How do tax havens work? Who benefits from using them? And who loses out?

ICIJ and its partners tackle these questions in our investigative reporting, and now the Pulitzer Center on Crisis Reporting is taking these questions into classrooms to help students understand the murky world of offshore finance.

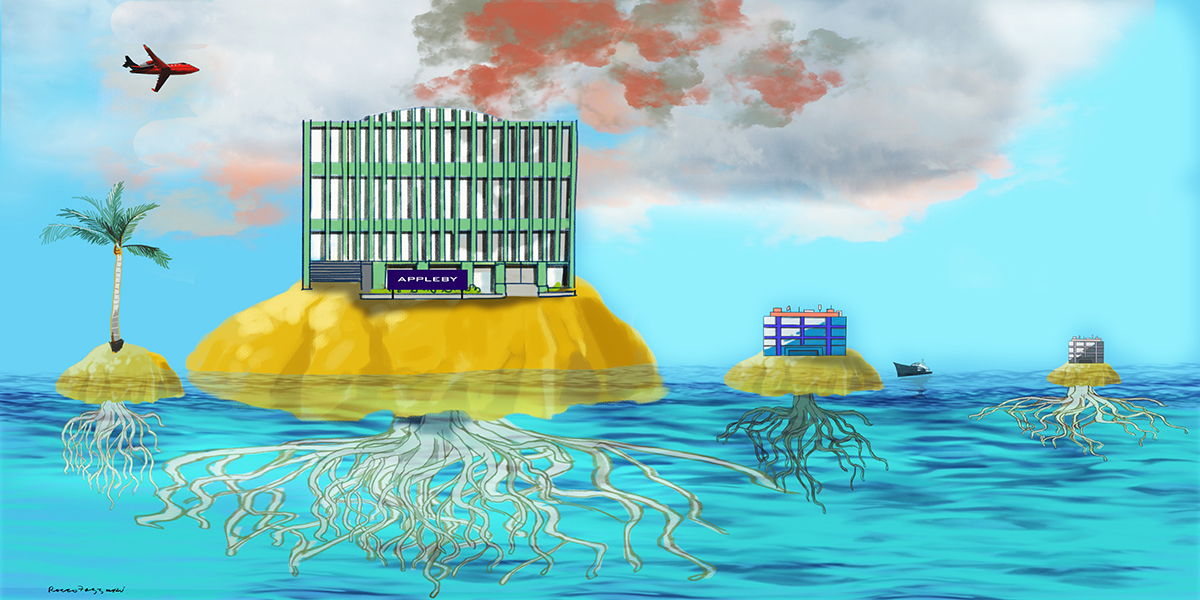

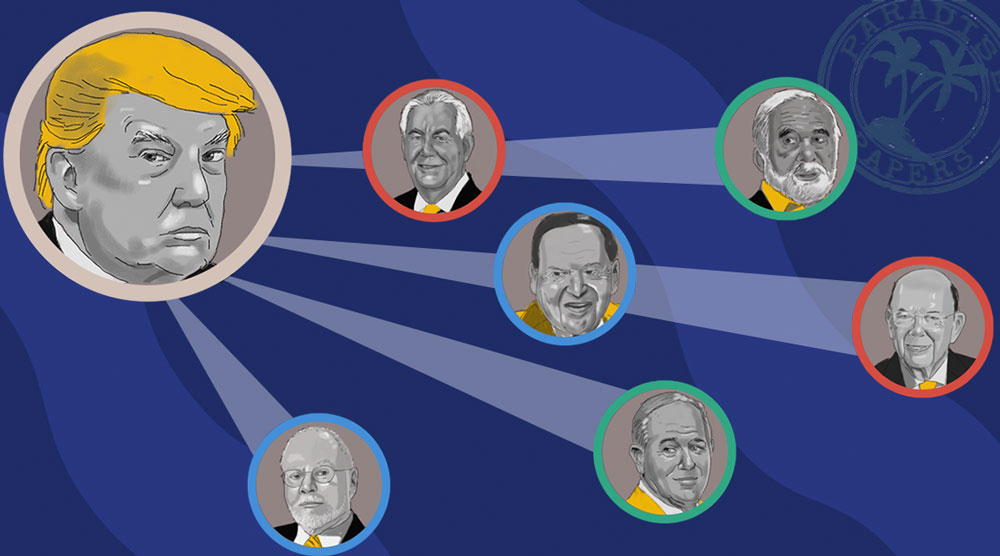

The Pulitzer Center supported two features of ICIJ’s latest project, the Paradise Papers. The Influencers interactive revealed the close associates of United States President Donald Trump who use offshore finance, and the Snax Haven video explained how the tactics used by multinational companies to avoid tax.

These two features along with numerous ICIJ stories form the backbone of two lesson plans built by the Center and made available to school teachers.

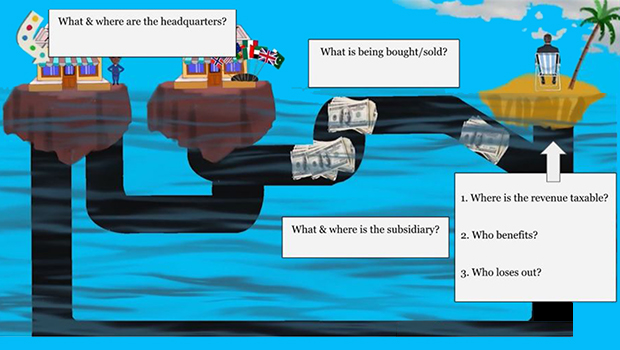

The first lesson plan takes a step back to look at the broader issue of tax avoidance through offshore structures. It asks students what would they do if they could be completely anonymous, and why might wealthy businesspeople seek out this sort of anonymity?

The lesson goes on to show some of the schemes multinational corporations use to slash their tax bills, and looks at who loses out when profits are funneled into tax havens. It also asks questions about some of the powerful individuals with links to offshore companies, and why it matters that important decision makers might have an interest in the offshore financial system.

The second lesson plan goes behind the scenes of the Paradise Papersinvestigation to focus on investigative journalism, and how reporters go about gathering information, building a story and, ultimately, how they tell that story to their audience.

Both lesson plans are available for free via the Pulitzer Center’s website, along with lesson plans from previous ICIJ investigations the Panama Papers and Fatal Extraction.