IMPACT

Chelsea FC faces over six dozen charges for improper conduct under Abramovich’s ownership

The Football Association announced it is investigating payments routed through offshore companies that were uncovered as part of ICIJ’s Cyprus Confidential investigation.

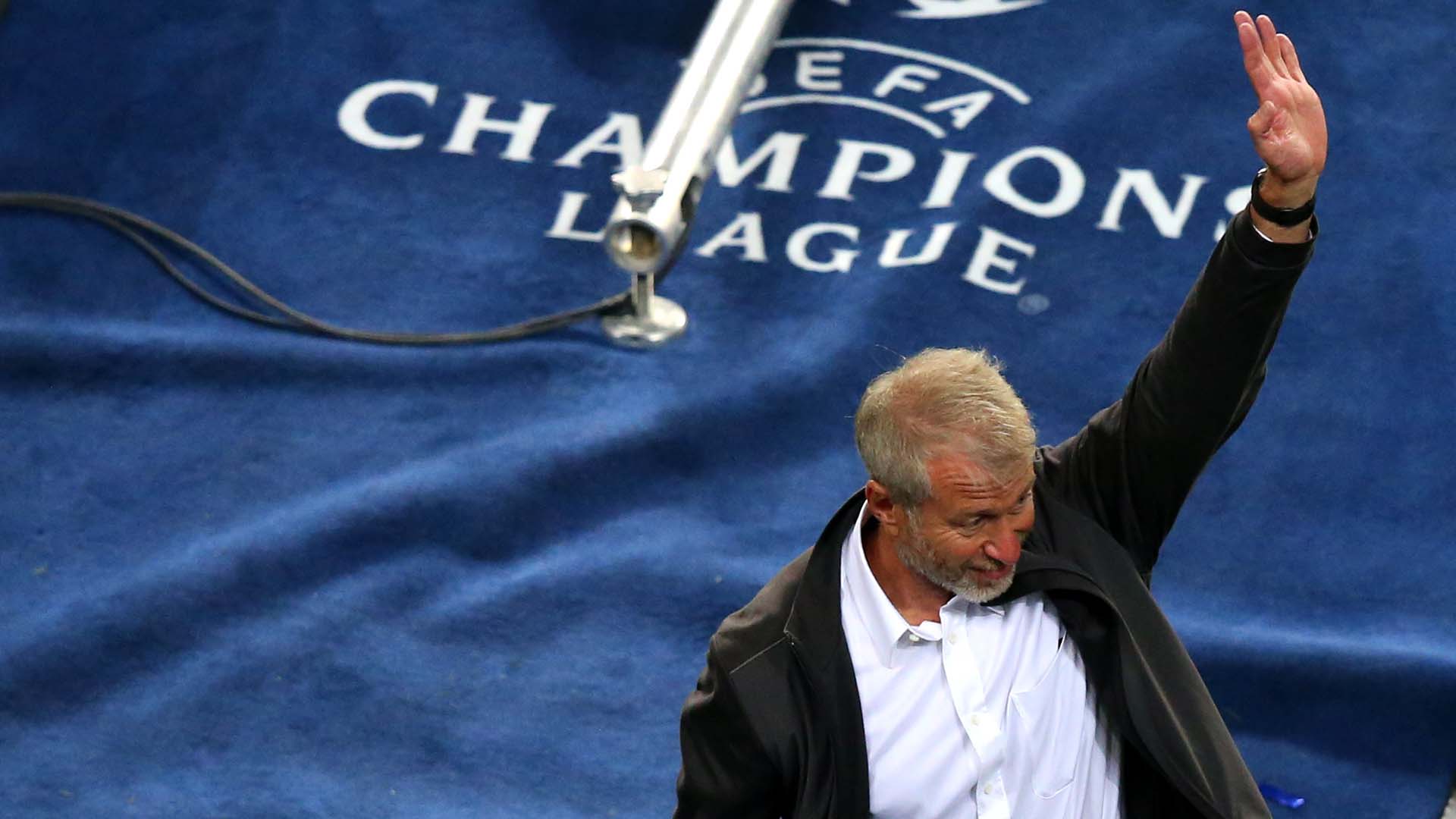

Chelsea Football Club has been charged with dozens of breaches of Football Association regulations relating to agents, intermediaries and third-party payments between 2011 and 2016 when billionaire Roman Abramovich owned the London club.

The U.K’s Football Association has given the club, now owned by the BlueCo consortium led by U.S. businessman and L.A. Dodgers co-owner Todd Boehly and the private equity firm Clearlake Capital, until Sept. 19 to respond.

The club is accused of making undisclosed payments to secure the transfers of Eden Hazard, Willian and Samuel Eto’o, among other charges to be heard by an independent regulatory panel. In response, Chelsea’s new owners pointed to their “unprecedented transparency” in the face of the allegations.

The club said in a statement that it reported the regulatory violations to the Football Association during its 2022 takeover of the club. During the sale, the buyers reportedly found financial discrepancies on the club’s books that were caused by suspect payments to offshore companies and the families and representatives of various Chelsea players.

The payments were uncovered in 2023 by The Guardian and The Bureau of Investigative Journalism as part of the International Consortium of Investigative Journalists and Paper Trail Media’s Cyprus Confidential, a global investigation that touched on Abramovich’s dealings in Cyprus, a notorious secrecy hub that has been entangled with questionable Russian money for decades.

At the time, four sports lawyers told The Guardian that the offshore payments may have broken U.K. league rules aimed at curbing spending that could jeopardize clubs’ longevity.

Jersey money laundering probe

Former Chelsea owner Abramovich faces separate legal troubles in Jersey, where he is the subject of a criminal probe into allegations of corruption and money laundering, as The Guardian reported earlier this week.

According to court documents released by Swiss prosecutors, Jersey authorities are investigating Abramovich’s early moves to amass his fortune. Jersey was allegedly one of the offshore secrecy jurisdictions Abramovich used to shield his wealth.

The documents also reveal the authorities suspect that companies under Abramovich’s control violated Jersey’s March 2022 sanctions and made corrupt payments in the 1990s to grow Sibneft, an oil and gas company he co-owned. Abramovich later sold his stake to the Russian government.

Jersey, a British crown dependency in the Channel Islands, previously froze billions of Abramovich’s assets that were funneled through its jurisdiction — a move prompted by the 2022 Russian invasion of Ukraine — and has since been looking into Abramovich’s financial activities in the country for three years, The Guardian reported.

Jersey’s attorney general requested the Swiss court release financial records related to suspected money laundering in the 2005 sale of Abramovich’s stake in Sibneft to the Russian government for $13 billion, according to Forbes.

Abramovich, who featured prominently in ICIJ’s Cyprus Confidential and other past investigations, has denied the allegations. His lawyers told The Guardian that any “suggestion that Mr Abramovich has been involved in criminal activity is false.”

Superyacht scheme

In Cyprus, tax authorities are closing in on former directors of Blue Ocean Yacht Management, the company at the center of an alleged tax evasion scheme involving Abramovich’s fleet of luxury yachts.

In August, ICIJ partners The Bureau of Investigative Journalism and Cyprus-based CIReN reported that the Cypriot tax commissioner had filed criminal charges against the unnamed directors of the company, which leased the superyachts to companies incorporated in the British Virgin Islands that were ultimately controlled by Abramovich.

The scheme, uncovered by TBIJ, the BBC, The Guardian and CIReN in an investigation based on the Cyprus Confidential leak, may have saved millions in EU taxes.

In June, Cyprus’ tax authorities faced scrutiny from the country’s legislature over its inability to recoup the roughly $15 million in unpaid value-added tax that should have been paid on fuel, maintenance and other expenses when the vessels docked in European ports.