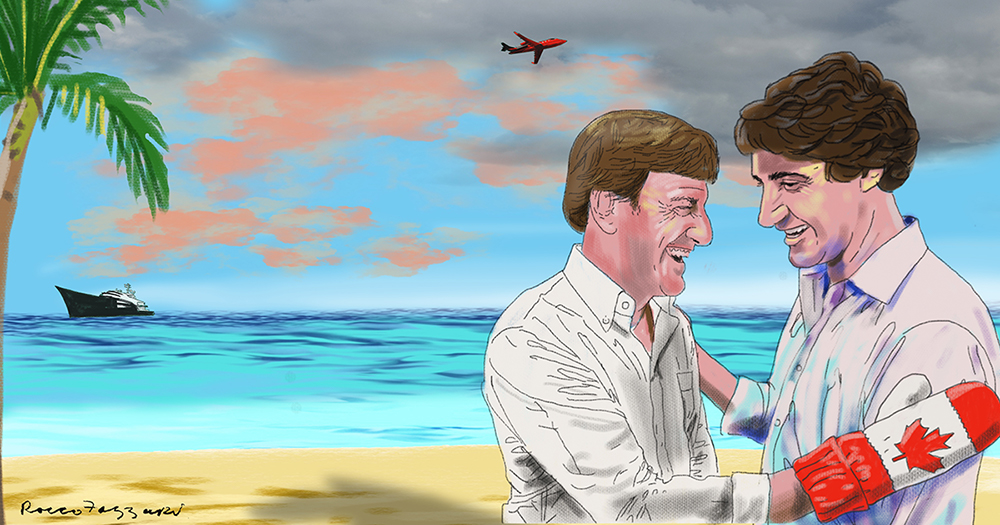

Canadian Liberal Party fundraiser Stephen Bronfman’s connection to companies that were owed millions by an offshore trust lasted into the mid-2000s, new documents uncovered by ICIJ’s Canadian partner reveal, despite Bronfman’s claim his involvement ended years earlier.

The Paradise Papers revealed that, as Justin Trudeau campaigned to become Canada’s prime minister on a platform of economic and tax fairness, his chief fundraiser Bronfman quietly helped move millions of dollars offshore, using his family’s private investment company Claridge.

In a statement issued after the Paradise Papers revelations were first published, Bronfman said his only connection to the offshore trust in question ended in 1998.

Trudeau then told reporters he was “satisfied” with Bronfman’s response and that “all rules were followed”

However, new documents uncovered by journalists at the CBC show Bronfman’s link to the trust appears to have lasted until 2005.

According to the CBC:

Newly discovered documents from corporate registries, the Securities and Exchange Commission in the United States and the Paradise Papers database show that Bronfman was a key “member/shareholder” of Claridge Israel LLC— a Delaware company that was owed more than $8 million by the Kolber Trust.

One Paradise Papers document shows that as late as 2005, the “borrower” — the Kolber Trust — still owed Claridge Israel more than $7 million.

The Kolber Trust was set up in the Cayman Islands in 1991 by Leo Kolber, a long-time business associate of the Bronfman family and major fundraiser for the Liberal Party.

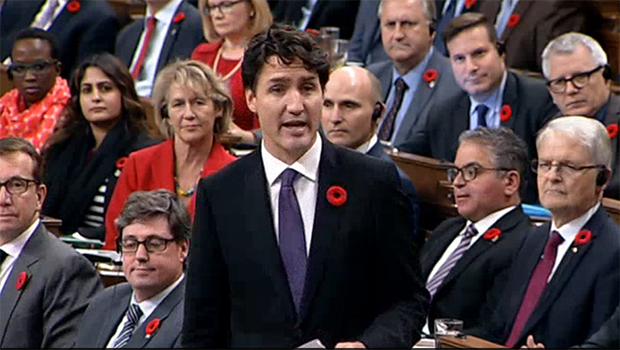

The latest revelations, first published last week, came as the issue continued to dominate question time in Canadian Parliament, and as Trudeau gave a speech calling on top earners and business leaders to take responsibility for rising income disparity in Canada.

Caron: did the PM mislead the House or did Stephen Bronfman lie? Lebouthillier: CRA is undertaking almost 1000 audits, and are working on tax system for all Canadians #hw

— CBC Politics (@CBCPolitics) November 23, 2017

Trudeau said the government had committed nearly 1 billion Canadian dollars ($787 million) to fighting tax evasion and aggressive tax avoidance, the Canadian Press reported.

“There are people in Canada who are so wealthy that not only do they think they don’t need to pay their fair share of taxes, they’re forcing us to spend a billion dollars to go after them just so they’ll do the right thing and pay what they owe,” Trudeau said.