Jan 17, 2024

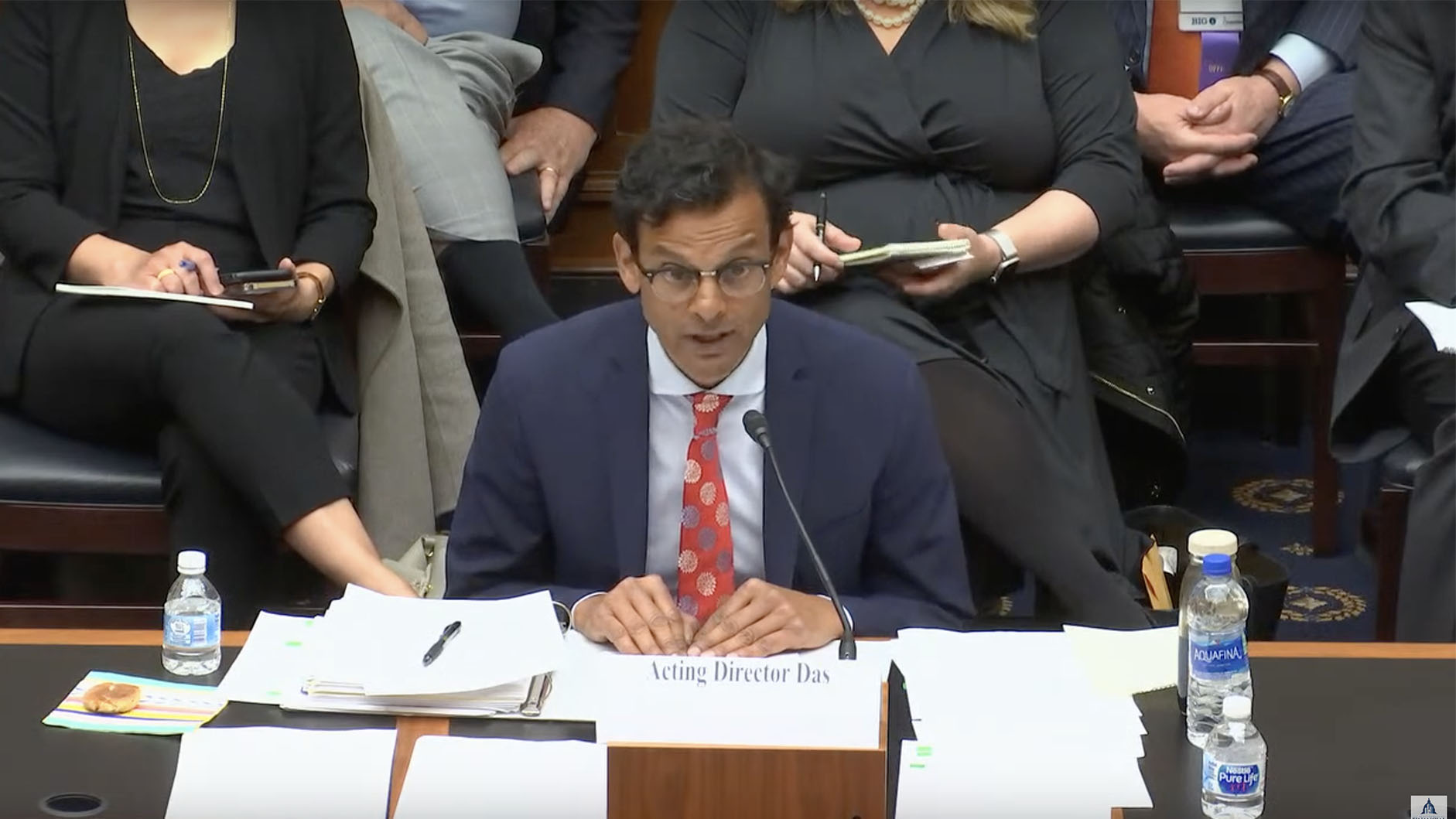

New US company ownership database faces continued political attacks weeks after launch

Advocates have warned that criticism and challenges from business groups and their political allies are sowing confusion and fear among business owners.