Since the invasion of Ukraine, Western authorities have embarked on an unprecedented campaign of sanctions targeting the massive wealth of Russia’s ruling elites. But, as years of ICIJ reporting have shown, much of that wealth is hidden offshore. The Panama Papers investigation of 2016, the Paradise Papers of 2017 and other ICIJ projects over a decade have won acclaim for bringing to light the hidden financial networks of oligarchs, businesses, frontmen and white-collar professionals who have backed Vladimir Putin’s rise to power.

Building on this decade of reporting, and based on the largest-ever leak of offshore records, Pandora Papers Russia represents ICIJ’s latest effort to expose the financial secrets of Putin’s inner circle. Since we began publishing these new investigations, we’ve gotten a lot of questions from readers about our work. Here are some answers.

What is an oligarch?

By definition, oligarchs are part of a small ruling elite, usually corrupt. While the degree of oligarch influence on Putin and on national policy is at issue, the country’s ultra-wealthy commonly called oligarchs did indeed emerge in a distinct — and highly corrupt — way. They built their wealth on assets stolen from the Russian public. In the chaotic aftermath of the Soviet Union’s collapse, a few politically connected officials and businessmen in the early 1990s gained control of state-owned enterprises for pennies on the dollar, locking the vast majority of Russians out of the rapid process of privatization and robbing the public treasury of the assets’ fair value. Over the following decades, these elites registered shell companies in secrecy jurisdictions like the British Virgin Islands and the Seychelles, used them to open bank accounts in countries with weak corporate regulation, and bought real estate, stocks, bonds and extravagant luxury items. Though there is no universally recognized list of oligarchs, ICIJ uses a list compiled by the U.S. Treasury in 2018 that identifies people close to Putin.

How are oligarchs different from other ultra-rich individuals?

Oligarchs are different because their wealth derives from stolen sovereign assets — which is not to say the world’s other super-wealthy individuals always play fair or derive their wealth legitimately. It just came from another source. Oligarchs also dominate some former Soviet republics other than Russia, including Georgia, Kazakhstan and Ukraine.

Why are oligarchs important to Vladimir Putin? What, or who, is “Putin’s wallet”?

Russian oligarchs created and financed what eventually would be known as United Russia, Putin’s political party. After Putin took office, he used state power to ensure their loyalty. Experts say oligarchs have helped Putin stay in power through their political quiescence and economic support of the Kremlin’s domestic initiatives.

ICIJ’s Panama Papers in 2016 revealed a series of complex offshore deals that channeled money and power toward a network of people and companies linked to Putin. Many of those involved are oligarchs who own major Russian enterprises; all are loyal associates. Evidence suggested that a well-known cellist and godfather to Putin’s eldest daughter, Sergey Roldugin, has acted as a frontman for a network of Putin loyalists — and perhaps for Putin himself. Roldugin has been called “Putin’s Wallet.”

Are Russians particularly prevalent in the offshore leaks investigated by ICIJ? Why?

Russians were more prevalent in the Pandora Papers than people of any other nationality, having links to around 14% of the companies whose ownership is revealed in the leak. In the Pandora Papers, there were nearly 3,700 companies with more than 4,400 beneficiaries who were Russian nationals. Russian oligarchs often use the offshore system as an insurance policy to protect ill-gotten gains from detection, according to British journalist Oliver Bullough, who’s spent much of his career studying tax havens. “They’re obviously going to be very sophisticated in how they obscure that wealth to make sure that we can’t find it any more than the Russian government can find it.”

What about high-profile Ukrainians who use the offshore system?

Like Russians, Ukrainians are well-represented in offshore leaks investigated by ICIJ. About 5% of offshore entities in the Pandora Papers data are linked to Ukrainians. Ukraine has the highest number of politicians identified in the Pandora Papers. The offshore activities of President Volodomyr Zelensky, his presidential aide and business partner, Sergiy Shefir, and other partners appear in the leaked documents.

Ihor Kolomoisky, a sanctioned Ukrainian oligarch under investigation for allegedly orchestrating one of the biggest bank heists in history, has also featured prominently in ICIJ reporting. A FinCEN Files investigation found that Kolomoisky and his business partners funneled hundreds of millions dollars through offshore companies to secretly amass a real estate empire in the U.S. Midwest over the course of a decade. Kolomoisky has denied involvement in any crimes.

How do sanctions work? What does it mean to freeze or seize assets?

Since the invasion of Ukraine, several Western governments and international bodies have sanctioned Kremlin loyalists by barring them from their countries and freezing assets in those countries. Although some Western authorities have seized oligarchs’ luxury assets, like yachts, they are still owned by the oligarchs. To win forfeiture, authorities may need to prove that the property was acquired by crime.

The offshore system can blunt the effect of sanctions to the extent that it enables oligarchs to hide assets behind anonymous shell companies and use other instruments of financial secrecy. Pandora Papers Russia reporting showcases examples of Russian elites utilizing the offshore system to shift assets before and after targeted sanctions regimes.

Are sanctions effective? Who do they really hurt?

Sanctions enforcement and oversight can vary, so how much pain they inflict on figures close to Putin is an open question. Experts and policymakers debate how much these economic penalties may influence Russia’s war effort or domestic support for Putin himself. “Sanctions never deter,” U.S. President Joe Biden said in a March 2022 speech. “The maintenance of sanctions … for the remainder of this entire year. That’s what will stop him.”

Experts say more financial transparency would mean more effective sanctions. “The most logical way to implement effective and fair sanctions would be to identify the assets held by very wealthy Russians offshore in a systematic manner, and to freeze these assets above a certain threshold,” Gabriel Zucman, an economist at the University of California, Berkeley, told ICIJ.

In fact, ordinary civilians feel the brunt of the economic punishment. After the ruble plunged in early March (before making a dramatic recovery), prices in Russia rose faster than at any point in the last 24 years, The Moscow Times reported. Sanctions have also cut off much international trade. Companies like Apple and Nike have shut stores in Russia, and aerospace companies like Boeing have have stopped supplying parts to Russian airlines.

What jurisdictions are popular with Russians for hiding wealth?

Cyprus has long been a popular destination for Russian oligarchs and politicians looking to incorporate companies to own ill-gotten wealth, in part because Cyprus and Russia signed a treaty in 1998 that banned double taxation on the income of citizens of either country. The treaty was, however, modified in 2020, indicating a potential shift in preferred offshore jurisdictions for Russians.

The Pandora Papers investigation, which included secret records from Demetrios A. Demetriades LLC, known as DADLAW, a family-run law firm popular with Russian clients, alone found at least 40 companies registered in Cyprus that had Russian political figures as beneficial owners, shareholders or directors.. More than 30% of the companies in the Pandora Papers served by DADLAW had one or more Russians as beneficial owners.

The British Virgin Islands was another jurisdiction popular with Russians in the Pandora Papers. In 2016, the BVI established a system to identify beneficial owners in the aftermath of ICIJ’s Panama Papers investigation.

The U.K. is another long-criticized home of hidden foreign wealth, especially that of Russians. London’s Eton Square has been called “Red Square” because of its popularity with Russian property owners. The rapid growth and deregulation of financial and professional services in London since the 1980s dovetailed with the collapse of the Soviet Union, opening the door for kleptocrats from former Soviet republics to launder profits through the city, according to the British think tank Chatham House.

What’s up with all the yachts?

Russian oligarchs often buy yachts and other luxury items, like jets and art, through companies registered in tax havens. The expensive boats are a store of value and hard to track because they’re mobile and because the owners, the crew and the docks are often from or located in different countries.

Which Western enablers help Russian oligarchs manage their money?

A British lawyer, a Monaco financial services firm and a Cyprus-based law firm are among the professional service providers identified by ICIJ as enablers of the Russian-dominated offshore system. They organize offshore companies in tax havens and offer advice, and move their money secretly.

New Pandora Papers reporting links more Western firms and professionals to notorious Russian figures and interests, including some sanctioned entities. These enablers include Baker McKenzie, the largest U.S. law firm; accounting giant PwC; Seychelles-based offshore services provider Alpha Consulting Ltd.; registered agents in Wyoming; and a small army of international specialists who help oligarchs snap up yachts, jets and other luxury assets.

What role have global banks played in moving Russians’ offshore wealth?

The world’s biggest banks move vast amounts of money for corrupt clients, including oligarchs, taking advantage of a broken enforcement system, as detailed in the FinCEN Files, a 2020 global investigation led by ICIJ and BuzzFeed News.

Major banks have played central roles in dirty money scandals tied to Russia.

In our latest exposé, leaked records from the FinCEN Files and Pandora Papers projects detail $700 million in secret transfers traced to oligarch Suleiman Kerimov. The transfers illustrate how a flawed bank oversight system makes it difficult for authorities to track Russian wealth and enforce sanctions when offshore entities are involved.

FinCEN files previously showed how U.K.-based HSBC provided banking services to a shell company that was part of a network that moved dirty money from former Soviet republics to the West. Top executives at Deutsche Bank also knew of internal failings implicated in a Russian mirror trading scandal — that involved the use of complex securities swaps to move billions of dollars out of Russia. And Danske Bank became embroiled in a massive scandal after its Estonia branch allegedly helped launder hundreds of billions of dollars out of Russia and other former Soviet states.

What have ICIJ’s investigations into hidden Russian wealth revealed?

Offshore Leaks (2013): ICIJ’s first investigation of leaked offshore records cracked the lid on the heavy use of tax havens by Russian elites, including prominent political figures and the heads of giant state-controlled enterprises. At that time, Putin was a vocal proponent of curbing Russians’ offshore investments, complaining that Russia’s economy was hurt because so much of it operated through tax havens.

The reporting also identified companies involved in the Magnitsky Affair, a massive tax-fraud case investigated by Russian lawyer and whistleblower Sergei Magnitsky. He died in police custody in 2009, inflaming a scandal that soured U.S.-Russian relations.

Swiss Leaks (2015): Leaked HSBC documents found that the global banking giant held a total of about $1.8 billion for hundreds of Russian clients, including sanctioned oligarch Gennady Timchenko and banker Vladimir Antonov.

Panama Papers (2016): The landmark investigation revealed key behind-the-scenes players in a clandestine network operated by Putin’s inner circle that shuffled at least $2 billion through banks and offshore companies. The documents shed light on about 100 financial deals tied to this network, which includes some of the Russian president’s childhood friends, like the cellist Roldugin and the billionaire Rotenberg brothers, and showed how offshore entities were used to benefit Putin’s allies.

Paradise Papers (2017): Leaked documents showed business ties between President Donald Trump’s network and Putin’s inner circle. The investigation discovered that then-U.S. Commerce Secretary Wilbur Ross maintained a stake in a company that did business with a major oligarch-controlled energy company. The probe also revealed that a major investor in Twitter and Facebook had financial ties to two Russian government-owned firms known as vehicles for politically sensitive Kremlin dealings. And it identified Russian billionaires who had registered private jets in tax havens and showed how the offshore world helped oligarch Arkady Rotenberg skirt sanctions related to Russian aggression in Ukraine.

FinCEN Files (2020): A global ICIJ- and BuzzFeed News-led investigation on the role of banks in dirty money flows, FinCEN Files uncovered more massive financial maneuvers by Russian oligarchs, including Roman Abramovich (and his $100 million donation to controversial Israeli settlers), Oleg Deripaska (and the billions he reportedly moved through a tiny Latvian bank), and the Rotenbergs, who were found to have transferred substantial assets to their sons after being sanctioned over the Russian invasion of Crimea.

Leaked files also showed that JPMorgan shuttled millions for Paul Manafort before and after he resigned from the Trump campaign because of allegations about his work with a pro-Russian political party in Ukraine.

Pandora Papers (2021): ICIJ identified more beneficial owners from Russia in the Pandora Papers than from any other country. Prominent figures included propaganda chief Konstantin Ernst, oil tycoon Gennady Timchenko, Putin’s childhood friend Peter Kolbin, a reported romantic partner of Putin’s, Svetlana Krivonogikh, and more than 45 oligarchs in all. The documents also show how Russian elites responded to U.S. sanctions punishing Russia for its “worldwide malign activity.” The widest-spanning offshore leak ICIJ has ever investigated also shed light on more key international enablers of Russian elites, including American law firm Baker McKenzie, British lawyer Alastair Tulloch, financial services firms DADLAW in Cyprus, Asiaciti Trust in Singapore and Moores Rowland in Monaco.

New Pandora Papers Russia reporting identifies more professional enablers and details the offshore dealings, before and after targeted sanctions, of top Russian bankers, Burger King’s Russian operations, gold magnate Suleiman Kerimov, the family of Russian arms tycoon Sergei Chemezov, and one of the country’s richest businessmen, Alexei Mordashov (and the help he got from elite accounting firm PwC).

How did Putin’s government react to ICIJ findings?

In 2016, Kremlin spokesperson Dmitry Peskov held a news conference after receiving detailed questions about Putin’s wealth from ICIJ and its German partners before publication of the Panama Papers. He called questions about the offshore dealings of figures close to Putin “an attack” and “a series of fibs” that concerned “a large number of businessmen Putin had never seen in his life,” according to Russian news services. Peskov dismissed the investigation’s findings, saying they had “no relation to us.”

Putin addressed the Panama Papers reports after they were published, saying the information was accurate but did not show wrongdoing or offshore financial ties to officials including himself. He also claimed that the investigation was part of a conspiracy orchestrated by U.S. officials and financiers and timed to influence Russian elections. Subsequently, Russian journalists Andrei Soldatov and Irina Borogan reported that Putin planned a retaliatory response to the Panama Papers that included cyber-meddling in the 2016 U.S. elections.

In 2021, Peskov responded to Pandora Papers reporting on the hidden offshore wealth of more high-profile Russians close to Putin by questioning the reliability of the reporting. He said the Russian government had no plans to investigate further. “Honestly speaking, we didn’t see any hidden wealth of Putin’s inner circle in there,” he said at a news conference, according to Reuters.

Have authorities asked ICIJ for information or data on prominent Russians or suspicious offshore entities in the offshore leaks?

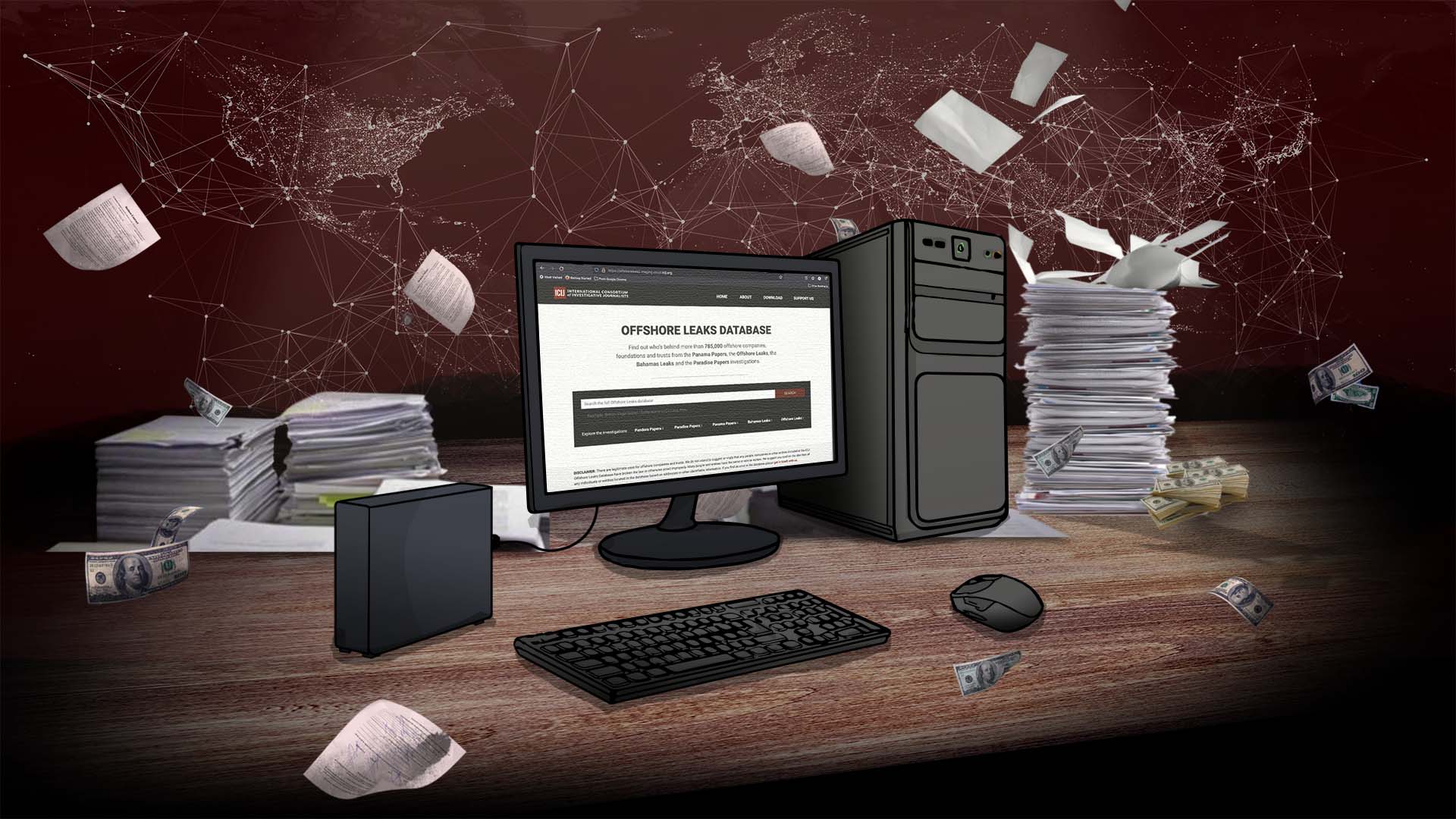

Yes. But ICIJ’s long-standing policy is to not turn over such material. ICIJ is not an arm of law enforcement nor an agent of the government. We are an independent news organization, served by and serving our members, the global investigative journalism community and the public. ICIJ publishes verified data from our offshore investigations in the Offshore Leaks Database, shining a light on owners of secretive entities in the public interest. The presence of a person or a company in the database does not imply that the person or the company engaged in illegal or improper conduct.

What is Pandora Papers Russia and the Russia Archive?

On April 11, 2022, ICIJ and its partners published new reporting on the offshore activities of Russian oligarchs, bankers and others in Putin’s orbit in a collection of investigative journalism called Pandora Papers Russia. ICIJ also released structured data from Alpha Consulting, an offshore services provider serving mostly Russian clients, in the Offshore Leaks Database.

For ease of access, ICIJ has compiled much of its reporting on the offshore maneuvering of Kremlin allies on a dedicated page called the Russia Archive.

Contributors: Brenda Medina, Emilia Díaz-Struck