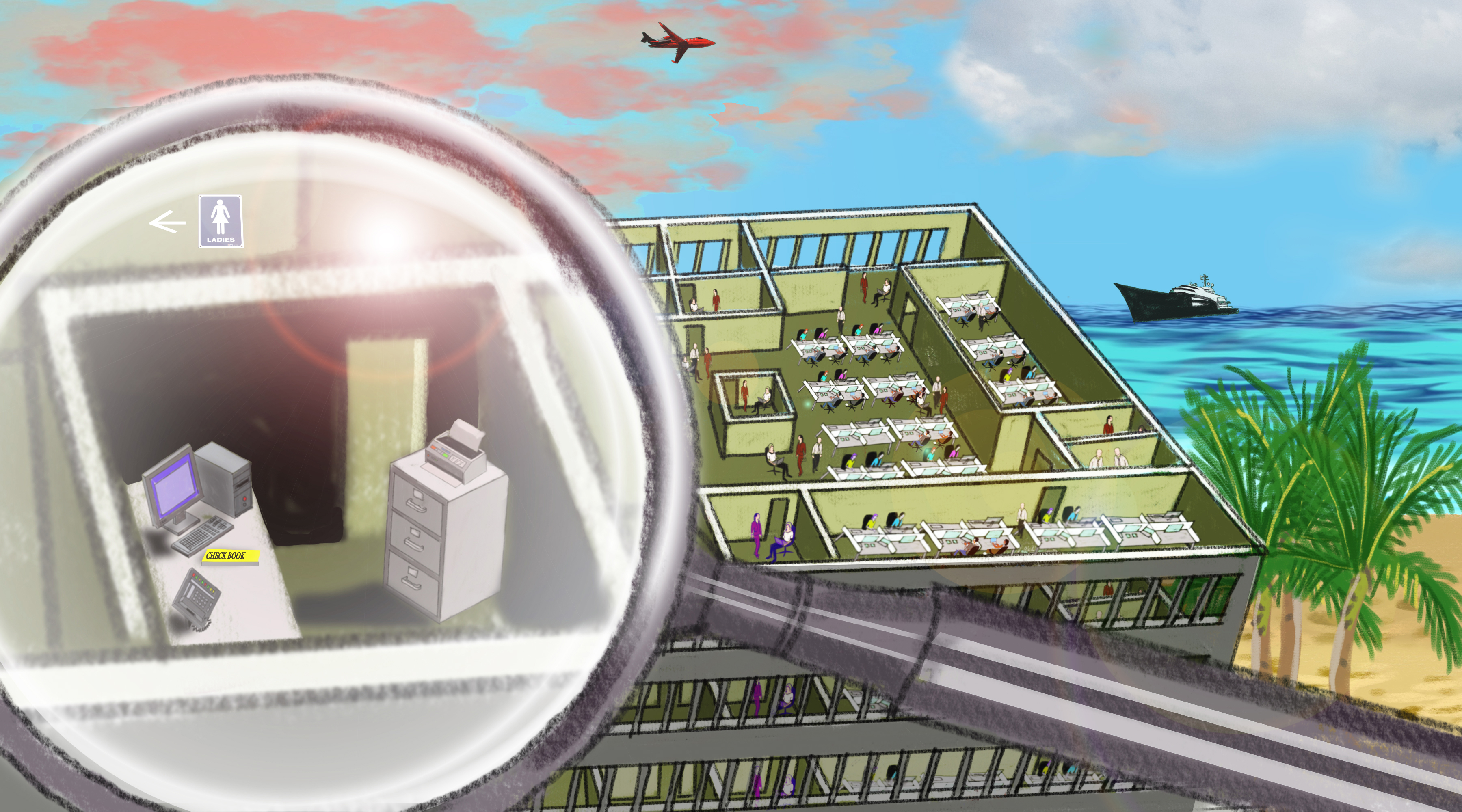

The International Consortium of Investigative Journalists today releases The Paradise Papers, a global investigation that reveals the offshore activities of some of the world’s most powerful people and companies.

ICIJ and 95 media partners explored 13.4 million leaked files from a combination of leaked files of offshore law firms and the company registries in some of the world’s most secretive countries.

The files were obtained by the German newspaper Süddeutsche Zeitung, and shared with ICIJ.

The Paradise Papers documents include nearly 7 million loan agreements, financial statements, emails, trust deeds and other paperwork over nearly 50 years from inside Appleby, a prestigious offshore law firm with offices in Bermuda and beyond.

The leaked documents include files from the smaller, family-owned trust company, Asiaciti, and from company registries in 19 secrecy jurisdictions.

The Paradise Papers reveal offshore interests and activities of more than 120 politicians and world leaders, including Queen Elizabeth II whose private estate indirectly invested in a rent-to-own loan company accused of predatory tactics. At least 13 allies, major donors and Cabinet members of U.S. President Donald J. Trump appear, including Commerce Secretary Wilbur Ross’s interests in a shipping company that makes millions from an energy firm whose owners include Russian President Vladimir Putin’s son-in-law and a sanctioned Russian tycoon.

The leaked files from Appleby, the offshore law firm, include details of tax planning by nearly 100 multinational corporations, including Apple, Nike and Uber.

ICIJ and its media partners will be publishing multiple stories in the coming days and weeks, including:

- On Monday afternoon, stories on strategies used by multinational corporations to shift profits to low-tax jurisdictions; and a look into the world of private jets and yachts registered by wealthy owners in offshore tax havens;

- On Tuesday afternoon, stories that look behind the huge offshore trust funds held by rich and powerful people; how prominent political donors in the U.S. make use of offshore financial structures; and reporting on tax haven shopping sprees by multinational companies in Africa that use shell companies in Mauritius;

- On Wednesday afternoon, a story about the role of offshore finance in the expansion of the forest industry, sometimes at the expense of the environment and local communities in Asia;

- More stories on Thursday, Friday and into the next week.

- ICIJ will also release the structured data connected to the Paradise Papers investigation in the coming weeks on its Offshore Leaks Database.

In the meantime, you can explore the offshore connections of some of the politicians and their associates in the Paradise Papers through our Power Players interactive, and also the offshore connections of 13 of Trump’s allies, major donors and Cabinet members through our Influencers interactive.

For media inquiries, please email contact@icij.org, or call on +1 202 481 1234 (English and French), +1 202 481 1228 (English and Spanish), +1 202 481 1211 (English and Spanish), or +1 202 481 1217, +1 202 481 1250 (English, Italian and Japanese).

For all inquiries related to the data or ICIJ membership inquiries, please email data@icij.org.