European banking regulator to probe Luanda Leaks’ allegations

European lawmakers have demanded the regulator assess “whether there were breaches of either national or EU law, and to assess the actions taken by financial supervisors.”

The European Banking Authority will probe revelations contained in Luanda Leaks, an investigation led by the International Consortium of Investigative Journalists (ICIJ) into how billionaire businesswoman Isabel dos Santos made her fortune.

Confirmation of the probe follows a demand by the European Parliament for the regulator to assess in particular “whether there were breaches of either national or EU law, and to assess the actions taken by financial supervisors.”

A spokesperson for the regulator said the allegations contained in Luanda Leaks fell under its remit.

“As part of our legal duty to lead, coordinate and monitor the EU financial sector’s fight against ML/TF (Money Laundering/Terrorism Financing), we are in continuous contact with NCAs (National Crime Agencies) in respect of issues of common concern,” the spokesperson told ICIJ in an email statement. “We will be providing the European Parliament with updates on our work as appropriate.”

The central role played by Eurobic, a small Portuguese lender 42.5% owned by dos Santos, in transfers of millions of euros came under particular scrutiny following the publication of Luanda Leaks in January. She has since put her stake in the bank up for sale.

She previously owned a significant stake in another Portuguese bank, BPI, which she sold in 2016 after the European Central Bank ordered the bank to lower its exposure to the struggling Angolan economy. BPI made sizable loans to entities owned or connected to dos Santos.

She has denied any wrongdoing, describing the various allegations against her as a “selective witch-hunt.”

In a wide-ranging series of resolutions adopted on July 8, following a vote to endorse an action plan to combat money laundering and terrorist financing, lawmakers also called on individual member states to initiate or continue investigations into Luanda Leaks and to prosecute anyone found in breach of financial regulations.

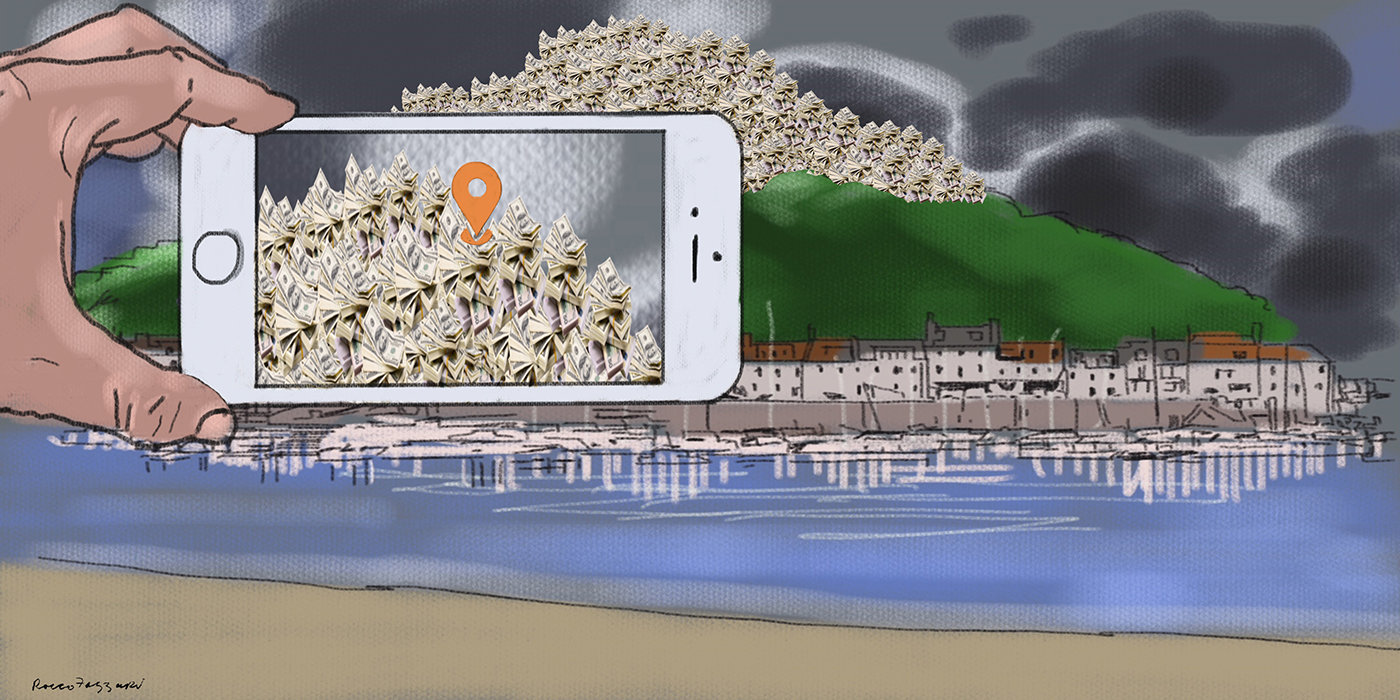

During the debate on the action plan, published on May 7, several lawmakers emphasized the huge sums of money involved in international tax avoidance and evasion, calling for greater urgency to combat the losses to European taxpayers.

Dutch MEP, Paul Tang, described recent estimates of trillions of dollars being lost to money laundering as “mind-boggling, staggering and a bloody shame.”

“This is money stolen, illegally gained, and it’s taken from governments and people that need it the most,” he said. “It is money that can be laundered and can be spent, thanks to our financial secrecy and thanks to opaque firms and funds, of which the owners are unknown.”

Lawmakers praised reporters and whistleblowers for bringing the issues of tax evasion, tax avoidance and secrecy jurisdictions to the top of the political agenda. Several contributors to the debate cited landmark ICIJ investigations such as the Panama Papers, Lux Leaks, Paradise Papers and Luanda Leaks as proof of the need for root and branch reform.

The resolution states that the revelations uncovered in these investigations “have repeatedly shaken citizens’ trust in our financial and tax systems” and “that the EU must seriously address its own internal problems, namely with regard to its low taxation and secrecy jurisdictions.”

During the debate, there were also numerous calls for the Maltese authorities to identify those responsible for the assassination of the journalist Daphne Caruana Galizia, and to investigate those against whom serious allegations of money laundering are still pending.

Many speakers also complained that the EU was not doing nearly enough to enforce current legislation. At present, individual member states must transpose European legislation at national level, which has led to a lack of cohesion in implementation.

In particular, the lawmakers demanded greater protection for whistleblowers, a focus on prosecution and asset recovery, and the creation of a cross-border, open registry of UBOs.

The action plan does not list a pan-European register among its six pillars and some states are still in breach of EU legislation, which requires countries to maintain their own registers. These may, or may not, be publicly available.

The EU has also attracted criticism over its failure to name any of its own member states among its list of international tax havens.

One Portuguese member, José Gusmão, demanded that lawmakers show more courage in rooting out criminality within EU member states, citing his own country’s island of Madeira and its controversial practice of dishing out ‘Golden Visas’ to non-resident investors.

“It is very difficult for us to understand that perhaps because of political or national sympathies, we are reluctant to establish which jurisdictions to point a finger at and which jurisdictions are facilitating money laundering.

“We must understand that there are third countries at high risk but not all high-risk countries are third countries – many of them are within the EU itself.”

The lawmakers endorsed the plan by 534 votes to 25, with 122 abstentions. It is expected to be implemented by early next year.