.K.”

New regulations, old problems

The missing freezing order on the Herbert Crescent deed was first noted by Ben Cowdock, senior investigator at Transparency International UK.

“[The] Government should remember they cannot sanction what they can’t see, which makes closing loopholes in the law vitally important,” he told ICIJ via email.

“Lifting the veil of offshore secrecy helps ensure the UK sanctions regime has teeth whilst enabling a crackdown on illicit wealth invested in real estate here.”

The use of secretive legal structures, such as trusts, has undermined the transparency efforts that the U.K. government calls world-leading, according to academics at the London School of Economics and elsewhere.

[The] Government should remember they cannot sanction what they can’t see.

— Ben Cowdock, senior investigator at Transparency International UK

In a paper published in September 2023, the researchers estimated that more than two-thirds of 152,000 U.K. properties held by overseas shell companies did not publicly disclose their real owners, despite the ROE. However, 87% of the cases where beneficial ownership information was missing or obscured fell within the bounds of the law, the researchers found.

“The Government should close this route for avoidance by enabling public access to information on those behind trusts holding UK property,” Cowdock said. “Being able to follow the money is an important factor in making sanctions effective, especially when those designated [with sanctions] often share their wealth among family, friends and associates.”