Footwear giant Nike cannot stop a probe into possible multibillion dollar tax avoidance, one of Europe’s highest courts ruled this week.

The General Court of the European Union on Wednesday rejected Nike’s arguments, which sought to end a high-stakes inquiry by the European Commission into allegations that the company obtained an unfair advantage over competitors when it signed deals with Dutch authorities in 2006 and 2010.

“The General Court does not accept any of the arguments put forward and dismisses the action in its entirety,” judges wrote.

The European Commission opened the probe into Nike’s Dutch tax arrangements in 2019 following an investigation by the International Consortium of Investigative Journalists and more than 300 journalists.

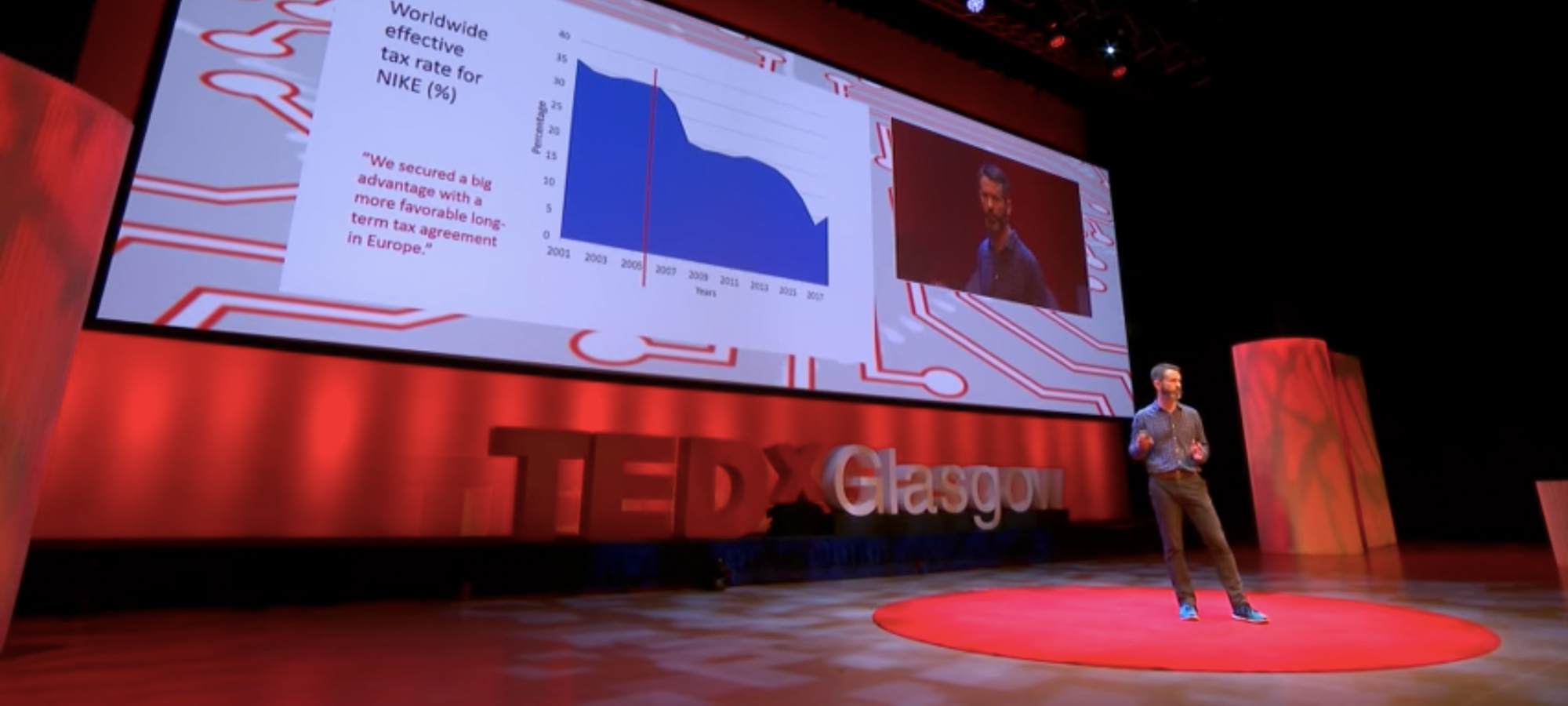

The Paradise Papers investigation revealed how the footwear and apparel manufacturer amassed billions of dollars in foreign earnings offshore. Much of the income was shifted out of Europe before it could be taxed, ICIJ reported.

In its submission to the court, Nike alleged that the European Commission targeted the company “unfairly” due to political pressure following ICIJ’s Paradise Papers investigation. The Commission should also have opened probes into 700 other companies with a similar tax structure, the company argued.

The court dismissed Nike’s argument, ruling that there was no unequal treatment and that the U.S.-headquartered company failed to identify other companies in the same situation.

Experts welcomed the decision.

“It’s an important ruling because the Commission’s state aid cases have played an important role in highlighting tax injustice,” said Tove Maria Ryding, policy and advocacy manager at the Brussels-based European Network on Debt and Development. “It also reflects how tax rules are so messy that we keep seeing all of these cases,” Ryding said.

In recent years, the European Commission has launched several battles against unfair tax deals. Its track record is mixed: the commission has lost disputes with Apple and Starbucks but succeeded against carmaker Fiat.

Nike told the Financial Times that it believes the ongoing investigation is “without merit.” It may appeal the ruling.