Prince Charles’ private estate held an undisclosed interest in an offshore company that could have benefited from his campaigning for changes to climate change rules, according to reporting by ICIJ’s British media partners in the latest round of Paradise Papers revelations.

The BBC and the Guardian reported on Tuesday that the prince’s estate, the Duchy of Cornwall, “secretly bought shares worth $113,500 in a Bermuda company,” Sustainable Forestry Management, that was directed by a friend of the prince.

The duchy told ICIJ’s media partners that the prince had no direct involvement in its investments, and a spokesman for the prince said his campaigning on climate change had nothing to do with his estate’s stake in the offshore company.

Days earlier, the prince’s mother, Queen Elizabeth II’s private estate was also named in Paradise Papers reporting as an investor in a Cayman Islands fund whose assets included a rent-to-own retailer accused of charging high interest rates.

The Paradise Papers revelations have prompted growing outrage in the U.K. as activists and politicians alike call for investigations and increased transparency in Britain’s financial system.

A spokesperson for the U.K. Prime Minister, Theresa May, said that the tax office had “asked to see the leaked Paradise Papers.”

In an interview, British opposition leader, Jeremy Corbyn, said those putting money offshore to avoid tax should apologize.

In other British news, the former deputy chairman of the Conservative party, Lord Ashcroft, avoided what he called a BBC “ambush” and took refuge in a toilet to avoid questions about payments from a trust in Bermuda, according to media reports.

U2 singer, Bono, said he was “distressed” to learn that a company in which he invests and which owns a shopping center in Lithuanian is being probed by tax authorities.

“I welcome this reporting,” Bono said. “It shouldn’t take leaks to understand what’s going on where.”

“I’ve been assured by those running the company that it is fully tax-compliant, but if that is not the case, I want to know as much as the tax office does,” Bono said.

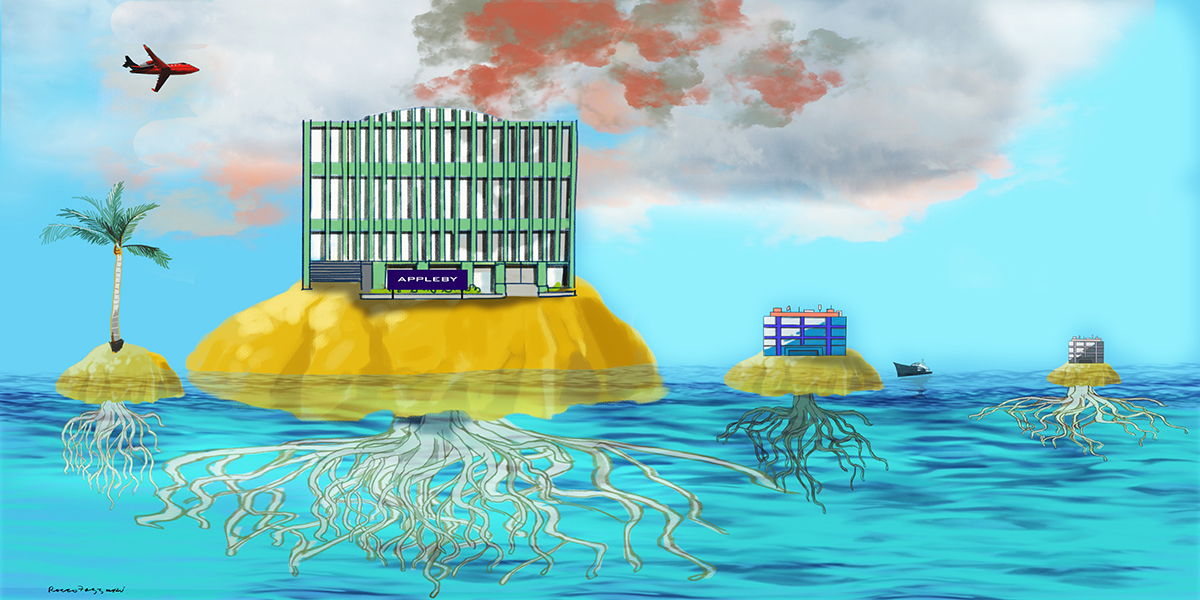

Several tax havens whose offshore industries spotlighted by the leak came to their defense – and that of others.

The Cayman Islands said it is “not a tax haven” and that it “will not tolerate unfair attacks against our Queen, Elizabeth II, who maintains normal and legal investments in Cayman, a British Overseas Territory.”

Bermuda’s premier promised to defend the island’s reputation and said it was not a place to “hide money.”