A Swiss court has confirmed ongoing criminal investigations into the businesses of Dan Gertler, an Israeli diamond dealer suspected of large-scale corruption in the Democratic Republic of the Congo (DRC).

Switzerland’s Federal Criminal Court released on Friday a 13-page judgment that details how the United States has sought information, including banking records, about Gertler’s business since 2012.

Gertler’s companies appealed a Swiss decision to provide information to the United States. The court rejected the appeal and published its decision.

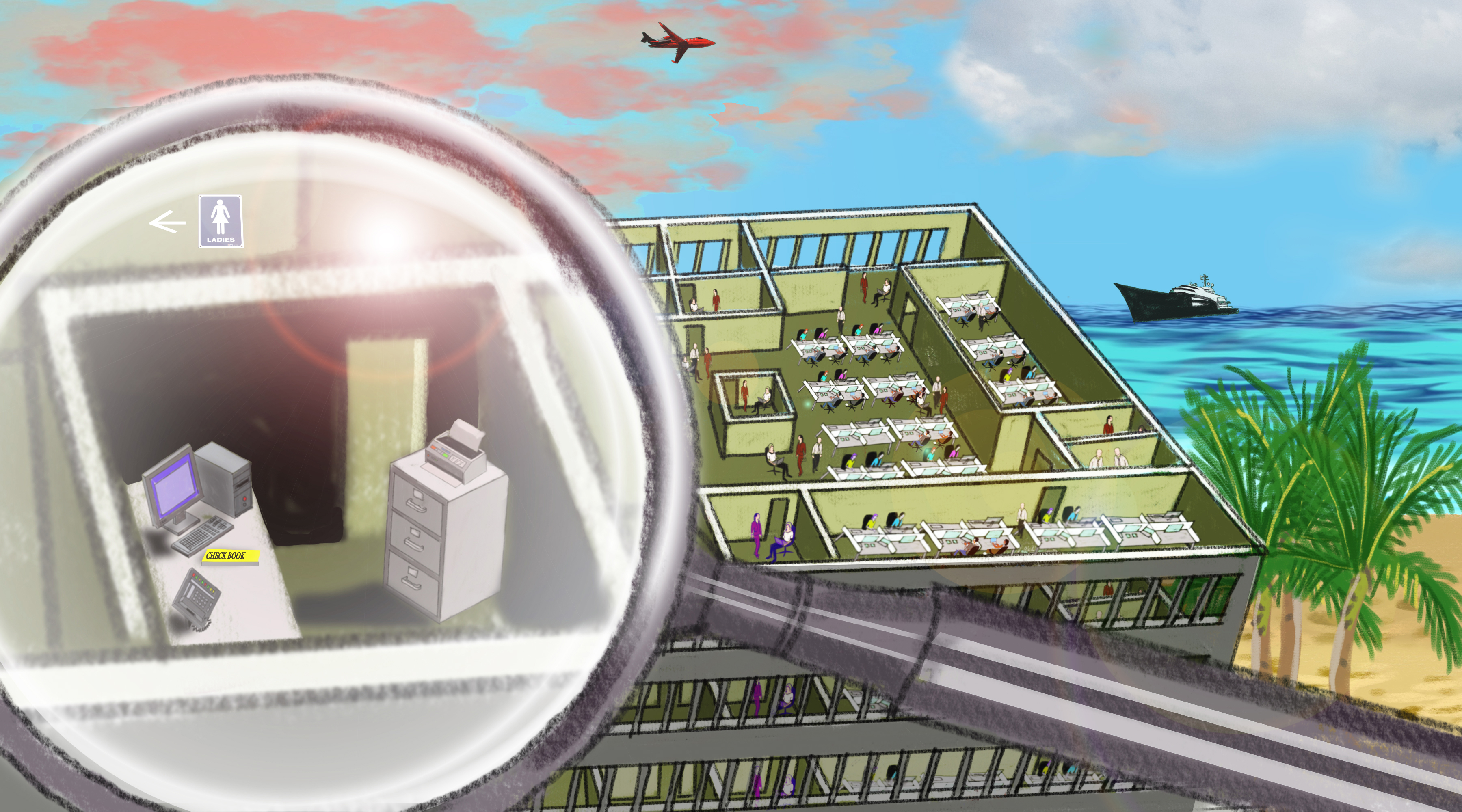

U.S. authorities claim to have evidence that shows bribes paid to high-level DRC officials in exchange for mining rights and government benefits, according to the judgment. The bribes involved cash and in-kind bribes such as luxury items and “extravagant personal holidays” given to at least three officials, who were not identified in keeping with Swiss legal practices.

A Gertler lawyer representing the companies that appealed the decision confirmed to ICIJ’s media partner, Tages Anzeiger, that the United States has made three requests for information. Britain’s Serious Fraud Office has also sought information, the lawyer added.

“The Americans will not find any illegal activity committed by Mr. Gertler,” said his lawyer, Marc Bonnant. Gertler has repeatedly denied wrongdoing.

The decision reveals a long-standing back-and-forth between U.S. and Swiss authorities that first began with an American request for information in December 2012. Requests continued until May 2017 when Swiss authorities granted the United States access to bank information that spans October 2010 to April 2016.

Swiss authorities confirmed to Tages Anzeiger that U.S. authorities requested information concerning Gertler and others. The authorities have already provided some evidence to the U.S., authorities said.

Paradise Papers connection

In November, ICIJ and media partners reported on leaked files from the offshore law firm Appleby that revealed how Gertler had helped secure lucrative mining rights for a company now owned by the world’s largest commodities trader, Glencore.

In December, the U.S. Department of Treasury sanctioned Gertler and more than a dozen companies for “hundreds of millions of dollars’ worth of opaque and corrupt mining and oil deals” in the DRC.

Glencore’s chairman told ICIJ media partners during the company’s 2017 annual meeting that its background checks on Gertler were “extensive and thorough.”

In response to earlier questions from ICIJ, Glencore said that the price for the mining licenses was agreed to before Gertler entered the negotiations and that a $45 million loan to the company controlled by Gertler while he helped Glencore strike a deal for the mine with DRC officials was “made on commercial terms” with standard provisions in place.