The masterminds who promote and sell tax avoidance schemes are under fresh scrutiny after European finance ministers decided on Mar. 13 to impose tough new rules in the wake of the Paradise Papers and the Panama Papers investigations.

The rules will require tax advisers, accountants and lawyers – also known as intermediaries or promoters – to report in advance schemes that may be used by companies or individuals to avoid taxes.

Intermediaries will also be required to report any structure that may disguise the true owner of an offshore company.

Tax avoidance and evasion is a global problem that requires co-ordinated rules and collaborative action

European countries will share details of the schemes through a database and penalize intermediaries who do not comply, the European Commission announced. The first details will be shared among tax administrations in July 2020.

The rules emerged from a consultation launched last December by the Organization for Economic Cooperation and Development (OECD).

“The Panama Papers and the Paradise Papers have focused the public’s attention on the global reach of the tax planning industry,” John Peterson, the head of the OECD’s aggressive tax planning unit, told ICIJ.

“These leaks make it obvious to everyone that tax avoidance and evasion is a global problem that requires co-ordinated rules and collaborative action,” Peterson said.

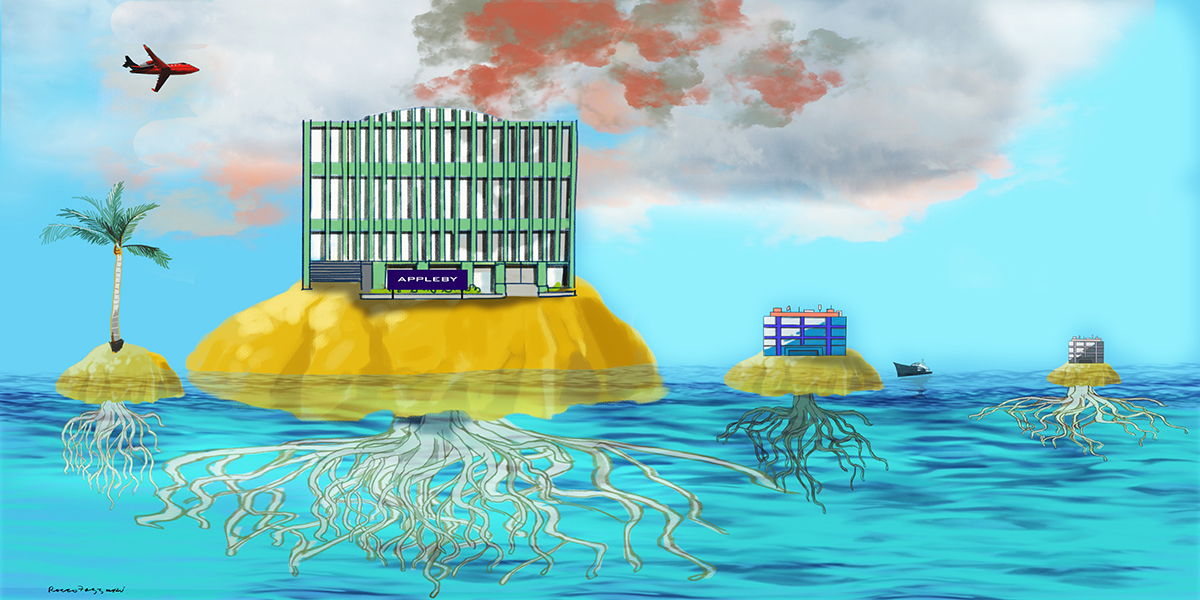

The rules’ targets include offshore law firms such as Mossack Fonseca and Bermuda-based Appleby, the companies whose client files contained information revealed in the Panama Papers and the Paradise Papers.

Other intermediaries covered by the rules would include wealth managers and private bankers as well as accounting firms such as KPMG, PricewaterhouseCoopers, Deloitte and EY, whose tax advice to oligarchs and multinational corporations including Apple and Nike sparked furor and official probes across Europe after last November’s Paradise Papers revelations.

“The way the offshore advisory industry operates (as evidenced in the Panama and Paradise Papers) means that our rules needed to target, not only the promoters, but also the local advisers and other service providers that play a key role in the global supply chain for these type of arrangements,” said Peterson.

“The world has changed,” Peterson said.