The former head of banking giant HSBC’s private Swiss unit has pleaded guilty in France to helping wealthy clients hide $1.8 billion.

Peter Braunwalder, who led HSBC Private Bank (Switzerland) from 2000 until his retirement in 2008, was fined $560,000 and received a one-year suspended sentence, according to reports by Bloomberg and AFP.

Braunwalder’s guilty plea comes one year after HSBC agreed to pay France $353 million to settle allegations as part of the same tax-dodging investigation.

In a separate case this week, the HSBC’s Swiss unit agreed to pay $329 million in Belgium to settle a criminal probe involving similar accusations as the bank faced in France. The settlement requires court approval before proceeding, according to a report by Bloomberg.

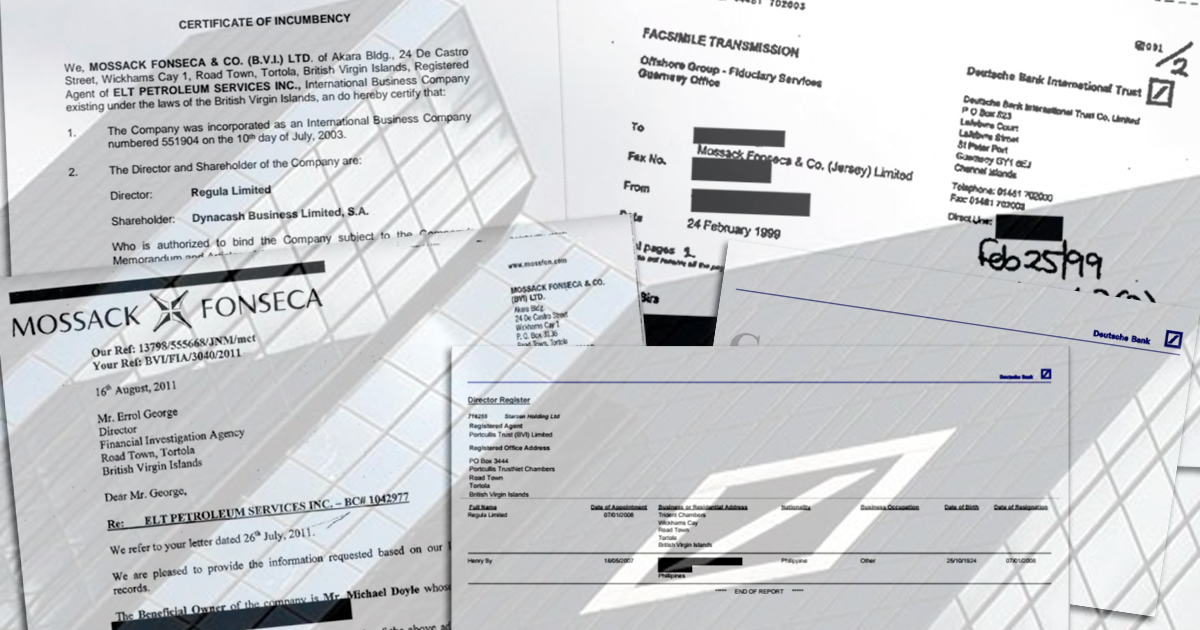

In 2015, the International Consortium of Investigative Journalists, in partnership with 140 journalists from 45 countries, published the Swiss Leaks investigation.

Swiss Leaks revealed that HSBC Private Bank (Switzerland) offered services to clients named-checked by the United Nations or in court documents in connection to arms trafficking, blood diamonds and bribery.

Other HSBC clients included allies and family members of despotic regimes in Egypt, Syria and Tunisia, politicians from Kenya to Georgia and Hollywood celebrities, including Christian Slater.

The Swiss Leaks investigation was based on 60,000 leaked files that provided details on the professions and assets of more than 100,000 clients. French newspaper Le Monde obtained the files and shared them with ICIJ.

It is not illegal to have a Swiss bank account. However, the Swiss Leaks investigation showed that HSBC Private Bank repeatedly advised clients on how to avoid paying taxes in their home countries.

HSBC acknowledged that standards “were significantly lower than today.”

Since the investigation, countries such as Malta, Belgium and India have reported recovering millions of dollars in fines, penalties and unpaid taxes from nationals who held accounts with HSBC’s Swiss private bank.

Documents from Swiss Leaks show that Braunwalder also intervened in cases for ultra-wealthy clients from outside France with special demands.

“Peter Braunwalder has confirmed his commitment to travel to London in order to meet with the client,” according to a 2005 internal memo that discussed one “extremely” valuable British client.

According to Swiss Leaks files, other clients whose records involved Braunwalder’s intervention or assistance included a U.S. employee of Warner Bros.’ studios; a Spanish banker seeking to transfer almost $50 million in inheritance; a German real estate agent; a Saudi-born Canadian housewife and a Belgian who met with Braunwalder at a music festival organized by HSBC.