Tax havens – and the financial secrecy they provide – may bolster industries tied to Amazon deforestation and the unsustainable management of natural resources, a new study has found.

“We need to start seeing the environmental costs of tax havens” and “how financial actors and financial flows are shaping the planet in very profound ways,” said Victor Galaz, a researcher at Stockholm University’s Resilience Centre and the leading author of the report that looked at the use of tax havens by agribusiness and fishing companies.

The study, which started after the unveiling of the Panama Papers investigation in April 2016 and was published Monday in the journal Nature Ecology & Evolution, examined jurisdictions where agribusiness conglomerates operating in the Amazon and fishing vessels involved in illegal activities are registered.

An analysis of Brazilian central bank data from 2000 to 2011 revealed that at least nine of the world’s largest producers of soy and beef, two industries considered to be main drivers of deforestation, use offshore subsidiaries to finance their operations in the Amazon forest, which Galaz called “a sleeping giant” in the climate change system. Scientists agree that deforestation is one of the main causes of global warming as the carbon dioxide that is typically absorbed by trees gets released in the atmosphere when they are cut or burnt.

The Stockholm University researchers found that, over the decade, about 70 percent of foreign capital – or about $18.4 billion – reached the operating companies in Brazil after being routed through subsidiaries in low or zero tax rate jurisdictions, such as the Cayman Islands. (Central bank data is not available for the years after 2011.)

Such routing is legal and often used to decrease companies’ tax burden, the report says. The lack of transparency associated with operations in tax havens, however, makes it difficult for watchdogs and researchers to monitor how offshore financing may affect operations “on the ground.”

Although the years examined partly overlap with the highest rate of deforestation in the Amazon, the authors say it’s currently “impossible” to establish a direct link between capital flowing from tax havens, land use and environmental damage.

“Direct proof of causality remains elusive,” according to the report.

In response to the researchers, international grain companies including Louis Dreyfus Company, Cargill, Bunge and Amaggi Group have said their organizational structures and trading policies comply with the law and that they are committed to the highest environmental standards.

In the past, investigations by the International Consortium of Investigative Journalists and its partners have shown how natural resource and agribusiness companies often take advantage of the secrecy provided by the offshore industry for various purposes, including tax avoidance.

Last year, ICIJ partners Premiere Lignes in France and Poder360 in Brazil reported that the Brazilian Amaggi and the Swiss-French Louis Dreyfus in 2009 set up a joint venture to operate in Bahia and other areas of Brazil. According to the investigation, the beneficial owner of the joint venture’s Cayman Islands subsidiary was Brazil’s current agriculture minister, Blairo Maggi, who denied any wrongdoing.

The findings were part of the Paradise Papers, a global investigation based on 13.4 million leaked files which detailed how wealthy individuals and corporations use shell companies in tax havens to avoid or evade taxes.

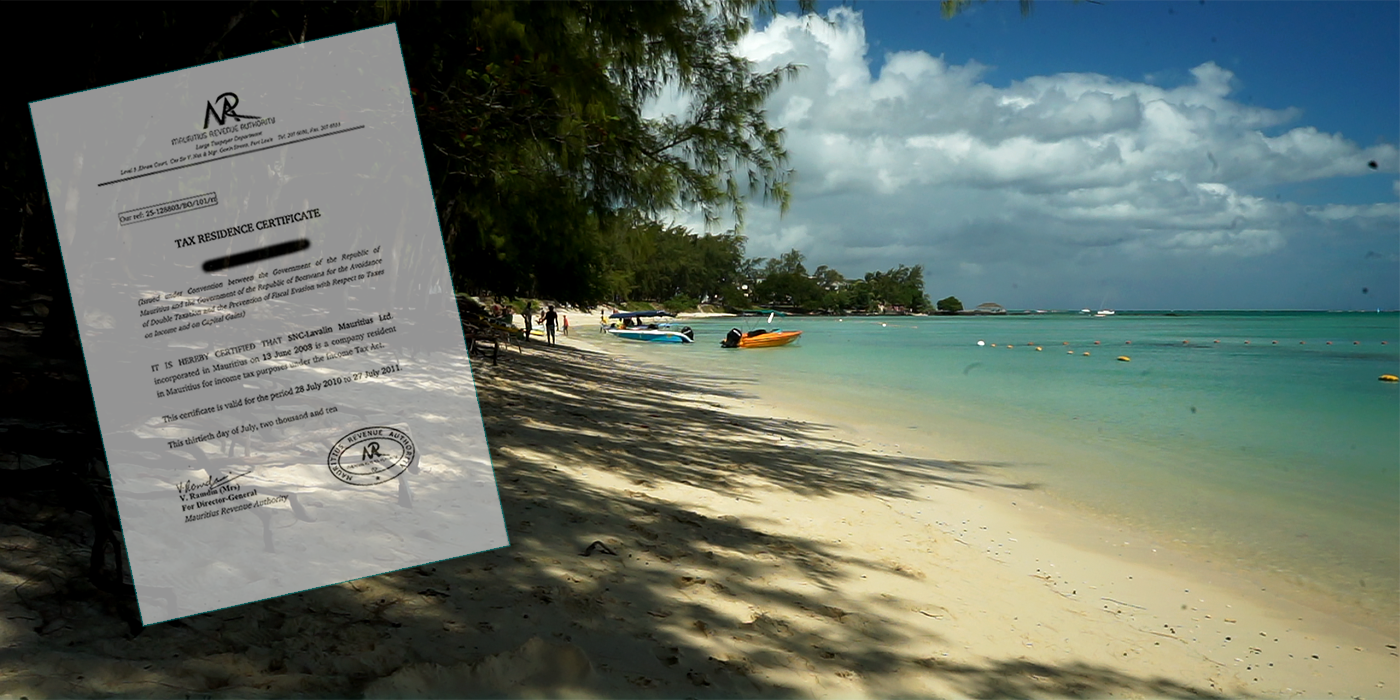

In Namibia, the ICIJ found that Pacific Andes, a major fishing company, set up a Mauritius subsidiary to manage its operations in the country and take advantage of a treaty between the two jurisdictions that shielded it from taxes. Pacific Andes told ICIJ the majority of the fees stayed in Namibia as capital.

Another report by ICIJ published in November 2017 found that a Singapore-based pulp and paper producer used a web of shell companies to avoid paying withholding tax on loans and to expand its Indonesian operations, while allegedly contributing to the destruction of the country’s fragile rainforest. A company spokeswoman said it “meets all tax obligations in the jurisdictions where it operates.”

At the time, experts interviewed by ICIJ questioned forestry and agribusiness companies’ practice of funding their business through offshore subsidiaries to exploit natural resources in developing countries.

“While profits are really earned from tangible land-based operations, a large portion of profits are routinely declared in jurisdictions with low corporate tax rates,” said Tom Picken, the forests and finance campaign director for Rainforest Action Network, a nongovernmental organization.

As a result, Picken said, supplying countries may end up with a lower tax revenue and fewer funds to implement critical national development programs for health, education and infrastructure.

The Organization for Economic Cooperation and Development estimates that about $200 billion is lost every year by developing countries due to tax avoidance.

The Stockholm University report also explores the role of tax havens in enabling and disguising illegal fishing. Through analyzing multiple datasets, researchers found 70 percent of vessels identified by Interpol as responsible for carrying out illegal or unregulated fishing are currently, or have been, flagged in a financial secrecy jurisdiction, mainly in Panama and Belize.

The study is part of an on-going research project that explores the relationship between financial markets and sustainability and will eventually include other environment-impacting sectors.

To promote sustainability, you need accountability, which comes with transparency, Galaz said. Only then “you have the power to change things,” he said. “Any progress we can do would have environmental benefits.”