Ending the kinds of offshore abuses revealed by the Panama Papers scandal requires a global solution led by the United States and Europe, a report released today by Nobel Prize-winning economist Joseph Stiglitz and Swiss anti-corruption expert Mark Pieth says.

The 25-page report, “Overcoming the Shadow Economy,” argues that, as “economic leaders,” the U.S. and the European Union “have an obligation to force financial centers to comply with global transparency standards.”

The U.S. and EU have shown they have the tools to stem the flow of dirty money in the fight against terrorism, but have failed to use these same anti-money-laundering tools as forcefully in the fight against financial corruption and tax dodging, the report says.

“Secrecy has to be attacked globally – offshore and onshore,” the report says. “There can be no places to hide.”

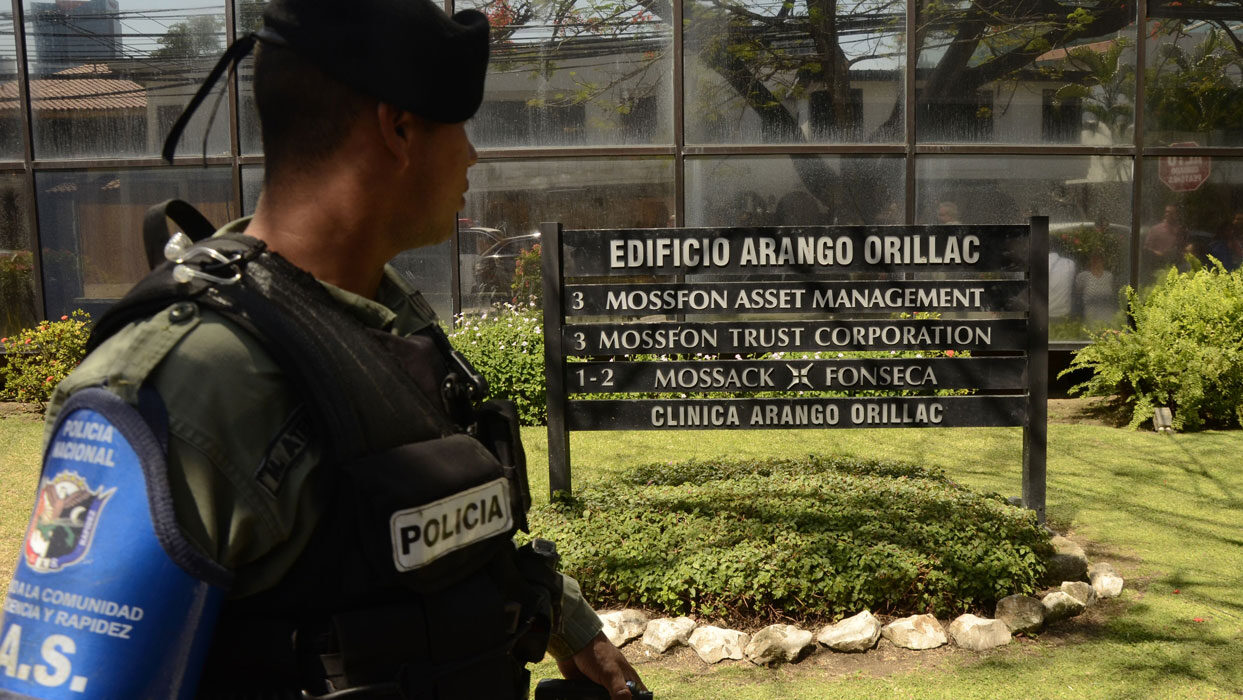

The new report is an outgrowth of the pair’s initial work on a study committee appointed by the Panamanian government in response to a series of news stories by ICIJ and more than 100 media partners. The media partnership’s Panama Papers investigation revealed the inner workings of Mossack Fonseca, a law firm headquartered in Panama that has helped create offshore structures used by world leaders, wealthy individuals, drug lords and financial fraudsters.

Stiglitz and Pieth resigned from the Panamanian government committee in August, saying that government officials had refused to assure the panel it had full independence to investigate and make its findings public. The government blamed their resignations over “internal differences” on the committee.

Stiglitz, a professor at New York’s Columbia University, said in an interview Monday that he and Pieth decided to go forward with their own report because they believe it’s important to articulate the global solutions to the challenges posed by the shadow economy.

Stiglitz said they wanted to address growing concerns about not only Panama but also about other secrecy havens and big nations, such as the U.S., that play a significant role in the offshore system. American banks, for example, have paid out large settlements over allegations by U.S. authorities that they failed to stem the flow of drug money and other illicit funds laundered through shell companies and offshore accounts.

“In a globalized world, if there is any pocket of secrecy, funds will flow through that pocket,” their report says. “That is why the system of transparency has to be global. The U.S. and EU are key in tipping the balance toward transparency, but this will only be the starting point: each country must play its role as a global citizen in order to shut down the shadow economy.”

Among the report’s recommendations:

- Every country should establish a searchable public registry that identifies the directors and actual owners of all companies, trusts and foundations incorporated within its borders.

- Governments should hand out stiff punishments to lawyers and other middlemen who knowingly register a corporation or trust “whose primary purpose is to evade or avoid taxes or to engage in money laundering.”

- Governments should discourage money laundering through real estate by requiring the disclosure of the real owners for all large real estate cash transactions.

Pieth and Stiglitz say that the U.S. and EU have the power to force other nations to embrace these and other reforms by simply threatening to cut off access to their financial systems. The pair writes that there’s “a widely shared perspective” that secrecy havens only exist because the U.S. and Europe “have looked the other way. … These major players have yet to pull the trigger, partly due to the delay in putting their own houses in order.”

The full report can be read here.

Stiglitz is due to speak with the EU's PANA Committee, which was convened to investigate financial secrecy in the wake of the Panama Papers, on Wednesday.