British Prime Minister David Cameron admitted that he had profited from an offshore fund set up by his father and marketed as managed in a way to be exempt from U.K. taxes.

Cameron, whose office had issued previous statements saying neither he nor his wife and children were currently profiting from the fund, nor would they in the future, disclosed that he had profited in the past.

Cameron said in an April 7, 2016 interview with ITV that he had sold his 5,000 stake in the Blairmore Investment Trust, named after his family’s estate, just months before he took office in May, 2010, making a profit of £31,500. Pressure had been mounting on Cameron since the disclosure of his father’s offshore fund in the Panama Papers April 3 and had grown as his office released what appeared to be narrowly worded statements.

In 2013, Cameron had urged his country’s overseas territories — including the British Virgin Islands — to work with him in the fight against tax evasion and offshore secrecy.

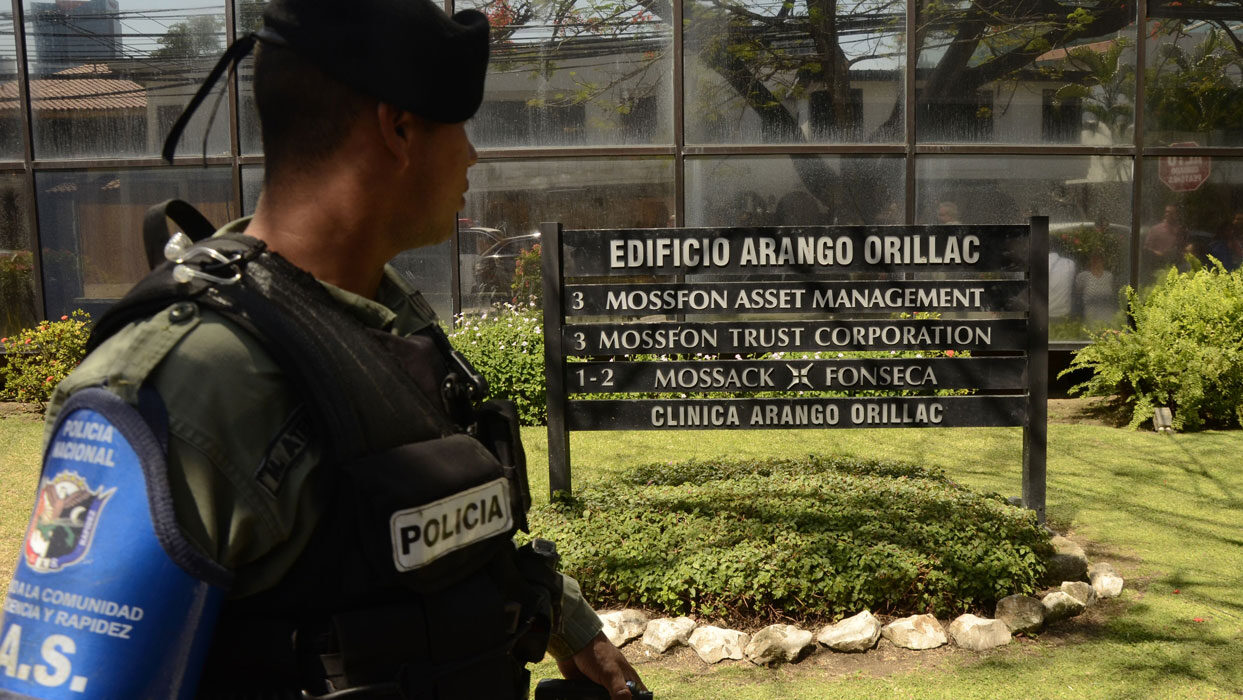

British regulators, meanwhile have given banks and financial institutions till just April 15 to disclose any dealings they have had with the Panama law firm Mossack Fonseca, which was at the center the Panama Papers investigation into the inner workings of the offshore financial secrecy industry.

United Kingdom regulators wrote approximately 20 firms to ask about “any significant issues or relationships identified.”

Russian President Vladimir Putin spoke publicly for the first time in response to the Panama Papers investigation, only to dismiss the findings as an “attempt to destabilize the internal situation” in Russia.

Speaking at a media forum in St Petersburg, he told reporters that his longtime friend Sergey Roldugin, who was linked in the Panama Papers to $2 billion in offshore transactions, had done nothing wrong, and had spent his money on “acquiring musical instruments.”

In the United States, a Securities and Exchange Commission official said the agency will review the investigation for possible information about wrongdoing, and officials at the U.S. Treasury used attention generated by the Panama Papers to highlight its own efforts to close a loophole in federal disclosure requirements that has allowed the actual owners of offshore companies to remain unknown.

Banks and financial institutions are currently required to know the identity of customers who open accounts in the U.S. but not the identity of owners of shell companies that open accounts. Treasury’s proposed “customer due diligence” rule, which has been in the works for a long time, would change that.

“I don’t think everyone recognizes the connection between the C.D.D. [consumer due diligence] and the Panama Papers,” Jennifer Shasky Calvery, director of Treasury’s Financial Crimes Enforcement Center told the New York Times. The proposed rule would require banks to know the identities of anyone who owns 25 percent or more of a corporation that opens a bank account or who exercises control of the corporation. That’s a higher standard. “Who is actually calling the shots? Who stands to gain?” she said.

Also in reaction to the investigation, Panama President Juan Carlos Varela said the government will create an international committee of experts to recommend improvements in transparency in the offshore financial industry and that the committee would share its findings with other nations in the interest of taking joint action.

And tax officials in Mexico said they would look at information related to 33 Mexican nationals mentioned in documents related to the investigation to see whether income from offshore activities was properly reported.