On an overcast afternoon in September 2009, Benin President Thomas Boni Yayi raised a pair of golden scissors above a ribbon at the entrance to the sprawling new Erevan superstore in the heart of Cotonou, Benin’s seaside seat of government.

Beside him, in a dark suit and sporting a yellow pocket handkerchief was Erevan’s founder, Marcel Tchifteyan. “The land of Benin welcomed me, seduced me, and for more than half a century, I have never left,” Tchifteyan declared.

Tchifteyan then accompanied Boni Yayi, who left office in 2016, through the sparkling aisles of one of the largest superstores in West Africa, brushing past packs of bottled water and locally roasted peanuts. Not far away was Tchifteyan’s son and superstore co-owner, Jean-Luc.

Marcel Tchifteyan’s legacy is visible throughout the country. He launched a construction company in the 1950s, followed by West Africa’s first paint business and then, in 2001, a beachfront hotel with tennis courts named “Dad’s House.”

He and his son have also accumulated titles. Marcel is an honorary consul representing Armenia in Benin, a ceremonial role that confers little official power, but is an indication of his ties to authorities. Jean-Luc, 57, is an unpaid trade adviser for France, appointed by the prime minister.

On the day the superstore opened, Boni awarded Tchifteyan the National Order of Benin to recognize his work. “It’s a true marriage that united Benin and I,” Tchifteyan said. “And it is a happy and fruitful marriage.”

Leaked files examined by the International Consortium of Investigative Journalists suggest that the Tchifteyans’ avowed love for their adopted country is not reflected in their tax filings. The Tchifteyan’s Erevan superstore routed payments from suppliers through a Panamanian company and to a bank account in Monaco for years, according to documents related to ICIJ’s Panama Papers investigation. The payments, which experts say could have been taxed if they had stayed Benin, were out of sight and out of reach of the country’s overstretched tax authority.

“Of course something like this is going to interest us,” said a Benin tax official, who asked not to be named because of the sensitivity of the subject.

Honorary consuls, also known as “honoraries,” occupy a little-known niche in the global elite. They are loosely regulated, generally unpaid, part-time public officials chosen for their economic and political clout – or sometimes for a favor done or a donation made.

In documents from ICIJ’s four major offshore investigations – Offshore Leaks, Swiss Leaks, Panama Papers and Paradise Papers – honorary consuls’ offshore financial dealings sometimes intermingle with those of corporations and kleptocrats accused of looting Africa to the tune of at least $50 billion a year.

An investigation found that some individuals who represent foreign countries in West Africa or who represent West Africa abroad have squirreled away money in tax havens, out of reach of the strapped treasuries of the nations that welcome them. The honorary consuls who used offshore companies and bank accounts to shelter money and potentially reduce tax bills include a soft drink baron representing Panama in Nigeria, a Portuguese executive representing Burkina Faso and a Belgian diamond cutter representing Liberia.

While it is not illegal for honorary consuls to own or use offshore companies, critics say that combining controversial financial practices and quasi-diplomacy is wrong.

Using foreign tax shelters is unacceptable, said French Sen. Eric Bocquet who led a 2012 parliamentary inquiry into tax evasion. “That’s true for any individual, and it is even more so for people who officially represent France.”

The honorary diplomatic corps

While some honorary consuls have exploited the position, for others it is a labor of love, an opportunity – with some nice perks – to help countries they adore.

On a cool Thursday evening recently in Los Angeles, the three-tier 115-foot-long yacht RegentSea idled at Marina del Rey.

In their finest, including fur stoles, bespoke suits and sequined mermaid skirts, guests approached the boat on a red carpet, stopping at the stern for photos in front of a large banner that read: Diplomat’s Diversi-Tea Gala.

Breezy conversation swirled as attendees arrived in Ubers and jet black diplomatic people movers with tinted windows. “We missed you at my country day the other week,” said one member of LA’s diplomatic corps, leaning in to greet another. “I saw you at the King Tut exhibit at the Science Center!” exclaimed yet another.

At precisely 7:15 p.m., the RegentSea pulled away from the shore. The gala was to honor one of Los Angeles’ most indefatigable honorary consuls, Robert Sichinga, who represents Zambia.

It was a chance for Sichinga, 46, to relax after a day at the Los Angeles County administration building, training with other members of the local consular corps, which describes itself as the third largest in the world. Paid career consuls and a few honoraries, including Sichinga, discussed how to order special license plates or State Department-issued identity cards, whom to call in an emergency, and how to arrange a police escort for visiting dignitaries. They were instructed, too, that no amount of grandstanding would get them off a drunken-driving charge.

Among his peers, Sichinga is known to spend more time than most honoraries selling the country he represents to Americans, who often don’t know where Zambia is or what he is talking about.

“‘Za-who?’ people often ask me,” Sichinga said. “I start having to give everybody a geography lesson.”

Sichinga is one of 1,144 honorary consuls in the United States. Especially prized by small or poorer nations without full-fledged diplomatic missions, honoraries represent foreign nations for a fraction of the cost of a salaried member of the diplomatic corps.

They are retired diplomats, personal injury lawyers, tequila magnates, restaurant managers and part-time singers. Jacqueline Onassis’ longtime partner, Maurice Tempelsman, represented Zaire in New York City. California Democratic Sen. Dianne Feinstein’s husband has been a proxy for Nepal and Mongolia. From 2007 to 2010, former U.S. Vice President Walter Mondale was Norway’s go-to man in Minnesota.

Some process passports for dual-nationality citizens. Others are on call 24/7 in case a tourist gets lost at Disneyland or a visiting investor is kidnapped, robbed or jailed. Others help facilitate business deals – for instance, hosting oil companies at energy industry conferences.

In nearly every case, they perform the role without drawing an official salary, attracted instead by the love of a country or the promise of privilege.

Countries that use honoraries “get a lot of bang” for their buck, said Pontus Jarborg, former Swedish consul general.

But while some honorary consuls work to rigorous standards, others seem to do mostly as they please.

“You could almost write your own playbook,” said Cynthia Blandford, Liberia’s representative in Georgia since 2009. “It’s very much about trust.”

History shows that not everyone deserves that trust.

In one notorious example, Adolf Hitler’s wartime Spanish translator worked under the cover of “honorary consul general” during and after World War II. Capt. Hans Hoffman was involved in Operation Werewolf, helping to maintain a network of Nazi sympathisers in southern Spain.

Around the world, honorary consuls have been fined, jailed and stripped of their titles for corruption, including alleged money laundering, operating an illegal gambling den, stealing millions from a state-owned lottery and raping a 12-year-old girl. In 2015, Turkey’s honorary consul to Togo, in West Africa, was jailed for allegedly issuing fake travel documents.

The goal was to avoid having a group of people with titles but no responsibilities, freelancing, acting as independent agents and cutting deals on their own.

Within the United States, officials have a phrase for what happens when things go wrong: “diplomats behaving badly.”

The State Department now requires honoraries to perform meaningful duties. “The goal was to avoid having a group of people with titles but no responsibilities, freelancing, acting as independent agents and cutting deals on their own,” said Larry Dunham, a consultant with Protocol Partners and the State Department’s former assistant chief of protocol.

Jarborg said Sweden was mindful of errant honoraries. “If we find out that the honorary consul could come into a conflict of interest situation or reflect badly on Sweden as a country,” he said, “we would ask the consul either to get out of that business or resign as honorary consul.”

Yet little about what honoraries may or may not do in the business sphere has been spelled out.

While many are honorable, some honoraries push deals with top officials and their wives. Some feel that they have no constraints at all and that, as unpaid volunteers, the concept of conflict of interest does not apply.

Looking for a job as an honorary consul?

“IMMUNITY. TAX SAVINGS. POLITICAL ACCESS. PRIVILEGES,” reads the pitch on the website diplomaticconsulting.com. “YOU TOO CAN BECOME AN HONORARY CONSUL.”

For anywhere between $60,000 and $500,000, Diplomatic Consulting will find applicants an honorary position representing one of 24 countries in Asia, Latin America, Europe and Africa. West and Central Africa are the company’s chief markets. Promotional material offers possibilities in six countries on the continent: Guinea, Guinea-Bissau, Mali, Gambia, Democratic Republic of Congo and Central African Republic. All are on the United Nations’ list of Africa’s least-developed countries.

Diplomatic Consulting founder Andrew Szabo, who launched the business after making a fortune in online matchmaking services, concedes that money can advance applications.

“It is a common practice that diplomats and foreign ministries don’t like to talk about,” Szabo told ICIJ, explaining that securing a position might involve giving a donation to a hospital, a school or orphanage. Or perhaps to the prime minister’s wife’s favorite charity.

“West African countries are the most cash-strapped countries in the world,” said Szabo, Mali’s honorary consul in Budapest. “And they’re the ones that are generally seeking representation and that have very limited diplomatic representation.”

Few West African countries were as desperate for representation – or taxes – as Liberia at the turn of the century.

Warlord-turned-president Charles Taylor supported and helped train rebels in neighboring Sierra Leone, a U.N. expert panel found. Between 2001 and 2004, the United Nations sanctioned Taylor and other senior leaders and banned Liberian diamond exports.

Around the same period, a little-known Belgian diamond cutter, Marc Robeyns, represented Liberia as its honorary consul in Belgium, home to one of the world’s largest diamond exchanges. It is unclear precisely when Robeyns began this role for Liberia. However, he was linked to four bank accounts with HSBC Private Bank in Switzerland while honorary consul, according to files from ICIJ’s Swiss Leaks investigation. The bank files do not detail Robeyns’ connection with the accounts but make it clear that he was a bank client.

In January, August and October 2005, Robeyns spoke to his banker and predicted that “some good business” would help him increase his offshore account balance. By then, notes of those discussions show, Robeyns had moved to the Bahamas, from where he continued to represent the West African country. Robeyns was thinking of selling his home on the island for up to $3 million, the notes state.

It is unclear how Robeyns divided his time between Belgium and Liberia, although HSBC files listed him as Liberian with mailing addresses in the Liberian capital of Monrovia and Antwerp, the Belgian city known as the world’s diamond capital. Robeyns did not respond to questions, including whether he was ever a Liberian resident for tax purposes and required to declare the accounts.

Since the publication of ICIJ’s Swiss Leaks investigation, several countries have recouped millions of dollars in fines and taxes on bank accounts. A spokesman for the Liberian Revenue Authority told ICIJ that it faces major challenges obtaining information from document leaks such as Swiss Leaks but said it is “definitely” interested in any information that could relate to lost revenue.

Benin superstore mogul’s offshore network

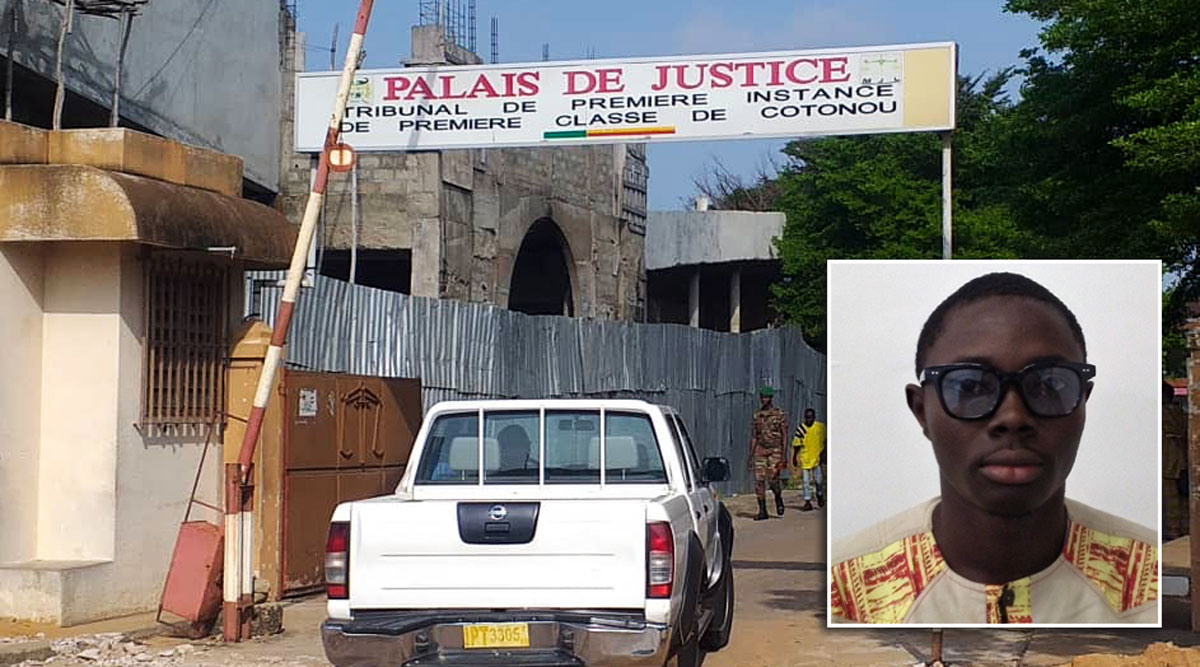

Back in Benin, while superstore entrepreneur Marcel Tchifteyan was constructing his business empire, his son Jean-Luc was building the offshore enterprise where some of the supermarket earnings ended up. Wagner Corp. was created in Panama in May 2005, according to documents from the Panama Papers. Initially, shares issued by the company concealed the name of the owners.

Years later, a background check by the law firm Mossack Fonseca on Jean-Luc Tchifteyan noted his father’s honorary position. Lawyers classified Jean-Luc a “politically exposed person,” language used to flag clients such as politicians and diplomats for additional screening.

“Mr J.L.T. will use Wagner Corporation, of which he is the sole beneficial owner, to collect commissions” a banker for the family explained to Mossack Fonseca in a 2014 email, which provided the law firm with updated passport and other information.

Supermarket suppliers would pay the shell company up to $150,000 a year, the email continued.

David Sables, CEO of Sentinel Management Consultants, which advises suppliers on deals with supermarkets, said big stores often receive commissions from suppliers who pay for their products to receive prominent placement. But he said routing those payments to shell companies is not common in the industry.

Panama’s taxes on income sources such as commissions are “almost non-existent,” making it possible to enjoy commissions virtually tax-free, said Reine Flore Tamo, a tax specialist in Cameroon.

Jean-Luc did not respond to emails, phone calls, WhatsApp messages and letters. Marcel Tchifteyan did not respond to questions, including those sent to an email account that combines his consular and his Erevan supermarket identities: consulat@erevanbenin.com.

Contributors to this story: Ignace Sossou