Under fire for anti-money laundering failures, a group of Belgium’s biggest banks proposed the creation of a platform to exchange information about suspect transactions with Belgian authorities and one other, as efforts to stem the flow of dirty money gather force globally.

In testimony before the Belgian parliament’s finance committee last week, the Belgian banks — ING Belgium, KBC Bank, Belfius Bank and Insurance and BNP Paribas Fortis — jointly asked for laws allowing them to set up a secure system to share information about suspected money laundering and the shadowy entities behind the transactions.

“We are urgently asking to engage as a real partner in the fight against money laundering, and not just as a reporter of suspicious transactions to the anti-money laundering unit, as is the case now,” Marc Raisière, chief executive of Brussels-based Belfius, testified, according to the Belgian news organization De Tijd.

The Belgian banks’ proposal follows a recent agreement by European finance ministers to create a new European Union-level body with direct supervisory powers over some “high-risk” institutions, as well as the authority to take over supervision from national regulators in “clearly defined and exceptional situations.” The ministers also gave their backing to a proposal to harmonize anti-money laundering rules across the EU and provide coordination and support for national financial intelligence units of member states.

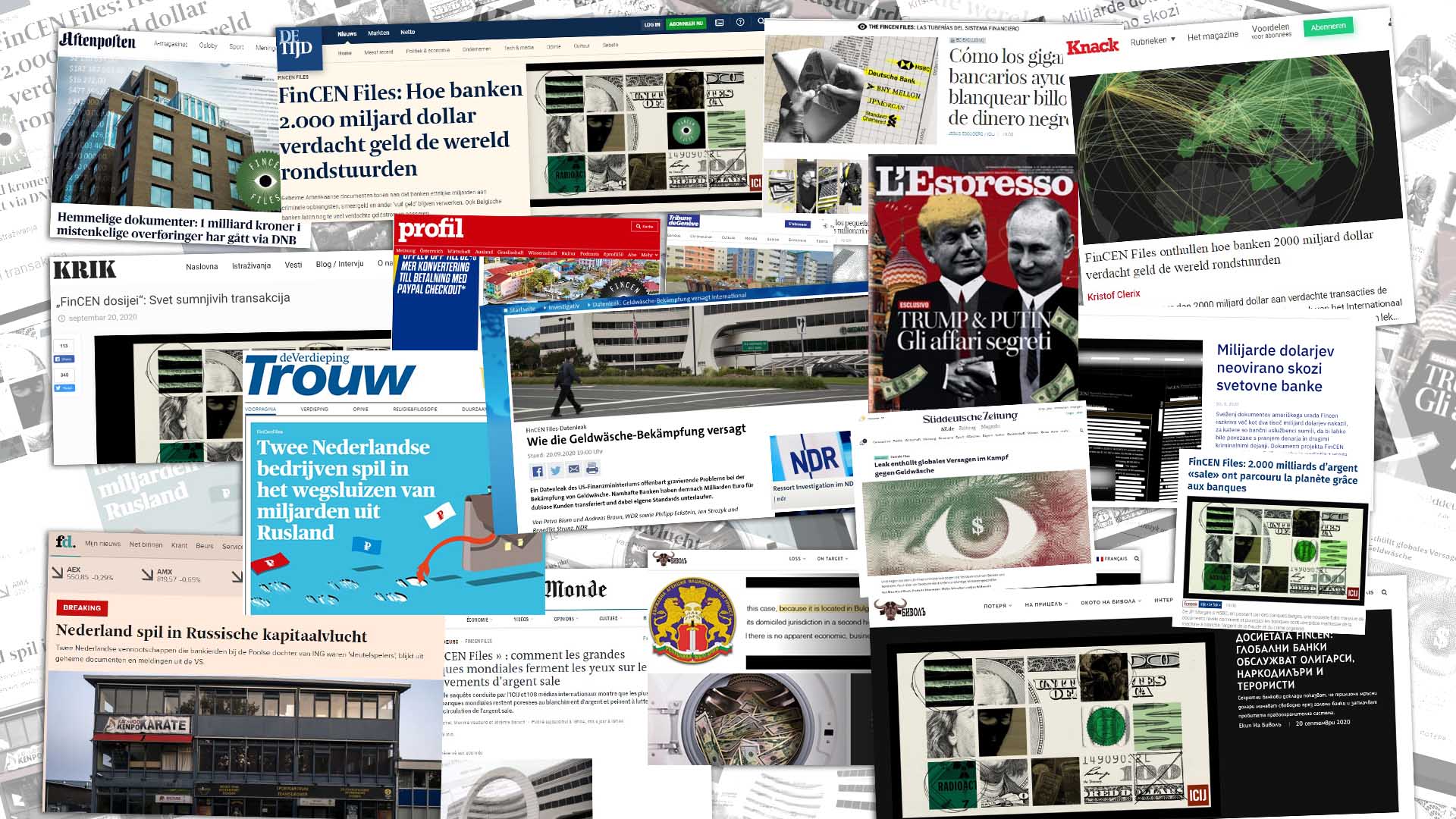

The Belgian proposal, and the hearings themselves, are the latest fallout from the FinCEN Files, a global investigation by more than 400 journalists that revealed how banks continue to move dirty money for drug cartels, corrupt regimes, arms traffickers and other international criminals, and how a broken U.S.-led enforcement system allows it to happen. The probe was based in part on 2,100 top-secret suspicious activity reports, or SARs, obtained by BuzzFeed News and shared with the International Consortium of Investigative Journalists and its global media partners. The SARs are filed by global banks to the United States Treasury Department’s intelligence unit, the Financial Crimes Enforcement Network, known as FinCEN.

Soon after the project was published in September, Belgian parliamentarians held an initial hearing that included testimony from reporters of ICIJ’s three Belgian media partners, Lars Bové of De Tijd, Kristof Clerix of Knack, and Xavier Counasse of Le Soir. The news organizations collaborated in probing Belgium-based banks’ role in money laundering for the FinCEN Files.

The second round of hearings last week, featured top bank officials, along with representatives of the financial sector trade group Febelfin, and the National Bank of Belgium, the country’s central bank and chief banking regulator.

Bank officials said the idea for interbank cooperation on money laundering echoes that of the United Kingdom’s Joint Money Laundering Intelligence Taskforce, created in 2015 and made up of more than 40 financial institutions, regulators and law enforcement agencies.

Karel Baert, chief executive of the trade group Febelfin, said banks’ anti-money laundering efforts have been hampered by the lack of an “umbrella platform” to communicate information in a secure environment between the banks and the government in the fight against money laundering.

At the hearing, Marianne Collin, Belfius’s chief risk officer, also proposed that the government provide banks a list of so-called “politically exposed persons” — politicians and others deemed to present a higher risk of being exposed to bribery or corruption — to help banks monitor their financial activity.

The banks also asked for greater access to Belgian authorities’ register of so-called ultimate beneficial owners, the real people behind anonymous shell companies that are typically used as money laundering vehicles.

Also at the hearing, an official at the National Bank of Belgium disclosed that nearly one in five financial institutions in the country had been assigned a “high risk profile” for anti-money laundering by the central bank.

ICIJ’s FinCEN Files investigation found that global banks with U.S. operations used their access to the U.S. Federal Reserve System to move more than $2 trillion between 1999 and 2017 in payments they believed were suspicious, flagging bank clients in more than 170 countries and territories whom they identified as being involved in potentially illicit transactions.

In exploring Belgian banks’ role, ICIJ’s three Belgian media partners found, among other things, that of 2,100 total reports in the FinCEN Files, 365 had links to Belgium, of which 179 regarded ING Belgium.

The three Belgian news organizations also reported that the NBB’s Sanctions Committee had imposed only four administrative fines on Belgian banks since 2013, each between 50,000 and 350,000 euros.

At the hearing, bank officials and regulators defended their anti-money laundering efforts and said they had invested heavily in improving compliance systems and adding personnel.

“The fact that a Belgian bank is mentioned in a report to the American anti-money laundering unit does not mean that there is a problem,” Febelfin’s Baert said. “They are a link in a chain in which the court determines whether there is a money laundering problem.”