The Netherlands’ state secretary for finance and Dutch lawmakers have called for an investigation into whether the Dutch tax office provided favorable treatment to Uber in the wake of revelations in the Uber Files investigation by the International Consortium of Investigative Journalists.

Internal Uber text messages, emails and other records leaked to The Guardian by a former Uber employee show that, in 2015, an Uber executive told a colleague that Dutch authorities were “trying to slow down” the sharing of information during an audit by tax agencies of five European countries seeking to assess Uber’s and drivers’ tax liabilities in their countries.

Paul Tang, a member of the European Parliament from the Netherlands who chairs the Parliament’s subcommittee on tax matters, said the findings were significant.

“The Dutch tax authorities directly violate European legislation,” he told a Dutch-language trade journal. “Apparently it was more important to keep large multinationals on board … The government must provide full transparency on existing tax deals with large corporations and detailed insight into the tax authorities’ conduct.”

On Tuesday, Dutch State Secretary for Finance Marnix van Rij announced he will investigate the matter internally, even though the tax office said officials had followed the procedures “correctly.”

“I always take these kinds of publications very seriously,” van Rij said.

The Netherlands, a corporate tax haven where Uber has registered dozens of subsidiaries, is the company’s hub for much of its financial activities in much of the world.

A report by the Center for International Corporate Tax, Accountability and Research estimates that, in 2019, the year Uber went public and was listed on the New York Stock Exchange, it avoided at least $556 million in taxes globally thanks to its corporate structure centered around the Netherlands.

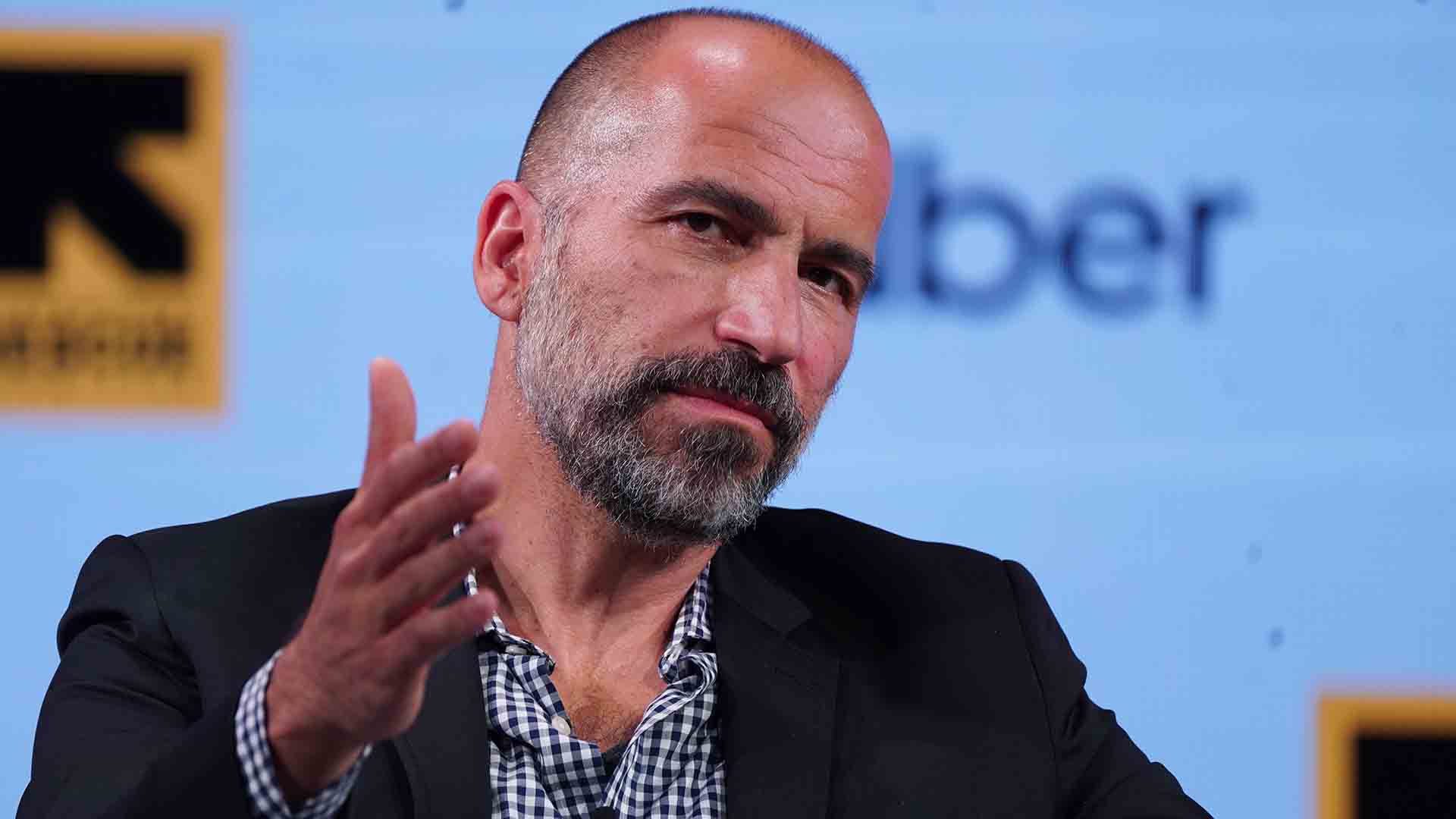

In internal 2015 emails to his colleagues, Uber’s former chief lobbyist in Europe, Mark MacGann, described the company’s tax structure as its “Achilles heel.” Earlier this week, MacGann came forward as the source of the Uber Files leak.

Buying time in a tax audit

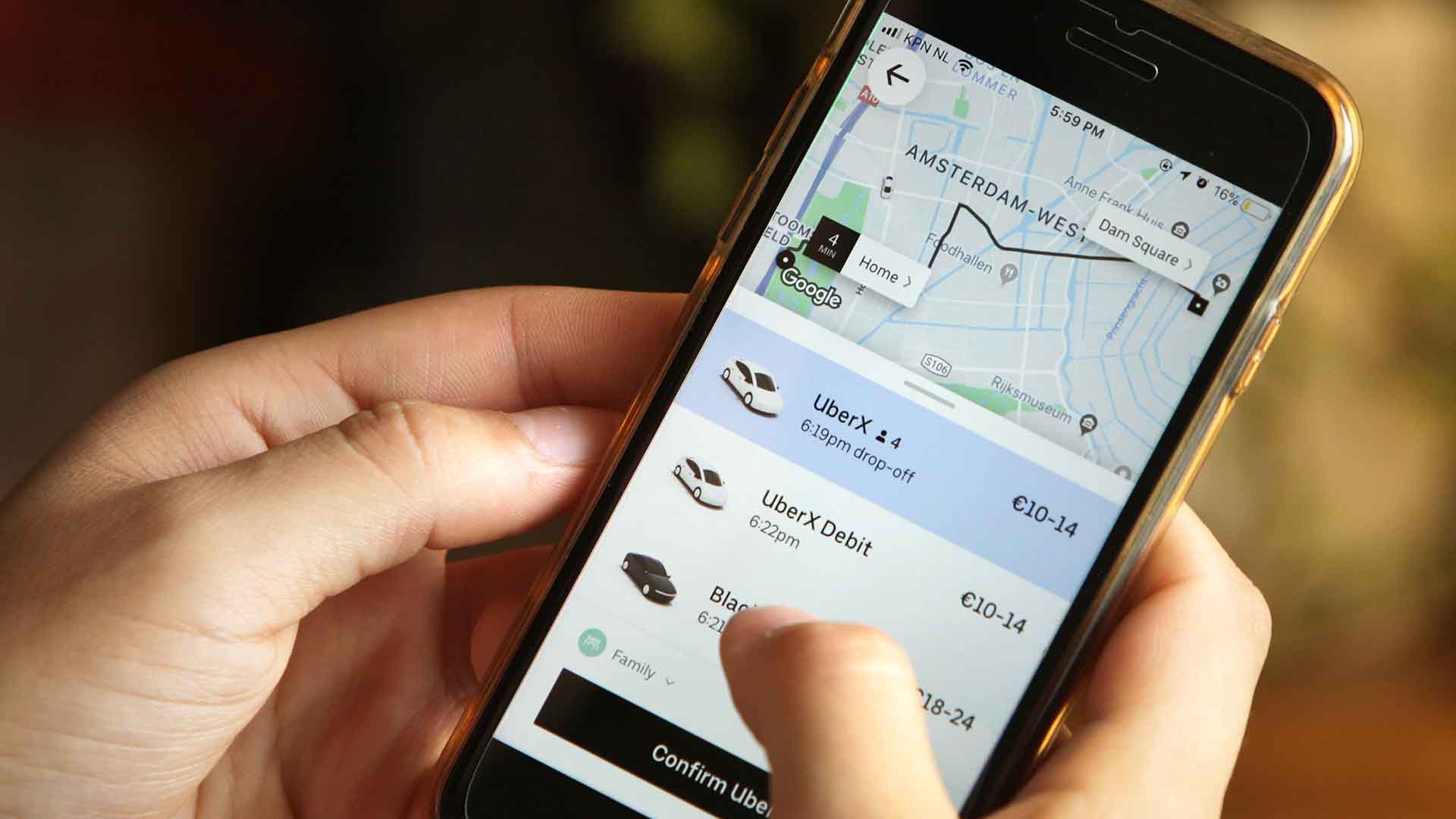

Uber argues that it’s not a transportation company but the operator of a digital platform that connects riders to drivers who are independent contractors, not employees. The arrangement allows the company to avoid a host of costs and responsibilities, such as making social security contributions and collecting value-added taxes on rides.

In 2015, as the company was expanding overseas, tax authorities from France, Germany, Sweden, the United Kingdom and Belgium contacted their Dutch counterparts to investigate whether Uber was paying income taxes where it should, and to request that a Dutch subsidiary called Uber BV share driver information.

Uber BV received payments from riders around the world and routed up to 80% of each fare back to the driver. The arrangement made it difficult for national taxing authorities to know how much workers earn because they are paid through the Netherlands.

Confidential emails and memos in the Uber Files indicate that Uber executives relied on Dutch authorities to buy the company more time while they considered how to respond to the requests, and that Dutch officials shared information about the international audit with the company.

Dutch officials gave the company enough time to “get our affairs in order,” one Uber manager wrote in emails to colleagues.

The company eventually agreed to share driver data with the authorities after executives realized that complying with the request may “contain” the authorities’ demand and deflect scrutiny away from Uber’s own tax liabilities, the leaked records show.

Experts interviewed by ICIJ reporting partners at Het Financieele Dagblad, Trouw and Investico said the Dutch officials may have violated local laws if they somehow stalled or delayed European authorities’ request for information, and shared details of the audit with Uber.

The Dutch tax office denied breaching any duty or delaying the audits, and told reporters that the officials didn’t show any “favoritism” toward Uber.

In response to questions from ICIJ, a spokeswoman for Uber said the company “is committed to complying with tax laws and regulations wherever we operate.” Uber is also “committed to maintaining an open and transparent working relationship with tax authorities,” she said.