Kenya’s High Court has struck down a tax agreement with offshore haven Mauritius, a potentially significant precedent for other African nations’ efforts to staunch billions of dollars in lost revenue.

Justice Weldon Korir sided with Nairobi-based nonprofit Tax Justice Network – Africa, finding that the double tax avoidance agreement was unconstitutional. Kenya’s government had failed to follow constitutional requirements for ratification, Justice Korir said in his March 15 ruling.

TJNA executive director Alvin Mosioma welcomed the ruling in a statement, saying: “This ruling is groundbreaking not just for Kenya but for other Africa countries.

“Today’s judgment validates our call for African countries to review all their tax treaties particularly those signed with tax havens.”

Mosioma added, “Evidence has shown that contrary to their objectives, these DTAs have led to double non-taxation and resulted to massive revenue leakage for African countries.”

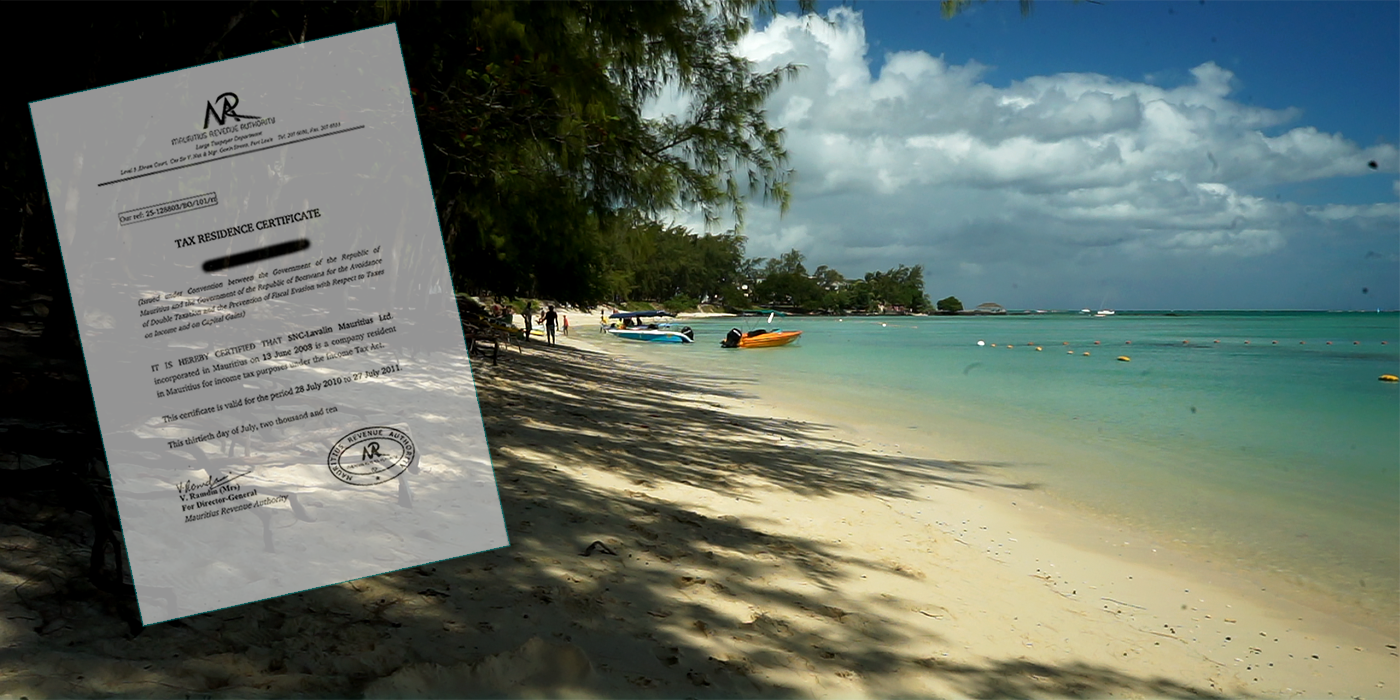

Kenya and Mauritius signed a tax treaty in 2012 that authorized reduced tax rates for companies established in the island nation.

But the treaty did not come into force before it was challenged in 2014, as Kenya had not notified Mauritius of the completion of ratification procedures.

While Nairobi argued before the High Court that the treaty would increase investment and jobs for Kenyans, critics claimed it would join a string of similar agreements signed between Mauritius and other African countries that reduce taxes available to poorer nations.

In its court submission, TJNA stated that both local companies and investors could potentially use the treaty to “dodge Kenyan tax by round tripping their investments illicitly through a Mauritius shell company.”

TJNA argued that the treaty could harm Kenya’s development by slashing taxes on interest, royalties and management fees – in some cases reducing them from 20 percent to zero.

Justice Korir said his ruling in favor of TJNA meant the tax treaty “ceased to have effect and became void.”

Officials did not immediately respond to ICIJ’s request for comment, although the government is expected to appeal.

TJNA called on Kenya to renegotiate other treaties, including those with the United Arab Emirates, Netherlands, China and South Korea.

As part of the 2017 Paradise Papers investigation, the International Consortium of Investigative Journalists revealed that profitable companies, assisted by law firms and accountants, used tax treaties to reduce monies paid to some of the world’s poorest nations, many of which are in Africa.

Emails from the investigation showed companies eagerly eyeing the Mauritius-Kenya treaty to pay less tax.

“This is a landmark case, because tax treaties are usually technical instruments that undergo only cursory parliamentary scrutiny, if any at all,” said Martin Hearson, a researcher at the London School of Economics who submitted an analysis to the High Court as part of the case.