Apr 22, 2024

New ethical guidelines for tax professionals announced following global scandals

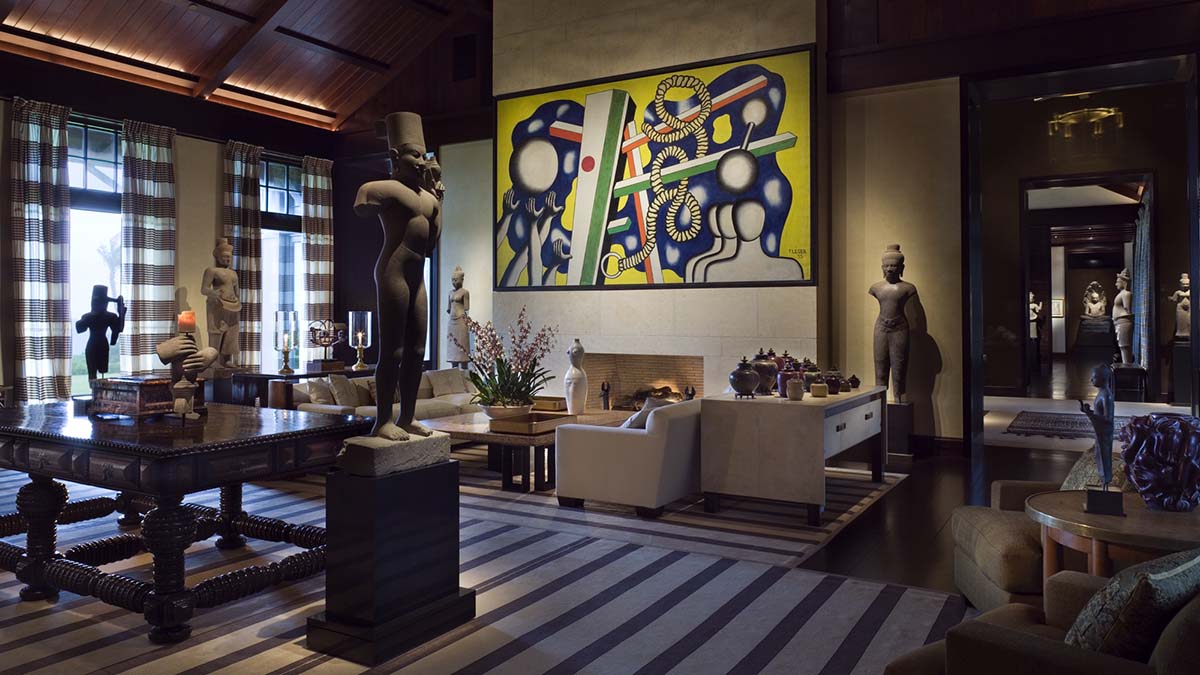

Citing both ICIJ’s Pandora and Paradise Papers revelations, an international accounting organization has for the first time urged accountants to consider public interest — and harm — when working on tax minimization schemes.