partner stories

An oligarch’s chef-turned-personal assistant, a Moroccan casino mystery, and more Cyprus Confidential stories from ICIJ’s partners

More than 270 journalists around the world collaborated on ICIJ’s latest investigation — here’s some of what they found in a trove of millions of leaked documents.

A new investigation by the International Consortium of Investigative Journalists, Paper Trail Media and nearly 70 media partners around the world exposed how Cypriot firms enabled Russian elites to move money and shield their wealth — even as sanctions came down against them in the wake of Russia’s 2022 Ukraine invasion.

The collaboration, which included over 270 journalists from 54 countries and one territory around the world, parsed through a 3.6 million document leak to uncover groundbreaking stories about major players on the world stage: Putin allies like Roman Abramovich, multinationals like global accounting firm PwC and policy heavyweights like the European Central Bank.

But in the cache of data, our partners found other characters as well. Here are a few stories you may have missed from Cyprus Confidential.

The 3.6 million leaked files at the heart of the Cyprus Confidential investigation come from six financial services providers and a website company.

The providers are: ConnectedSky, Cypcodirect, DJC Accountants, Kallias & Associates, MeritKapital, and MeritServus in Cyprus. The MeritServus and MeritKapital records were obtained by Distributed Denial of Secrets. Leaked records from Cypcodirect, ConnectedSky and i-Cyprus were obtained by Paper Trail Media. In the case of Kallias & Associates, the documents were obtained from Distributed Denial of Secrets, which shared them with Paper Trail Media and ICIJ. DJC Accountants’ records were obtained by Distributed Denial of Secrets and shared by the Organized Crime and Corruption Reporting Project. The partner organizations shared all the leaked records in the project with ICIJ, which structured, stored and translated them from several languages before sharing them with journalists from around the world. Additional records came from Latvia-based Dataset SIA, which maintains the i-Cyprus website, through which it sells information about Cyprus companies, including Cyprus corporate registry documents.

Abramovich’s cook-turned-personal assistant

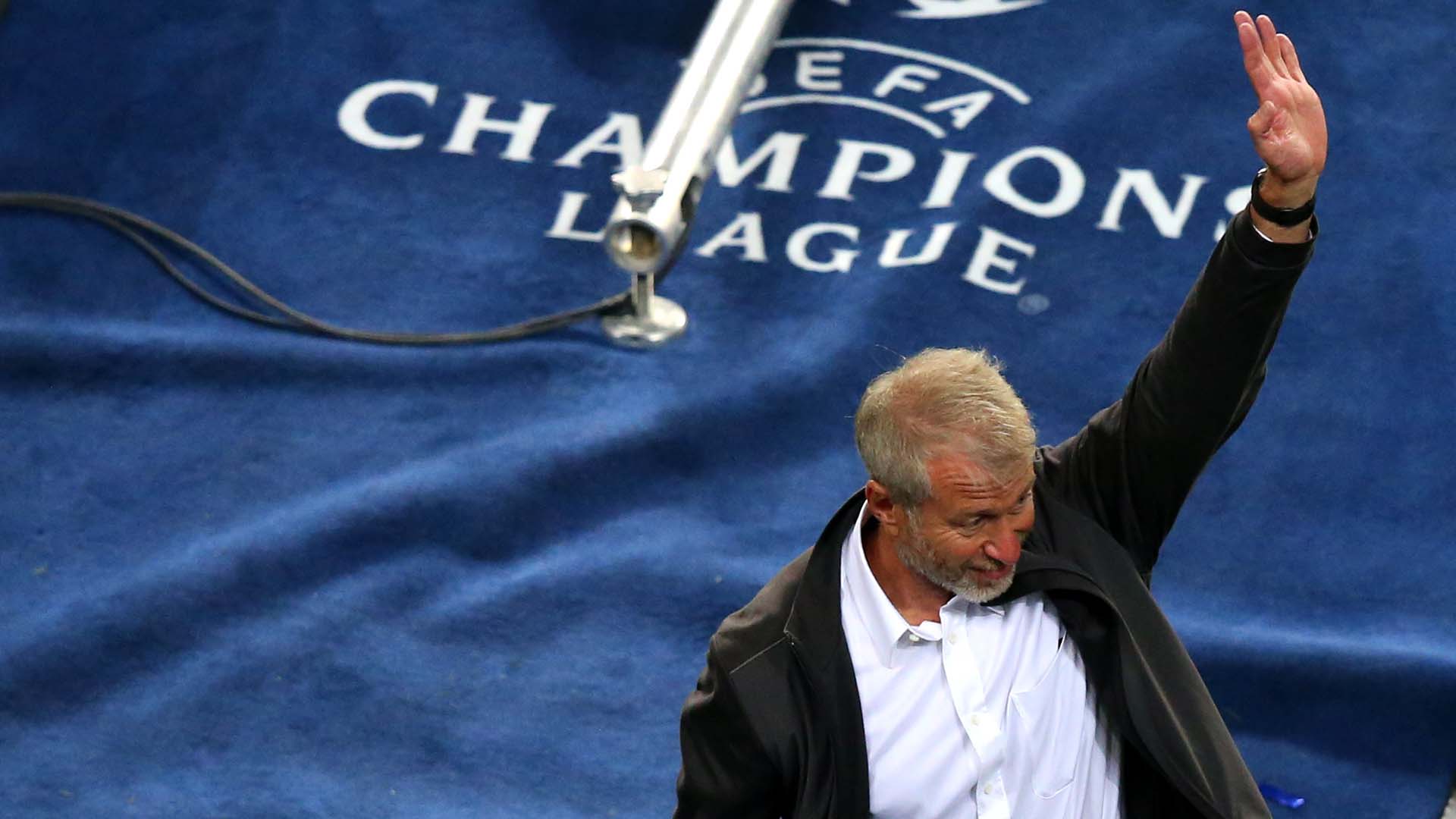

The financial networks revealed in the Cyprus Confidential investigation shed new light on Russian billionaire Roman Abramovich’s close relationship with his former personal chef, reporting from German partner Der Standard reveals.

Cyprus Confidential uncovered how the oligarch, who rose to Russian President Vladimir Putin’s inner circle through Russia’s oil and steel sector — and to Western fame with his purchase of the Chelsea Football Club — relied on Cypriot financial services providers to help move billions into European economies and make secret payments that may have breached professional football’s strict financial fair play rules.

The unnamed subject of Der Standard’s story is a 51-year-old Austrian who worked his way up through the elite food industry and into Abramovich’s high esteem through an award-winning restaurant in the early ’90s. After a turn with a star chef in London, he was then hired by Abramovich at the age of 25 in 1997, Der Standard reports.

Cyprus Confidential’s data cache shows that while he initially came into Abramovich’s circles as a personal chef, he’s since taken on a more intimate role — more akin to a project manager or personal assistant. He pops up as a “protector” in two trust structures of which Abramovich was a beneficiary, according to Der Standard, and currently serves as a representative for a company that manages one of Abramovich’s Caribbean properties.

The former chef’s lawyer told Der Standard that his client lent Abramovich a hand in real estate, sometimes viewing properties. As a non-public figure, the former chef remains anonymous. But Der Standard reports those who recognize him know he was a regular face in Abramovich’s football box. He even testified on Abramovich’s behalf in a 2011 civil case in London.

“I have seen incredible places and had fantastic trips with Mr. Abramovich,” the former chef testified, according to Der Standard. When asked on the witness stand if he had Abramovich’s trust, he replied: “I hope so.”

Secretive investments in the ‘Anne Frank’ film

Cyprus Confidential also shone a light on secretive investments Abramovich made into the Belgian animated film “Where is Anne Frank,” Luxembourg partner Reporter.lu reports.

The movie, which took eight years to produce and debuted at the Cannes Film Festival in 2021, tells the story of Anne Frank by animating Kitty, the imaginary friend to whom she penned her diary.

With a budget equivalent to more than $22 million, the film was one of Luxembourg’s most expensive co-productions. Over $2 million came from Film Fund Luxembourg, a government-funded body that supports the film industry. Cyprus Confidential documents show that more than $3.9 million silently came from Abramovich, Reporter.lu reports.

According to Reporter.lu, Abramovich funneled the money through offshore structures with the help of a financial services provider in the coastal city of Limassol, Cyprus. Documents show how his company promised funding on the condition that the agreement be kept secret, that Abramovich be permitted to visit the studios at any time, and that the producer grant his representatives access to the director and other artists.

The reason for the secretive nature of the funding remains a mystery. But Abramovich, Reporter.lu reports, is no stranger to the film industry. His Kinoprime Foundation in Moscow supports filmmakers, and his name appears as co-producer in the credits of Roman Polanski’s 2019 “J’accuse.”

Questionable tax practices at two Moroccan casinos

In the early 2000s, an Israeli company decided to invest in casinos in Morocco, before the two countries normalized relations in 2020. Cyprus Confidential documents show how shell companies were set up in Cyprus and elsewhere to facilitate the business dealings — and the strange conflict that followed, according to Moroccan partner Le Desk.

In July 2004, the director of an Israeli holding company dedicated to residential and hotel real estate, the Red Sea Group, reached out to Demetris Ioannides, a financial fixer in Cyprus, Le Desk reported. Now sanctioned for his close ties to Russian oligarchs, Ioaniddes founded the financial services firm Meritservus and, at one point, headed the Cypriot arm of Deloitte.

The discussions resulted in two investments: the casino of the Atlantic Palace in Agadir, as well as the casino of Tangier, part of the Mövenpick Hotel & Casino Malabata.

Nearly 15 years later, the Israeli businessmen sold the two casinos to a Spanish group called Cirsa. But three years later, those assets were at the center of a tussle between Cirsa and the Red Sea Group after Cirsa was audited by Moroccan authorities, Le Desk reports.

Cirsa sent documentation of tax payments to the Red Sea Group, asserting that the Spanish group should be reimbursed by the Israeli organization for the years during which the Red Sea Group owned the properties, Le Desk wrote.

But details of checks sent to the Red Sea Group included not only what Cirsa claimed to have paid to the tax authorities, but also 2.6 million dirhams — over $250,000 — to its accounting adviser, the Tax Account Service firm, Le Desk reports.

It’s a number that would be “greatly exaggerated,” accounting professionals told Le Desk. When investigated, its reporters found the Tax Account Service had never filed a status or even summary statements; there exists no trace of the company on the internet. Tax Account Service, which has a single partner, seems to be an empty shell company, Le Desk reports.

Cirsa did not respond to Le Desk’s questions regarding its work with the Tax Account Service.

Indian elites take advantage of ‘golden passports’ scheme

At least 66 prominent Indian nationals gained Cypriot citizenship, in some cases within a couple of months to one year, The Indian Express reports. Among them were Radhika and Pankaj Oswal, a fabulously wealthy couple that became the talk of the town in Switzerland for buying one of the country’s most expensive houses.

Cyprus Confidential documents show how the couple failed to open a bank account to operate a Cypriot petroleum refinery they set up in 2017. The company closed in 2019, shortly after the couple obtained Cypriot passports in 2018, according to The Indian Express reports.

The refinery, The Indian Express reports, helped the couple take advantage of the controversial “golden passports” scheme introduced in 2007 as the “Cyprus Investment Programme.” The program provided a loophole to facilitate the granting of Cypriot citizenship to wealthy individuals as a way of attracting foreign investment.

Icelandic bankers’ wives invest in Spanish real estate

Three Icelandic women, all wives of prestigious former bankers at Kaupthing Bank, played key roles in the construction of luxury apartments in Spain, Icelandic partner Heimildin reports.

Anna Lísa Sigurjónsdóttir, Lovísa María Gunnarsdóttir and Þórhildur Einarsdóttir — whose husbands all received heavy prison sentences or were ordered to pay compensation after the bank collapsed in 2008 — together owned several companies registered in the British Virgin Islands, Cyprus, Denmark and Spain, according to Heimildin’s reporting.

Through Cyprus Confidential documents, Heilmildin traced the funds for the Spanish apartments from offshore accounts through Cypriot firms. The apartments have since sold for more than 150 million ISK, or over $1 million, each.