Nov 05, 2024

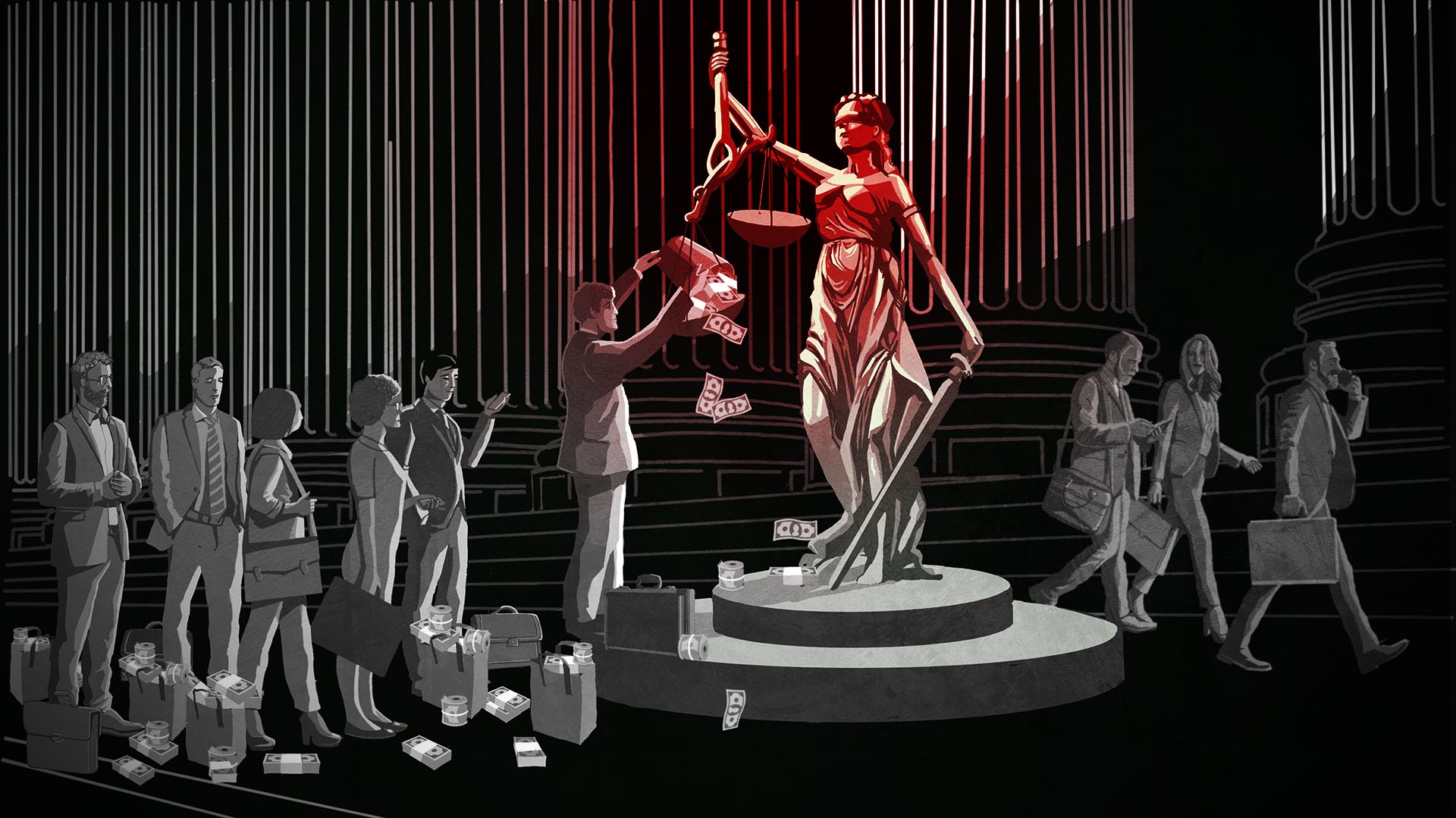

Ten years on, ‘Lux Leaks’ remains a byword for corporate tax chicanery

In November 2014, ICIJ and dozens of media partners published a groundbreaking exposé of corporate tax avoidance in the heart of Europe. A decade later, the impacts are still being felt.