Politicians and leaders whose secret dealings are revealed in the Pandora Papers are facing increasing criticism and scrutiny, and more governments around the world are pledging investigations in the wake of the biggest-ever offshore leak.

Since Sunday, when the International Consortium of Investigative Journalists and other media partners began releasing the first stories, enforcement agencies or leaders in India, Spain, Ireland, Mexico, Germany, Pakistan, Bulgaria, Australia, Brazil, Sri Lanka, Paraguay and Panama have vowed to take action.

The Pandora Papers is the largest-ever leak of records from tax havens and the largest journalistic collaboration. The investigation reveals the secret deals and hidden assets of more than 330 politicians and high-level public officials in more than 90 countries and territories, including 35 country leaders.

Leaders identified in the leak have been on the defensive.

Chilean President Sebastián Piñera, one of the three current Latin American heads of state linked to the Pandora Papers, held a press conference on Monday at his presidential palace to address reporting on a controversial business deal exposed by the investigation. He denied conflicts of interest and said the information was already public.

In Malaysia, opposition leader Anwar Ibrahim Monday submitted an emergency motion to the lower house of parliament requesting the House to debate Pandora Papers revelations, which include details on the offshore financial assets and business associates of former finance minister Daim Zainuddin, according to ICIJ partner Malaysiakini.

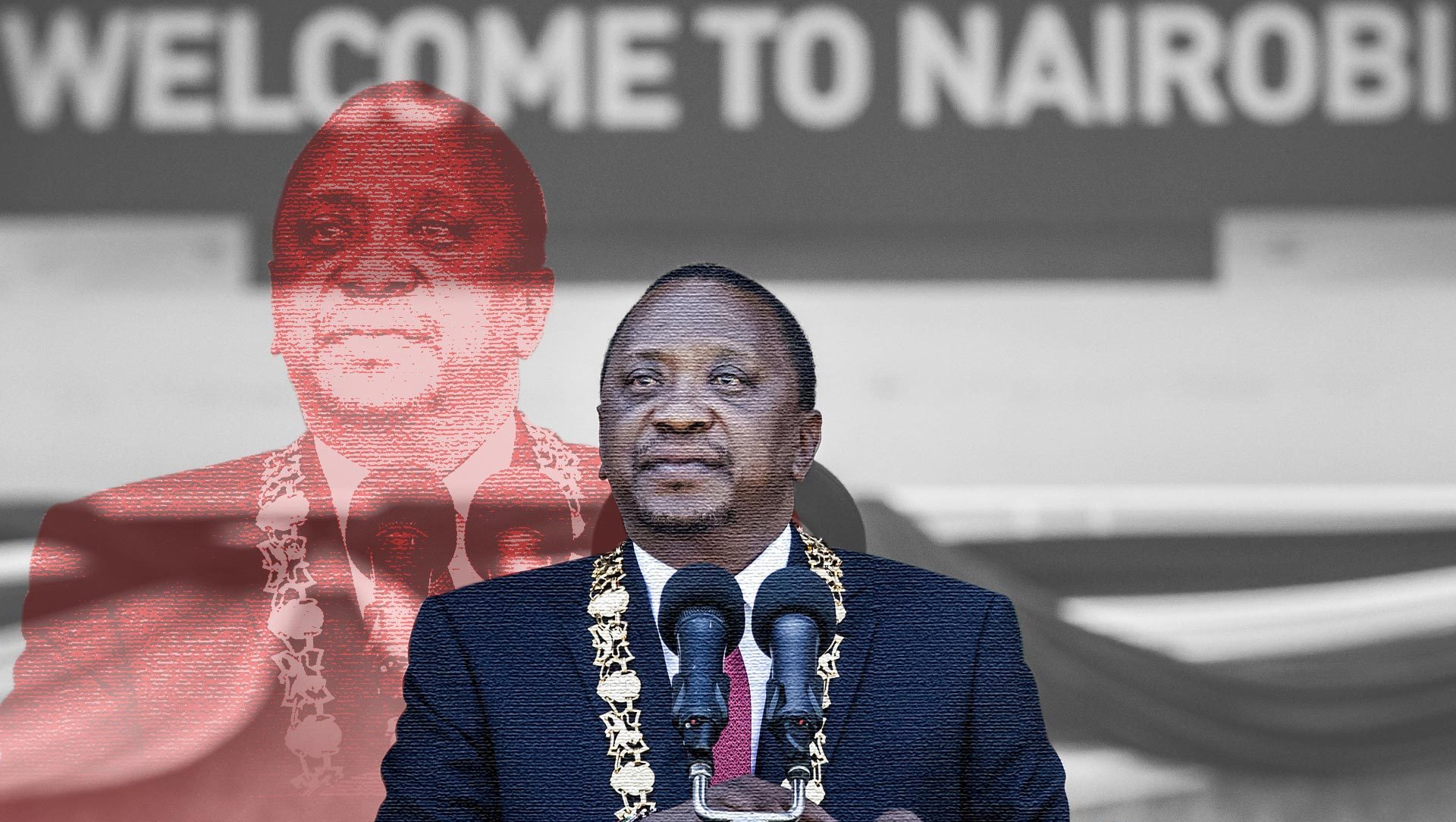

In a statement, Kenyan President Uhuru Kenyatta said he will address the Pandora Papers revelations after returning from an overseas visit.

“That these reports will go a long way in enhancing the financial transparency and openness that we require in Kenya and around the globe,” Kenyatta said. Kenyatta and his family did not respond to more than a dozen emails, phone calls and WhatsApp messages before publication of the Pandora Papers investigation, which revealed his family’s extensive offshore holdings.

In Paraguay, former president Horacio Cartes amended his public disclosure forms to add an offshore company he owned but didn’t declare during his presidency following questions from ICIJ’s partners ABC Color.

Among the many officials who have commented on the investigation is European Commission President Ursula von der Leyen, who condemned the practices exposed in the Pandora Papers and said that the EU must do more to combat tax evasion and aggressive tax planning.

Speaking at an event Monday in Finland, von der Leyen said that “tax evasion and aggressive tax planning is completely unacceptable.”

“We have in the European Union some of the highest tax transparency standards in the world, but as we see it’s not enough, more work is needed,” she said.

In Germany, the finance minister of Hessen, the state that previously analyzed the Panama Papers documents, said its team is ready to examine the Pandora Papers records.

“If the Pandora Papers contain evidence of tax crimes, we will pursue them consistently,” the state’s finance minister, Michael Boddenberg, said.

U.S. President Joe Biden’s press secretary told reporters that the White House has read Pandora Papers reporting and that the President is committed to enhancing the U.S.’s fight against financial crime.

Also on Monday, India’s finance ministry announced it will investigate the Indian names exposed in the leak and take “appropriate action.” It also said that, as of last month, Indian authorities had identified $2.7 billion in undisclosed assets following ICIJ’s Panama Papers and Paradise Papers investigations.

The ministry said that “leaks appearing in the media under the name ‘PANDORA PAPERS’ will be monitored” by a multi-agency taskforce that includes the country’s Financial Intelligence Unit, which monitors financial crime.

Hours after Pandora Papers published, Dutch financial authorities said they will examine the Pandora Papers findings “to assess the tax consequences for parties based in the Netherlands,” according to a statement released to the press. Dutch opposition lawmakers urged finance minister Wopke Hoekstra to respond to questions about his offshore dealings exposed by the publications Trouw, the FD and Investico.

“It is of course no surprise that the elite operate like this,” said Lilian Marijnissen, a politician with the Dutch Socialist Party. “But the fact that the Minister of Finance is dealing with this in this way makes you think about how credible this minister can still be in tackling tax avoidance.”

Ireland’s deputy prime minister said that the government will close any tax or company law loopholes that allow people or companies to use the country as a tax haven.

Ireland has been one of the world’s foremost tax havens for multinational companies. “It would appear on the face of it that some of the arrangements that may be routed to Ireland are very dubious,” Irish Deputy Prime Minister Leo Varadkar said Monday. “We certainly don’t want to be part of any supply chain that people use to conceal their assets. There is nothing in that for us, we don’t want any part of it.”

Montenergean Vice Prime Minister Dritan Abazovic, said that police are prepared to conduct an investigation into alleged illegal activities of Montenegro President Milo Djukanovic and his son, Blazo. Prime Minister Zdravko Krivokapic posted on Twitter that he is calling prosecutors to react and question findings on Djunakovic.

On Monday, a pro-Kremlin media activist announced that he is formally requesting that ICIJ be designated an “undesirable” organization in Russia, a move that would effectively prevent Russian groups from taking part in ICIJ’s collaborations.

If such a move was successful, it would become a criminal offense to work with ICIJ within Russia, and make it illegal to even share links to ICIJ’s website. The move followed ICIJ and its partners’ publication of offshore holdings and connections of key figures in Russian President Vladimir Putin’s inner circle.

More Pandora Papers stories by ICIJ and its partners will be coming out this week and beyond.